–US Equity Allocation Sees Biggest Monthly Drop on Record

By Vicki Schmelzer

NEW YORK (MaceNews) – A drop in expectations that the U.S. economy will outperform and rising worries about the global economy prompted a “bull crash” in global investor sentiment in March, according to BofA Global Research’s monthly fund manager survey, released Tuesday.

When asked the question, “Do you think the theme of ‘U.S. exceptionalism’ has peaked?” a net 69% of fund managers said “Yes,” while a net 21% said “No.”

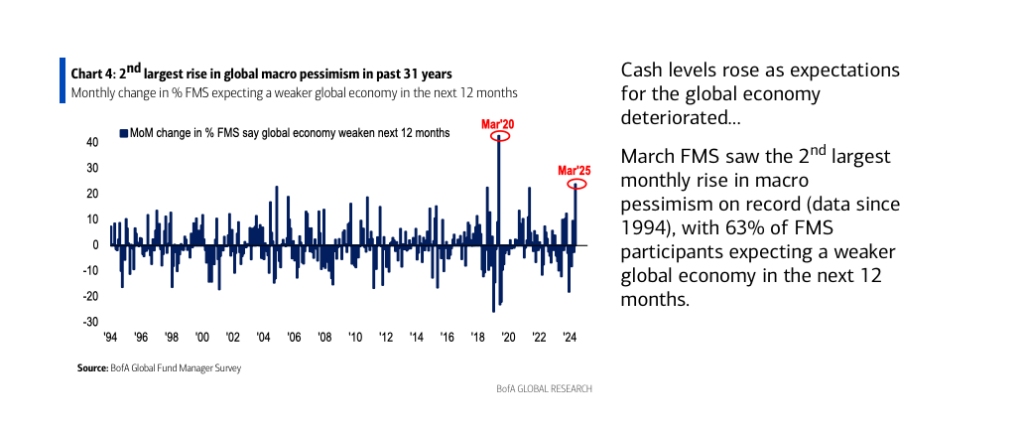

This sharp shift in investor outlook was evidenced by the second largest monthly rise in macro pessimism sentiment on record, (BoA Global data since 1994).

A net 63% of those polled this month looked for a weaker global economy in the coming 12 months.

“The rise in global economic growth pessimism was driven by a worsening outlook for the U.S. economy,” the survey said, adding, “Conversely, China’s economic growth outlook brightened.”

In March, a net 71% of fund managers looked for the U.S. economy to weaken and a net 28% looked for China’s economy to strengthen.

This month, a net 7% of managers looked for higher global inflation in the next 12 months, compared to February, when a net 4% looked for lower global inflation in the coming year. This is the first time since August 2021 that investors looked for higher inflation, the survey noted.

Cash levels reversed course sharply, rising to 4.1% in March from 3.5% in February, which was the lowest level since 2010.

Cash allocation jumped to a net 10% overweight in March from a net 6% underweight in February. This compared to a net 11% underweight in January.

In terms of asset allocation, global investors tweaked bond, real estate and commodity holdings while dumping equity holdings.

In March, a net 6% of portfolio managers were overweight global equities, compared to a net 35% overweight in February and a net 41% overweight in January.

A net 13% of those polled were underweight bonds, compared to a net 11% underweight in February and a net 20% underweight in January.

Allocation to real estate stood at a net 7% underweight this month, compared to a net 6% underweight in February and a net 9% underweight in January.

Commodity allocation held at a net 1% underweight in March, little changed from a net 2% underweight in February and compared to a net 6% underweight in January.

In regional equity allocation this month, the U.S. saw larger outflows, while the eurozone and emerging markets saw larger inflows.

Allocation to U.S. equities stood at a net 23% underweight in March, compared to a net 17% overweight in February and a net 19% overweight in January. The 40-percentage point drop in allocation was the biggest monthly decline on record, the survey noted.

This month, a net 39% of those polled were overweight eurozone stocks, up from a net 12% overweight in February and compared to a net 1% overweight in January.

Allocation to global emerging markets (GEM) stood at a net 20% overweight in March, versus neutral in February and a net 3% overweight in January.

This month, allocation to Japanese equities held at a net 1% underweight compared to a net 2% underweight in February, while UK allocation rose robustly to a net 4% overweight from a 18% underweight last month.

Sentiment was little changed in terms of overall U.S. Federal Reserve rate cut expectations, although the magnitude of the cuts shifted.

In March, 68% of managers looked for the Fed to lower interest rates in 2025, up from 51% in February. Forty nine percent of fund managers looked for two cuts this year, compared to 46% with that view last month.

This month, the two biggest “tail risks” were “Trade war triggers global recession” (55% of those polled) and “Inflation causes Fed to hike” (19%). In third place were managers “concerned about the impact of the Department of Government Efficiency (DOGE) on the U.S. economy”, with 13% of those polled fearful that “DOGE sparks U.S. recession.”

In February, the two biggest “tail risks” were “Trade war triggers global recession” (39% of those polled) and “Inflation causes Fed to hike” (31%), with “AI Bubble” (13%) the third largest concern.

In March, the three “most crowded” traders were deemed “Long Magnificent 7” (40% of those polled), “Long EU stocks” (23%), and “Long crypto” (9%).

In February, the three “most crowded” trades were “Long Magnificent 7” (56% of those polled), “Long U.S. dollar” (17%) and “Long Crypto” (13%).

Note: the term “Magnificent Seven” was coined by Bank of America’s chief investment strategist Michael Hartnett, referring to a basket of the seven major tech stocks: Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla and Meta.

An overall total of 205 panelists, with $477 billion in assets under management, participated in the BofA Global Research fund manager survey, taken February 07-13, 2025. “171 participants with $426bn AUM responded to the Global FMS questions and 107 participants with $193bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com