Contact Mace News President

Tony Mace tony@macenews.com

to find a customer- and markets-oriented brand of news coverage with a level of individualized service unique to the industry. A market participant told us he believes he has his own White House correspondent as Mace News provides breaking news and/or audio feeds, stories, savvy analysis, photos and headlines delivered how you want them. And more. And this is important because you won’t get it anywhere else. That’s MICRONEWS. We know how important to you are the short advisories on what’s coming up, whether briefings, statements, unexpected changes in schedules and calendars and anything else that piques our interest.

No matter the area being covered, the reporter is always only a telephone call or message away. We check with you frequently to see how we can improve. Have a question, need to be briefed via video or audio-only on a topic’s state of play, keep us on speed dial. See the list of interest areas we cover elsewhere

on this site.

—

You can have two weeks reduced price no-obligation trial for $199. No self-renewing contracts. Suspend, renew coverage at any time. Stay with a topic like trade while it’s hot and suspend coverage or switch coverage areas when it’s not. We serve customers one by one, 24/7.

—

Tony Mace was the top editorial executive for Market News

International for two decades.

Washington Bureau Chief Denny Gulino had the same title at Market News for 18 years.

Similar experience undergirds our service in Ottawa, London, Brussels and in Asia.

President

Mace News

D.C. Bureau Chief

Mace News

Federal Reserve

Mace News

Reporter and expert on the currency market.

Mace News

Reporter and expert on derivatives and fixed income markets.

Mace News

Financial Journalist

Mace News

Reporter, economic and political news.

Japan and Canada

Mace News

WASHINGTON (MaceNews) – The following are Thursday’s schedules for the White House, Treasury, USTR, the State Department and Capitol Hill as well as U.S. economic data

DAILY GUIDANCE AND PRESS SCHEDULE FOR

THURSDAY, APRIL 25, 2024

In the morning, the President will receive the President’s Daily Brief. This meeting will be closed press.

After, the President will travel to Syracuse, New York. The departure from the South Lawn will be open press. The departure from Joint Base Andrews will be covered by the out-of-town pool. The arrival at and departure from the Hancock Field Air National Guard Base will be open press.

In the afternoon, the President will deliver remarks on how the CHIPS and Science Act and his Investing in America agenda are growing the economy and creating jobs in Central New York and communities across the country. These remarks at the Milton J. Rubenstein Museum, Syracuse, New York will be open press.

Then, the President will travel to Westchester County, New York. The departure from Hancock Field Air National Guard Base will covered by the out-of-town pool. The arrival at John F. Kennedy International Airport will be open press. The arrival at the Westchester County Airport will be covered by the out-of-town pool.

In the evening, the President will participate in a campaign reception. This reception in Westchester County, New York will be covered by the restricted pool and the out-of-town pool will accompany.

Then, the President will travel to New York, New York. The departure from the Westchester County Airport will be covered by the out-of-town pool. The arrival at the Wall Street Landing Zone will be covered by the out-of-town pool.

In-Town Pool

Wires: AP, Reuters, Bloomberg

Wire Photos: AP, Reuters, AFP, NYT

TV Corr & Crew: FOX

Print: Boston Globe

Radio: NPR

Out-of-Town Pool

Wires: AP, Reuters, Bloomberg

Wire Photos: AP, Reuters, AFP, NYT

TV Corr & Crew: FOX

Print: New York Times

Radio: NPR

EDT

10:00 AM In-Town Pool Call Time

10:00 AM THE PRESIDENT receives the President’s Daily Brief

Closed Press

10:15 AM Out-of-Town Pool Call Time

Joint Base Andrews Overhang

11:10 AM THE PRESIDENT departs the White House en route to Joint Base Andrews

South Lawn

Open Press (Gather 10:55 AM – Palm Room Doors)

11:30 AM THE PRESIDENT departs Joint Base Andrews en route to Hancock Field Air National Guard Base

Joint Base Andrews

Out-of-Town Pool

12:40 PM THE PRESIDENT arrives at Hancock Field Air National Guard Base

Hancock Field Air National Guard Base

Open Press

2:00 PM THE PRESIDENT delivers remarks on how the CHIPS and Science Act and his Investing in America agenda are growing the economy and creating jobs in Central New York and communities across the country

Milton J. Rubenstein Museum, Syracuse, New York

Open Press

3:30 PM THE PRESIDENT departs Hancock Field Air National Guard Base en route to John F. Kennedy International Airport

Hancock Field Air National Guard

Out-of-Town Pool

4:30 PM THE PRESIDENT arrives at John F. Kennedy International Airport

John F. Kennedy International Airport

Open Press

4:40 PM THE PRESIDENT departs John F. Kennedy International Airport en route to the Westchester County Airport

John F. Kennedy International Airport

Out-of-Town Pool

5:00 PM THE PRESIDENT arrives at the Westchester County Airport

Westchester County Airport

Out-of-Town Pool

6:15 PM THE PRESIDENT participates in a campaign event

Westchester County, New York

Restricted Out-of-Town Pool

7:30 PM THE PRESIDENT departs Westchester County Airport route the Wall Street Landing Zone

Westchester County Airport

Out-of-Town Pool

7:50 PM THE PRESIDENT arrives at the Wall Street Landing Zone

Wall Street Landing Zone

Out-of-Town Pool

Briefing Schedule

EDT

Press Secretary Karine Jean-Pierre will gaggle aboard Air Force One en route to Syracuse, New York

Saturday, April 27, 2024

The President, the First Lady, the Vice President, and the Second Gentleman will all attend the White House Correspondents’ Dinner in Washington, D.C. The President will deliver remarks.

###

TREASURY DEPT –

Thursday –At 10:00 AM, Secretary of the Treasury Janet L. Yellen will participate in a Reuters NEXT Newsmaker fireside conversation with Reuters Editor-in-Chief Alessandra Galloni. Media interested can register to watch this event here.

STATE DEPT

Thursday – Secretary Blinken is on travel to the People’s Republic of China from April 24-26, 2024.

9:00 a.m. LOCAL Secretary Blinken meets with Shanghai Chinese Communist Party Secretary Chen Jining in Shanghai, People’s Republic of China.

(POOLED CAMERA SPRAY AT TOP)

10:20 a.m. LOCAL Secretary Blinken participates in a discussion with NYU Shanghai students in Shanghai, People’s Republic of China.

(POOLED CAMERA SPRAY AT TOP)

11:30 a.m. LOCAL Secretary Blinken participates in a discussion with business leaders in Shanghai, People’s Republic of China.

(POOLED CAMERA SPRAY AT TOP)

12:40 p.m. LOCAL Secretary Blinken holds a meet and greet with employees and families of U.S. Consulate General Shanghai in Shanghai, People’s Republic of China.

(CLOSED PRESS COVERAGE)

5:25 p.m. LOCAL Secretary Blinken participates in a discussion with scholars in Beijing, People’s Republic of China.

(CLOSED PRESS COVERAGE)

Headquarters press briefings, when held on weekdays, occur around 1:15p ET and are livestreamed at State.gov. The transcript of Wednesday’s 1:08p ET briefing is at: https://www.state.gov/briefings/department-press-briefing-april-24-2024/

USTR

Thursday – Ambassador Tai has no public engagements

US HOUSE

Thursday Out. Next pro-forma meeting 9:30a.

US SENATE

Wednesday – Out. Next pro forma session 10a ET Friday.

UPCOMING US, JAPAN, CANADA ECONOMIC REPORTS AND FEDERAL RESERVE EVENTS

Thursday, April 25 – 8:30a ET US jobless claims

Thursday, April 25 – 8:30a ET US flash 1Q GDP

Thursday, April 25 – 8:30a ET US international trade in goods

Thursday, April 25 – 8:30a ET US retail and wholesale trade inventories

Thursday, April 25 – 10a ET US pending home sales

Thursday, April 25 – 10a ET US Tsy’s Yellen Q&A at Reuters event

Thursday, April 25 – 11a ET US Kansas City Fed manufacturing

Thursday, April 25 – 12:00 ET US Freddie Mac mortgage rates

Thursday, April 25 – 13:00 ET US Treasury 7-year note auction

Thursday, April 25 – 16:30 ET US Fed weekly balance sheet

Thursday, April 25 – 19:30 ET Japan Tokyo CPI

Thursday, April 25 – 22:30 ET Japan BOJ policy announcement

—

Friday, April 26 – 8:30a ET US personal income and spending/PCE

Friday, April 26 – 10a ET US UMich consumer sentiment

Friday, April 26 – 13:00 ET US Baker Hughes oil rigs

—

Content may appear first or exclusively on the Mace News premium service. For real-time delivery contact tony@macenews.com. X (Twitter) headline news flow @macenewsmac

WASHINGTON (MaceNews) – The following are Wednesday’s schedules for the White House, Treasury, USTR, the State Department and Capitol Hill as well as U.S. economic data

DAILY GUIDANCE AND PRESS SCHEDULE FOR

WEDNESDAY, APRIL 24, 2024

In the morning, the President will receive the President’s Daily Brief. This meeting will be closed press.

After, the President will deliver political remarks at North America’s Building Trade Union National Legislative Conference. The departure from the North Grounds and arrival to the Washington Hilton will be covered by the in-town travel pool. After, the President will return to the White House. The departure from the Washington Hilton and arrival to the North Grounds will be covered by the in-town travel pool.

In-Town Pool

Wires: AP, Reuters, Bloomberg

Wire Photos: AP, Reuters, AFP, NYT

TV Corr & Crew: CNN

Print: Bloomberg Government

Radio: VOA

EDT

10:00 AM In-Town Pool Call Time

10:00 AM THE PRESIDENT receives the President’s Daily Brief

Closed Press

11:5o AM THE PRESIDENT departs the White House en route to the Washington Hilton

North Grounds

In-Town Travel Pool (Gather 11:35 AM – Palm Room Doors)

12:30 PM THE PRESIDENT delivers political remarks at North America’s Building Trade Union National Legislative Conference

Washington Hilton, Washington, D.C.

In-Town Travel Pool

1:20 PM THE PRESIDENT arrives at the White House

North Grounds

In-Town Travel Pool

Briefing Schedule

1:30 PM Press Briefing by Press Secretary Karine Jean-Pierre

###

Saturday, April 27, 2024

The President, the First Lady, the Vice President, and the Second Gentleman will all attend the White House Correspondents’ Dinner in Washington, D.C. The President will deliver remarks.

###

TREASURY DEPT –

Wednesday – Secretary Yellen has no public engagements

STATE DEPT

Tuesday – Secretary Blinken departs on travel to the People’s Republic of China from April 24-26, 2024.

Headquarters press briefings, when held on weekdays, occur around 1:15p ET and are livestreamed at State.gov. The transcript of Tuesday’s 1:23p ET briefing is at: https://www.state.gov/briefings/department-press-briefing-april-23-2024/

USTR

Wednesday – Ambassador Tai has no public engagements

US HOUSE

Wednesday – Out. Next pro-forma meeting 9:30a Thursday.

US SENATE

Wednesday – Out. Next pro forma session 10a ET Friday.

UPCOMING US, JAPAN, CANADA ECONOMIC REPORTS AND FEDERAL RESERVE EVENTS

Wednesday, April 24 – 7a ET US Mortgage Bankers Assoc mortgage applications

Wednesday, April 24 – 8:30a ET US durable goods orders

Wednesday, April 24 – 8:30a ET Canada retail sales

Wednesday, April 24 – 10:30a ET US EIA petroleum status

Wednesday, April 24 – 11a ET US survey of business uncertainty

Wednesday, April 24 – 12:30 ET Atlanta Fed GDPNow

Wednesday, April 24 – 13:00 ET US Treasury 2-year FRN, 5-year note auction

—

Thursday, April 25 – 8:30a ET US jobless claims

Thursday, April 25 – 8:30a ET US flash 1Q GDP

Thursday, April 25 – 8:30a ET US international trade in goods

Thursday, April 25 – 8:30a ET US retail and wholesale trade inventories

Thursday, April 25 – 10a ET US pending home sales

Thursday, April 25 – 11a ET US Kansas City Fed manufacturing

Thursday, April 25 – 12:00 ET US Freddie Mac mortgage rates

Thursday, April 25 – 13:00 ET US Treasury 7-year note auction

Thursday, April 25 – 16:30 ET US Fed weekly balance sheet

Thursday, April 25 – 19:30 ET Japan Tokyo CPI

Thursday, April 25 – 22:30 ET Japan BOJ policy announcement

—

Friday, April 26 – 8:30a ET US personal income and spending/PCE

Friday, April 26 – 10a ET US UMich consumer sentiment

Friday, April 26 – 13:00 ET US Baker Hughes oil rigs

—

Content may appear first or exclusively on the Mace News premium service. For real-time delivery contact tony@macenews.com. X (Twitter) headline news flow @macenewsmac

–Govt Still Warns About Downside Risks from Chinese Slowdown, Inflation, Mideast Conflict, January Earthquake

By Max Sato

At the same time, the government continued to warn against downside risks from Chinese slowdown, the Middle East conflict and inflation. It still mentioned the effects of the powerful New Year’s Day earthquake in the northwestern region of Hokuriku that had reduced electronic parts supply and battered tourism.

In its April report, the government said the economy is “recovering at a moderate pace, although it appears to be pausing.” Before the February downgrade, it had said the economy was “pausing in some areas.”

“The government and the Bank of Japan will continue to work closely together to conduct flexible policy management in response to economic and price developments,” the government said, repeating its resolve expressed last month.

In March, the government briefly dropped its long-held request that the BOJ should “achieve the price stability target of 2% in a sustainable and stable manner, accompanied by wage increase.”

However, it revived its request in April, saying, “The government expects the Bank of Japan to achieve the price stability target of 2% in a sustainable and stable manner, while confirming the virtuous cycle between wages and prices, through conducting appropriate monetary policy in light of economic activity, prices and financial conditions.”

“The government and the bank will foster widespread recognition among the public that there is no going back to deflation, and will bring deflation to an end,” the government said, repeating its March statement. It has not clearly declared that deflation is completely gone in Japan.

The BOJ board is expected to hold the overnight interest rate target steady in a range of zero to 0.1 percent at its April 25-26 meeting after conducting its first rate hike in 17 years and ending the seven-year-old yield curve control framework last month.

The next rate hike is likely to be in July, September or October, when more evidence of a higher pace of wage hikes emerges. At their March meeting, many board members judged that the risk of Japan’s economy slipping back into deflation had been reduced and inflation was likely to be led by sustained wage hikes, instead of a spike in import costs, following news that wage hikes for fiscal 2024 ending in March 2025 were set to well surpass the pace of increase seen in the previous year.

Governor Kazuo Ueda told a post-meeting news conference that the pace of further rate hikes as part of the bank’s policy normalization process is likely to be gradual. But after the Group of 20 meeting last week, he also told reporters that if the depreciation of the yen pushes up import costs and thus inflation, having a huge impact that cannot be ignored, “it could cause a change in monetary policy.”

The government continues to promise it will support widespread wage hikes and robust business investment. It will swiftly implement the supplementary budget for fiscal 2023 as well as the fiscal 2024 budget.

As for overseas economies, the government maintained its overall assessment after upgrading it for the first time in 21 months in May 2023, saying, “The world economy is picking up, although some regions are showing weakness.”

The government upgraded its view on China for the first time in 12 months, saying it is “showing signs of a pickup thanks to the effects of policy measures,” instead of “a stalled pickup.” The government regards the U.S. economy as “expanding” while it continues to see “a weak tone” in the Eurozone.

Japan’s Economy Expected to Stay on Recovery Track but Risks Remain

On the near-term outlook for the Japanese economy, the government repeated its recovery outlook adopted in May 2023, saying, “The economy is expected to continue recovering at a moderate pace with improving employment and income conditions, supported by the effects of the policies.”

“However, slowing down of overseas economies is a downside risk to the Japanese economy, including the effects of global monetary tightening and the concern about the prospect of the Chinese economy,” the government warned.

“Also, full attention should be given to price increases, the situation in the Middle East and fluctuations in the financial and capital markets,” it said, adding that it is also watching the economic impact of the earthquake.

The yen remains weak, limiting Japan’s purchasing power and pushing up import costs. Investors are betting that the BOJ’s future rate hikes will be gradual and the Federal Reserve is in no hurry to start lowering interest rates as the U.S. economy has been resilient and inflation remains sticky. The yen has depreciated to ¥153.30, a nearly 34-year low, after firming to ¥147 in early March on emerging signs that the BOJ wouldn’t wait until April to hike rates.

Japanese officials have repeatedly said they are watching the currency market “with a high sense of urgency,” suggesting they are prepared to intervene. Finance Minister Shunichi Suzuki has been warning against one-sided yen selling, saying the government will “respond to excessive moves (in the currency market) appropriately, without ruling out any options.”

Last week, Suzuki stressed that he and his U.S. and South Korean counterparts shared their concern about the recent sharp depreciation of the yen and won. The Ministry of Finance currency intervention team seems to be standing by for a better timing to step in when yen short positions build up and markets start to speculate for the next BOJ rate hike and lower U.S. inflation figures.

Previously, the dollar briefly surged to ¥151.94 in October 2022 (a 32-year high at the time) but Japan’s second wave of massive yen-buying forex intervention pushed it down to a low of ¥143.55 in the same month.

Key points from the monthly report:

The government repeated its recent view that business sentiment is “improving” but added that “some manufacturers are affected by the suspension of production and shipment by some automakers,” referring to suspended output of Toyota Motor group vehicles from late December through mid-February over a safety test scandal. The change to the official wording is not considered a downgrade.

The BOJ’s quarterly Tankan business survey released on April 1 showed that confidence among manufacturers fell slightly in March as the suspended vehicle output triggered a widespread slump in overall production while sentiment among some non-manufacturers continued improving. However, the effects of domestic pent-up demand for traveling and eating out and strong post-Covid inbound spending appeared to have lost some steam.

The government noted that business investment is “showing signs of a pickup,” unchanged from March, when it upgraded it for the first time in 17 months after the fourth quarter GDP was revised up to show a slight rise, averting a second straight quarterly drop, thanks to an upward revision to capex. Previously, it had said the pickup in business investment was “stalling.”

Since then, the BOJ Tankan has shown solid capex plans for fiscal 2024 that began on April 1, backed by strong demand for digitization and automation amid rising profits.

The government maintained its assessment of private consumption, which accounts for about 55% of the gross domestic product, after downgrading it for the first time in two years in February. The pickup in consumption is “stalling,” it said.

Japan’s real household spending posted its 12th straight drop on the year in February, as mild weather led to lower costs for heating, but the pace of decrease slowed to a 0.5% fall from a 6.3% slump in January, backed by the leap-year effect, data released this month by the Ministry of Internal Affairs and Communications showed. Without the boosting effect of having an extra day of consumption in a leap year, spending would have been down by a deeper 2.7%, closer to the median economist forecast of a 3.0% drop.

Easing but still elevated living costs have kept consumers frugal and new car purchases remained weak due to suspended vehicle output over a safety test scandal. Partly offsetting lower spending were higher tuition fees and medical costs but these factors are also squeezing households.

On the month, expenditures rose a solid 1.4% for the first increase in five months after falling 2.1% in January. It was much stronger than the median forecast of a 0.3% rise. Generally, consumers are seeking lower prices for goods and services including prevalent discount mobile phone plans while the Covid-era necessity has simplified ceremonies and lowered their costs.

Data from the Ministry of Health, Labour and Welfare showed the pickup in nominal wages in Japan continued for just over two years in January but real wages fell on the year for nearly two years.

Total monthly average cash earnings per regular employee in Japan posted their 26th straight year-on-year rise, up a preliminary 1.8% in February, posting the highest growth since 2.3% in June 2023, after rising 1.5% (revised down from 2.0%) in January.

Base wages rose 2.2% on year, marking the 28th straight gain, after rising a revised 1.3% in January. Last year, the pace of increase accelerated from 0.5% in March to 0.9% in April and then to 1.7% in May as many firms raised wages to secure workers at the start of fiscal 2023. A higher pace of wage hikes are expected for the current fiscal year.

In real terms, average wages fell a preliminary 1.3% on year in February after falling a revised 1.1% in January, with the pace of decline easing from a sharp 2.9% seen in September 2023. To calculate real wages, the ministry uses the overall consumer price index minus the structurally weak owners’ equivalent rent, which rose 3.3% on year in February after rising 2.5% in the prior month.

The BOJ’s supply-side consumption activity index rebounded a seasonally adjusted 0.6% on the month in February after slipping 0.1% in January and plunging 1.5% in December. The index dipped 0.6% in the January-February period compared to the October-December quarter, when it fell 1.1% on quarter. Figures exclude inbound tourism consumption but include outbound tourism spending.

The government also maintained its assessment of industrial production after downgrading it for the first time in 11 months in February, saying factory output “was on its way toward a pickup, but has declined recently due to the effects of suspension of production and shipment by some automakers.”

Industrial production unexpectedly slipped 0.6% (revised down from a 0.1% drop) on the month in February following an upwardly revised 6.7% plunge in January as the impact of suspended vehicle output over a safety test scandal lingered and the powerful New Year’s Day earthquake in the northwestern region of Hokuriku had reduced electronic parts supply, revised data released by the Ministry of Economy, Trade and Industry showed.

The METI’s survey of producers indicated production is expected to rebound 4.5% in March and rise a further 3.3% in April. Economists expect factory output to continue picking up from the January plunge as the direct impact of the auto industry problem and the earthquake wanes.

The government maintained its assessment of exports, saying their “pickup is pausing.”

The index of export volumes rebounded a seasonally adjusted 3.3% on the month in March after slumping 4.2% in February and slipping 4.1% in January, according to the Cabinet Office.

Similarly, the BOJ’s index of real export values bounced back 3.4% on the month in March after falling 2.7% in February and sliding 3.9% in January. The index slumped 2.5% on quarter in the January-March period after increase of 0.3% in October-December, 0.5% in July-September and 1.7% in April-June, following a 2.9% dip in January-March 2023. The decrease in the first quarter of 2024 was led by a plunge in shipments of automobiles and auto parts cause by suspected vehicle production over the safety scandal as well as a continued slight drop in those of information technology goods and the first decline in three quarters for capital goods.

Japanese export values rose 7.3% on year in March for the fourth straight increase, led by solid global demand for automobiles and Asian purchases of semiconductors while export volumes slipped, data released last week by the Ministry of Finance showed. The pace of increase was faster than the consensus forecast of a 5.8% gain but was slightly slower than the 7.8% rise in February.

Shipments to China, one of the key export markets for Japanese goods, posted their fourth straight increase after a year-long decline through November last year amid a gradual recovery in the world’s second-largest economy. In its quarterly update to its outlook released last week, the International Monetary Fund left its forecast for China’s GDP growth unchanged at 4.6% in 2024, slowing from 5.2% in 2023.

Other details:

The government’s assessment of key components of the economy in the monthly economic report:

* The pickup in private consumption is “stalling” (unchanged; upgraded in May 2023; downgraded in February 2024).

* Business investment is “showing signs of a pickup” (unchanged; upgraded in March 2024; downgraded in November 2023).

* Housing construction is “in a weak tone” (unchanged; upgraded in June 2022; downgraded in September 2023).

* Public investment is “firm” (unchanged; upgraded in July 2023; downgraded in October 2023).

* The pickup in exports is “stalling” (unchanged; upgraded in August 2023; downgraded in January 2024).

* Imports are “weakening” (unchanged; upgraded in April 2023; downgraded in March 2024).

* Industrial production “was on its way toward a pickup but has declined recently due to the effects of suspension of production and shipment by some automakers.” (unchanged; upgraded in May 2023; downgraded in February 2024).

* Corporate profits are “improving as a whole” (unchanged; upgraded in September 2023; downgraded in March 2023).

* Business sentiment is “improving but some manufacturers are affected by the suspension of production and shipment by some automakers” vs. “improving“ (unchanged in assessment; upgraded in December 2023; downgraded in March 2022).

* The number of bankruptcies “has been rising” (unchanged; upgraded in March 2021; downgraded in April 2023).

* Employment conditions are “showing signs of improvement” (unchanged; upgraded in June 2023; downgraded in May 2020).

* Domestic corporate goods prices are “being flat” (unchanged).

* Consumer prices “have been rising at a moderate pace” (upgraded in May 2022; downgraded in March 2020).

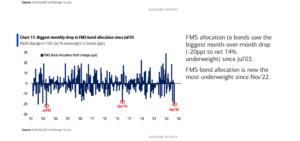

fund managers switch to equities, commodities

WASHINGTON (MaceNews) – The following are Wednesday’s schedules for the White House, Treasury, USTR, the State Department and Capitol Hill as well as U.S. economic data

Japanese exports rise again

WASHINGTON (MaceNews) – The following are Tuesday’s schedules for the White House, Treasury, USTR, the State Department and Capitol Hill as well as U.S. economic data

WASHINGTON (MaceNews) – The following are Monday’s schedules for the White House, Treasury, USTR, the State Department and Capitol Hill as well as U.S. economic data

Japanese machinery orders jump in February from January

WASHINGTON (MaceNews) – The following are Friday’s schedules for the White House, Treasury, USTR, the State Department and Capitol Hill as well as U.S. economic data

WASHINGTON (MaceNews) – The following are Thursday’s schedules for the White House, Treasury, USTR, the State Department and Capitol Hill as well as U.S. economic data

Contact Mace News President

Tony Mace tony@macenews.com

to find a customer- and markets-oriented brand of news coverage with a level of individualized service unique to the industry. A market participant told us he believes he has his own White House correspondent as Mace News provides breaking news and/or audio feeds, stories, savvy analysis, photos and headlines delivered how you want them. And more. And this is important because you won’t get it anywhere else. That’s MICRONEWS. We know how important to you are the short advisories on what’s coming up, whether briefings, statements, unexpected changes in schedules and calendars and anything else that piques our interest.

No matter the area being covered, the reporter is always only a telephone call or message away. We check with you frequently to see how we can improve. Have a question, need to be briefed via video or audio-only on a topic’s state of play, keep us on speed dial. See the list of interest areas we cover elsewhere

on this site.

—

You can have two weeks reduced price no-obligation trial for $199. No self-renewing contracts. Suspend, renew coverage at any time. Stay with a topic like trade while its hot and suspend coverage or switch coverage areas when it’s not. We serve customers one by one 24/7.

—

Tony Mace was the top editorial executive for Market News International for two decades.

Washington Bureau Chief Denny Gulino had the same title at Market News for 18 years.

Similar experience undergirds our service in Ottawa, London, Brussels and in Asia.