–Investors Reallocate into Eurozone Stocks

By Vicki Schmelzer

NEW YORK (MaceNews) – Global investors pared equity and bond holdings in January, as growth optimism wobbled at the start of 2025, according to BofA Global Research’s monthly fund manager survey, released Tuesday.

A net 8% of those polled in January looked for a weaker global economy in the coming 12 months, a sharp turnabout from December, when a net 7% looked for stronger growth. “Optimism fell for both the U.S. and China,” the survey said.

At the same time, inflation expectations have risen to the highest level since March 2022, with only a net 7% of those polled looking for lower inflation in the coming 12 months.

Cash levels held steady at 3.9% of assets under management. This is the second month of a “sell” signal for BoA Global’s FMS cash rule, which kicks in when cash levels break below 4.0%

“Since 2011, there have been 12 prior ‘sell’ signals which saw global equity (ACWI) returns of -2.4% in the 1 month after and -0.7% in the 3 months after the ‘sell’ signal was triggered,” the survey noted.

Cash allocation held at a net 11% underweight in January, versus a net 14% underweight in December and a net 4% overweight in November.

In terms of asset allocation, global investors added to commodity holdings while paring back other asset classes.

In January, a net 41% of portfolio managers were overweight global equities, down from a net 49% overweight in December and compared to a net 34% in November.

A net 20% of those polled were underweight bonds, compared to a net 15% underweight in December and a net 10% underweight in November.

Allocation to real estate fell to a net 9% underweight this month, compared to a net 7% underweight in December and a net 12% underweight in October.

This month, commodity holdings stood at a net 6% underweight, up from a net 12% underweight in December and compared to a net 9% underweight in November.

Fund managers were asked about the best performing global asset class for the coming year. Twenty-one percent said global equities would outperform, while 14% chose Bitcoin, the survey said.

Sentiment continued to hinge on Federal Reserve rate cut expectations. In January, 79% of those polled looked for the Fed to cut rates in 2025, with a breakdown of 39% saying two cuts, 27% saying one cut and 13% saying 3 cuts. Only 2% of managers expected a Fed hike in 2025.

In regional equity allocation this month, the U.S. saw larger outflows, while the eurozone saw larger inflows. Other regions were little changed.

Allocation to U.S. equities fell to a net 19% overweight in January, down from the record high allocation of a net 36% overweight seen in December, but still up from the net 13% overweight seen in November.

This month, a net 1% of portfolio managers were overweight eurozone stocks, a big jump from a net 25% underweight in December and compared to a net 3% underweight in November.

Allocation to global emerging markets (GEM) stood at a net 3% overweight in January, little changed from the net 4% overweight seen in December and well down from the net 27% overweight seen in November.

This month, allocation to Japanese equities rose to a net one percent underweight from a net 4% underweight in December, while UK allocation slipped to a net 16% underweight from a net 14% underweight in December.

In January, the top two biggest “tail risks” were “Inflation causes Fed to hike” (41% of those polled) and “trade war triggers global recession” (28%).

In December, the top two biggest “tail risks” were tied, with 37% each of FMS investors fearful that “Global trade war triggers recession” and “Inflation causes Fed to hike.”

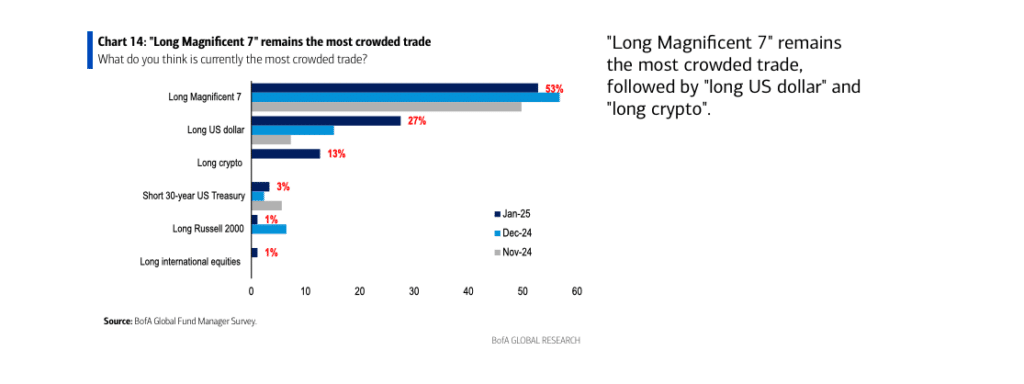

In January, the top three “most crowded” trades were deemed “Long Magnificent 7” (53% of those polled), “Long U.S. dollar” (27%) and “Long Crypto” (13%).

Last month, the top three “most crowded” trades were “Long Magnificent 7” (57% of those polled), “Long U.S. dollar” (15%) and “Long Russell 2000” (6%).

Note: the term “Magnificent Seven” was coined by Bank of America’s chief investment strategist Michael Hartnett, referring to a basket of the seven major tech stocks: Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla and Meta.

An overall total of 214 panelists, with $576 billion in assets under management, participated in the BofA Global Research fund manager survey, taken January 10-16, 2025. “182 participants with $513bn AUM responded to the Global FMS questions and 111 participants with $214bn AUM responded to the Regional FMS questions,” BofA Global said. Contact this reporter: vicki@macenews.com