–ISM: Firms Seeking Supply-Demand Equilibrium; New Orders Plunge

–ISM Concerned About Backlog Orders Slide To 15-Month Low

–Supplier Delivery Delays Easing But Still Hurting Production

By Max Sato

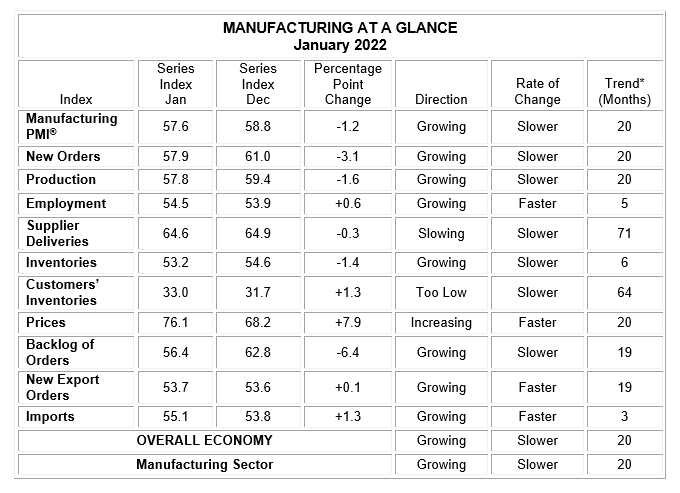

(MaceNews) – The U.S. manufacturing sector index compiled by the Institute for Supply Management Tuesday fell to a 14-month low of 57.6 (versus the Econoday consensus forecast for 57.5) in January from a revised 58.8 in December as supply delays and labor shortages continued amid the Omicron-led surge in coronavirus cases. The ISM revised past data in an annual update to seasonal adjustments.

The ISM reading was the lowest since November 2020, when the index dipped to 57.3, and marked the third straight monthly drop. The main index was still above the breakeven point of 50, indicating that the overall economy expanded for the 20th consecutive month.

Timothy Fiore, chair of the ISM Manufacturing Business Survey Committee, described the current conditions as “more stable.” Manufacturers have been “moving toward a supply and demand equilibrium in the past three months,” he told reporters.

“The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment, but January was the third straight month with indications of improvements in labor resources and supplier delivery performance,” he summarized in a statement. “Still, there were shortages of critical intermediate materials, difficulties in transporting products and lack of direct labor on factory floors due to the Covid-19 omicron variant.”

The new orders index plunged 3.1 percentage points to 57.9 in January from 61.0 in December, hitting the lowest point since June 2020, when it picked up to 56.8 from 32.3 the previous month in the aftermath of the first wave of the pandemic

The production Index fell for the second straight month, down 1.6 points at 57.8 percent from 59.4. It was also the lowest level since June 2020, when it rose to 56.1 from 34.0 it the prior month.

Among the sub-indexes, Fiore said he was “most concerned” about the backlog orders index, which slumped 6.4 points to a 15-month low of 56.4 from 62.8. It was the lowest since 55.7 in October 2020 and compared with a record high of 70.6 hit in May 2021.

The supplier deliveries index marked the third straight monthly decline to a 14-month low of 64.6 in January, down 0.3 percentage point from December’s 64.9. Lower numbers indicate an improvement. The inventories index fell to 1.4 points to a six-month low of 53.2 from 54.6 percent the previous month.

“Our suppliers are having difficulty meeting scheduled releases as their suppliers experience delays and shortages, so lead times and inventories are struggling, resulting in lost production,” according to a firm in the food, beverage and tobacco industry.

A fabricated metal products echoed the sentiment: ““Lack of skilled production personnel, either from missing work due to (COVID-19) variants or leaving for better opportunities, making it more difficult to complete work. Working off a backlog.”

The prices index surged 7.9 points to a record high of 76.1 in January from 68.2 in December (except that the diffusion index hit the full 100 figure in June 1950). The employment index registered 54.5, up 0.6 point from 53.9.

—

Contact this reporter: max@macenews.com

Content may appear first or exclusively on the Mace News premium service. For real-time delivery contact tony@macenews.com. Twitter headlines @macenewsmacro.