By Vicki Schmelzer

NEW YORK (MaceNews) – Cash levels fell sharply in February as global investors took sidelined monies and made a beeline into equities, according to BofA Global Research’s monthly fund manager survey, released Tuesday.

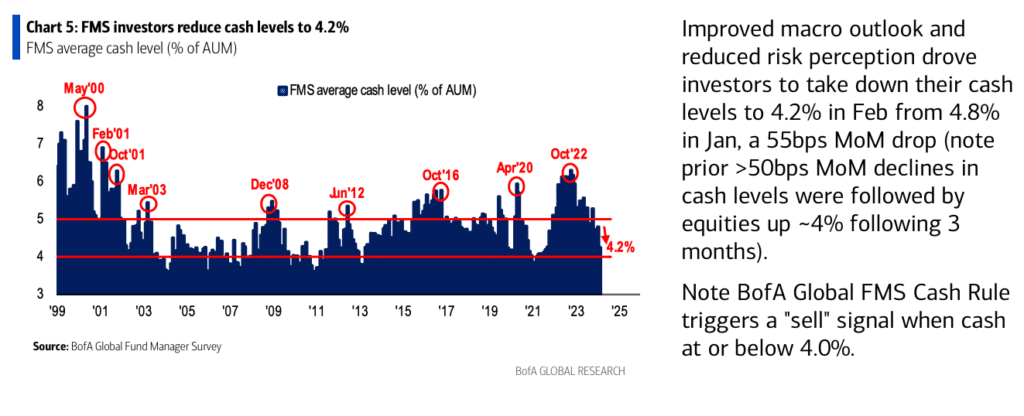

Average cash balances fell to 4.2% in February from 4.8% in January, a 55 basis point drop, and compared to 4.5% in December.

Prior monthly cash level declines of greater than 50 bps “were followed by” equities rising about 4% in the following three months, the survey said.

Allocation to cash fell to a net 6% overweight this month, from a net 16% overweight in January and a net 3% overweight in December.

An “improved macro outlook and reduced risk perception” were behind the move out of cash, the survey said.

Inflation projections have seen only minor changes in recent months, even as global economic prospects have improved.

In February, a net 69% of portfolio managers expected lower inflation, versus a net 71% in January and a net 75% in December.

This month, a net 25% of managers looked for weaker economic growth in the coming year, versus a net 40% in January and a net 50% in December.

These levels compare to July 2022, when at the peak of global growth concerns, a net 79%, a record high, were looking for weaker growth.

On overall holdings, as cash levels declined markedly and equity levels rose markedly, other asset classes saw only minor changes.

In February, a net 21% of portfolio managers were overweight global equities, “the highest level since Feb’22” and compared to a net 9% in January and a net 15% in December, the survey said.

A net 6% of managers were overweight bonds in February, compared to a net 3% in January and a net 20% overweight in December.

“Investors have been overweight bonds for 11 of the past 12 months,” BofA Global Research said.

Commodity allocation stood at a net 6% underweight in February, versus a net 2% underweight in January and a net 10% underweight in December.

On regional asset allocation, U.S., Eurozone and Japanese stocks benefited from monies being moved out of UK and Emerging Markets.

Allocation to U.S. equities rose to a net 21% overweight in February, the “highest since Nov’21,” the survey said. This compared to a net 14% overweight in January and a net 9% overweight in December.

This month, a net 10% of managers were underweight eurozone stocks, versus a net 12% underweight in January and a net 9% underweight in December.

Allocation to global emerging markets (GEM) fell to a net 8% underweight in February, “the lowest allocation since Nov’22,” the survey said. This compared to a net 8% overweight in January and a net 1% overweight in December.

Allocation to Japanese equities stood at a net 13% overweight in February versus a net 6% overweight in January, while UK allocation fell to a net 27% underweight this month from a net 25% underweight in January.

In February, the biggest “tail risks” feared by portfolio managers were: “Higher inflation” (27% of those polled), “Geopolitics” (24%), “Systemic credit event” (16%), “Economic hard landing” (15%), “The US election” (12%), and “China banking crisis” (4%).

In January, the biggest “tail risks” were: “Geopolitics worsen” (25% of those polled), “Economic hard landing” (24%), “Higher inflation” (21%), “Systemic credit event” (11%), “US election” (11%), “China banking crisis” (3%) and “AI bubble” (2%).

“U.S. commercial real estate takes the #1 spot for the most likely source of a systemic credit event,” BoA Global Research said, adding that “US shadow banking (e.g. private credit)” was the top concern in January.

Real estate holdings in the United States and China are seen as “2 of the top 3 most likely sources of a credit event,” the survey said.

In February, the “most crowded” trades deemed by global managers were: “Long Magnificent Seven” (61% of those polled), “Short China equities” (25%). “Long Japan equities” (4%), “Long cash” (2%), and “Long IG corporate bonds” (1%).

In January, the “most crowded” trades were: “Long Magnificent Seven” (52% of those polled), “Short China equities” (24%), “Long Japan equities” (7%), “Long 30-year Treasury” (5%) and “Short REITS” (5%).

Note: the term “Magnificent Seven” was coined by Bank of America’s chief investment strategist Michael Hartnett, referring to a basket of the seven major tech stocks: Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla and Meta.

An overall total of 249 panelists, with $656 billion in assets under management, participated in the BofA Global Research fund manager survey, taken February 2 to February 8, 2024. “209 participants with $568bn AUM responded to the Global FMS questions and 145 participants with $331bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service.