–US Recession Concern Top Tail Risk

–Sixty percent of Managers Expect Four Or More Fed Cuts in Next 12 Months

By Vicki Schmelzer

NEW YORK (MaceNews) – Global investors made a beeline into bonds in July, driven by declining world growth expectations, according to BofA Global Research’s monthly fund manager survey, released Wednesday.

Jitters about the U.S. economy were at the forefront of these concerns, the survey said.

In August, a net 47% of portfolio managers looked for weaker economic growth in the coming year. This compared to a net 27% in July and a net 6% in June. This is in sharp contrast to April when a net 11% of managers looked for stronger world growth.

Inflation concerns abated further month, with a net 76% of investors looking for lower CPI in the next 12 months versus a net 62% in July and a net 57% in June.

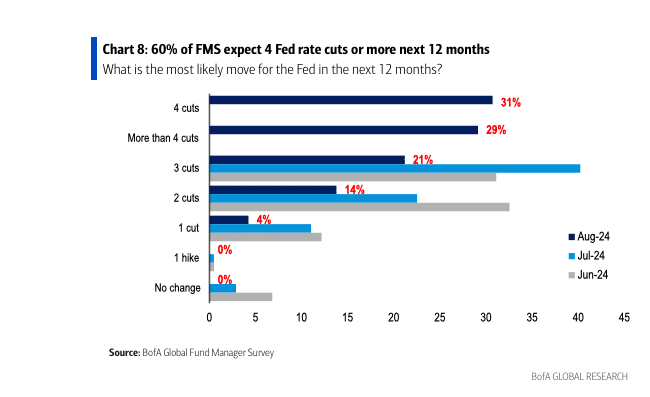

In August, 60% of those polled looked for four or more rate cuts from the Federal Reserve in the coming 12 months. This month, 94% looked for the first cut at the Sept. 18 FOMC meeting versus 87% with that view in July.

“Core optimism” about a “soft landing” in the U.S. economy was unchanged this month, “but investors now expect a greater degree of Fed policy easing in the next 12 months will be required to achieve this outcome,” the survey said.

In terms of asset allocation, for the second month global investors pared back riskier assets and moved monies to more stable instruments.

In August, a net 11% of portfolio managers were overweight global equities, compared to a net 33% overweight in July and a net 39% overweight in June.

A net 8% of managers were overweight bonds this month, compared to a net 9% underweight in July and a net 17% underweight in June.

In August, commodity holdings fell to a net 7% underweight. This compared to a net 1% underweight in July and a net 6% overweight in June.

Allocation to real estate stood at a net 28% underweight, little changed from the net 29% underweight seen in July and still softer than the net 23% underweight seen in June.

Average cash balances rose to 4.3% in August compared to 4.1% in July and 4.0% in June. Allocation to cash held at a net 6% overweight this month, compared to a net 1% underweight in July and a net 6% underweight in June.

This month, all regional asset allocations saw outflows.

Allocation to U.S. equities fell to a net 11% overweight in August from a net 16% overweight in July. This compared to a net 7% overweight in June.

This month, a net 4% of managers were overweight eurozone stocks. This compared to a net 10% overweight in July and a net 30% overweight in June.

Allocation to global emerging markets (GEM) stood at a net 3% overweight in August. This compared to a net 9% overweight in July and a net 1% overweight in June.

This month, allocation to Japanese equities fell to a net 9% underweight from a 7% overweight in July, while UK allocation slipped to a net 8% underweight from a net 4% underweight last month.

In August, the biggest “tail risks” feared by portfolio managers were: “US Recession” (39% of those polled), “Geopolitical conflict” (25%), “Higher Inflation” (12%), “Systemic credit event” (11%), “AI bubble” (7%), and “US election ‘sweep’ (4%).

In July, the biggest “tail risks” were: “Geopolitical conflict” (26% of those polled), “Higher inflation” (22%), “US Recession/Hard Landing” (18%), “AI bubble” (12%), “US election ‘sweep’” (12%), and “Systemic credit event” (7%).

In August, the top three “most overcrowded” trades were deemed “Long Magnificent Seven” (53% of those polled), “Short China equities” (15%) and “Short Japanese Yen” (12%)

In July, the “most overcrowded” trades were: “Long Magnificent Seven” (71% of those polled), “Short Japanese yen” (12%), and (tied for third place) “Short China equities” (5%) vs “Short small cap stocks” (5%).

Note: the term “Magnificent Seven” was coined by Bank of America’s chief investment strategist Michael Hartnett, referring to a basket of the seven major tech stocks: Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla and Meta.

An overall total of 220 panelists, with $590 billion in assets under management, participated in the BofA Global Research fund manager survey, taken August 2 to August 8, 2024. “189 participants with $508bn AUM responded to the Global FMS questions and 122 participants with $265bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com