By Vicki Schmelzer

NEW YORK (MaceNews) – Federal Reserve tapering prospects, potential People’s Bank of China easing and the fast-paced spread of the COVID-19 Delta variant weighed on the growth outlook in August, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday.

Even though world growth expectations slipped more markedly this month, investors made only mild tweaks in their equity and bond portfolios.

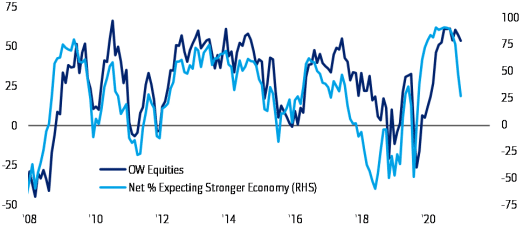

A net 27% of those polled in August looked for stronger world economic growth this year, down from a net 47% in July and a net 75% in June and compared to 91% peak seen in March and February, the survey said.

Inflation concerns have been largely wiped away, with a net 4% of managers looking for higher global CPI in the coming 12 months, versus a net 22% and a net 64% with that view in July and June respectively, and compared to the record net 93% seen in April and March.

“Short-term rate expectations however are still high and lag inflation expectations more than historically,” the survey said.

In August, a net 65% of those polled saw inflation as transitory versus a net 32% saying that it is permanent. Last month, a net 70% saw inflation as transitory, with a net 26% stating that inflation is permanent.

In terms of portfolio holdings, average cash balances nudged up to 4.2% in August from 4.1% in July and 3.9% in June, according to BofA Global.

Allocation to cash rose 0.1% to a net 13% overweight this month, which was the highest since October 2020, the survey said.

Global investor allocation to commodities fell to a net 17% overweight in August, the lowest since November 2020. This compared to the net 29% overweight seen in July, which was the highest reading ever, BofA Global said.

On overall asset allocation, a net 54% of portfolio managers were overweight global equities in August, down from a net 58% overweight in July and a net 61% in June. These levels compare to the record highs near 70% seen in 2011.

This month, a net 67% of managers were underweight bonds, versus a net 68% underweight in July and a net 69% underweight in June.

In terms of Federal Reserve policy, a net 84% of those polled in the latest survey expect the Fed to signal its willingness to taper asset purchases by year-end.

A net 28% of investors look for the Fed to signal tapering at the Jackson Hole policy symposium in late August, a net 33% see the Fed signaling a taper at the September 21-22 FOMC meeting and a net 23% think the Fed will wait until later in Q4 to make its intentions known.

In addition, investors polled this month pushed back Fed hike expectations to January 2023 from November 2022, as seen in the July survey.

In other monetary policy musings, a net 78% of global investors now look for China to ease its monetary policy, “up drastically from 44% in July,” the survey said.

The decline in global yields seen in the past two months was driven by three main concerns, “peak U.S. growth/inflation” (34%), “Positioning” (27%) and concerns about the “COVID-19 Delta variant” (21%), fund managers said.

On regional equity asset allocation, global investors trimmed holdings in most regions.

Allocation to U.S. stocks held at a net 11% overweight in August, unchanged from July and compared to a net 6% overweight in June and May.

This month, a net 36% of managers were overweight eurozone stocks, down from a net 45% in July, which was the highest since January 2018 and compared to a net 41% overweight in June.

Fund managers reduced global emerging market (GEM) holdings to a net 3% overweight in August, the lowest since May 2020. This compared to a net 14% overweight in July and a net 31% overweight in June and was well down from the record net 62% overweight seen in January.

Portfolio managers had a net 12% underweight in Japanese equity markets this month, versus a net 6% underweight in July and a net 4% underweight in June.

UK equity allocations showed managers with a net 2% underweight in August, compared to a net 1% overweight in July and a net 4% overweight in June, the survey said.

In August, the biggest “tail risks” feared by portfolio managers were: “Inflation” (22% of those polled), “A ‘taper tantrum’” (20%), “COVID-19 delta variant” (19%), “Asset bubbles” (17%) and “China policy” (16%)

Last month, the biggest “tail risks” were: “Inflation” (29% of those polled), “A ‘taper tantrum’” (26%), “Asset bubbles” (15%), “China slowdown” (13%), and “COVID-19” (13%).

“When asked (before the Afghan debacle), what was the greatest risk to financial market stability, the biggest perceived risks to financial markets was Emerging Market risk (due to China) and monetary risk (due to tapering),” BofA Global said.

In August, the “most crowded” trades deemed by managers were: “Long Tech Stocks” (40% of those polled), “Long ESG” (20%), “Short China Stocks” (11%), “Long U.S. Treasuries” (10%), “Long Bitcoin” (9%), and “Long Commodities” (7%). Note that ESG stands for Environmental, Social and Governance and refers to a class of investment also known as “sustainable investing.”

Last month, the top “most crowded” trades were: “Long Tech Stocks” (26%), “Long ESG” (25%), “Long Bitcoin” (15%), “Long Commodities” (14%), “Short U.S. Treasuries” (9%), and “Long stock values” (7%).

An overall total of 257 panelists, with $749 billion in assets under management, participated in the BofA Global Research fund manager survey, taken August 6 to 12, 2021. “232 participants with $702bn AUM responded to the Global FMS questions and 101 participants with $200bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@dgulinoStories may appear first on the Mace News premium service. For real-time delivery contact tony@macenews.com. Twitter headlines @macenewsmacro