— Inflation Expected to Decline

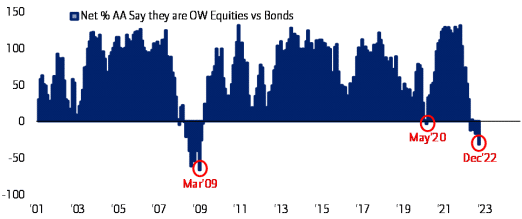

— First Bond Overweight Since April 2009

By Vicki Schmelzer

NEW YORK (MaceNews) – Global investors polled at year-end were decidedly less pessimistic about 2023 prospects especially for inflation, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday.

In December, a net 68% of managers said a recession was likely in the coming 12 months. This is down from a net 77% in November, which was the highest level since the COVID-19 high from April 2020 and back at September 2022 levels.

A net 69% of those polled looked for weaker overall economic growth in the next year, down from a net 73% in November and a net 72% in October and compared to the record high print of 79%, seen in July.

On the inflation front, a record net 90% of fund managers looked for lower global CPI in the coming 12 months, up from a net 85% in November and a net 79% in October.

For the second month, this was a new record reading for this view, breaking above the prior record of a net 82% looking for lower inflation, seen in December 2008 at the peak of the U.S. financial crisis.

In December, global investors saw U.S. headline CPI inflation at 4.2% in the next 12 months, versus a view of 4.5% in November.

In terms of asset allocation, global investors began to put side-lined cash to work.

Allocation to cash stood at a net 38% overweight in December, down from a net 51% in November and a net 59% in October, and compared to the record net 62% overweight seen in September.

Average cash balances fell to 5.9% this month, compared to 6.2% in November and 6.3% seen in October, which was the highest seen since April 2001.

In December, a net 22% of portfolio managers were underweight global equities, compared to a net 34% underweight in November, a net 49% underweight in October and the record 52% underweight seen in September.

For the first time in many months, allocation to bonds turned to an overweight as investors locked in higher yields.

A net 10% of managers were overweight bonds in December, compared to a net 19% underweight in November and a net 32% underweight in October. This was the first net overweight in bonds since April 2009.

A net 27% of those polled at year-end looked for government bonds to be the best performing asset of 2023. In terms of other best performing assets for next year, a net 25% favored stocks, a net 24% favored corporate bonds, a net 12% favored commodities, a net 6% favored cash and a net 4% favored crypto.

This month, commodity allocation declined to a net 9% underweight from a net 13% overweight in November and a net 15% overweight in October. For the first time since April 2009, investors’ net allocation to bonds surpassed that of commodities, the survey noted.

On regional equity allocation, global investors trimmed U.S. holdings while increasing assets in other regions.

Allocation to U.S. stocks stood at a net 12% underweight in December, compared to a net 7% underweight in November and a net 9% underweight in October.

This month, a net 10% of managers were underweight eurozone stocks, compared to a net 23% underweight in November and a net 32% underweight in October. This compared to a net 42% underweight in September, which was a record underweight.

Allocation to global emerging markets surged to a net 13% overweight in December, compared to a net 9% underweight in November and a net 6% underweight in October.

Allocation to Japanese equities saw a net 6% underweight in December compared to a net 11% underweight in November and UK allocation stood at a net 18% underweight compared to a net 25% underweight in November.

In December, the biggest “tail risks” feared by portfolio managers were: “Inflation stays high” (37% of those polled), “Deep global recession” (20%), “Central banks stay hawkish” (16%), “Geopolitics worsen (e.g., Russia/Ukraine, China/Taiwan)” (12%), and “Systemic credit event” (12%).

In November, the biggest “tail risks” were: “Inflation stays high” (32% of those polled), “Geopolitics worsen (e.g. Russia/Ukraine, China/Taiwan)” (18%), “Central banks stay hawkish” (18%), “Deep global recession” (18%), “Systemic credit event” (13%) and “Debt deflation” (1%).

In December, the “most crowded” trades deemed by global managers were: “Long US dollar” (37% of those polled), “Short China equities” (16%), “Long Oil” (10%), “Long ESG assets” (10%), and “Long T-bills” (7%).

Last month, the “most crowded” trades were: “Long US dollar” (58% of those polled), “Short China Equities” (13%), “Long oil” (10%), “Short EU equities” (7%), “Long ESG assets” (6%), and “Long T-bills” (2%).

An overall total of 319 panelists, with $815 billion in assets under management, participated in the BofA Global Research fund manager survey, taken December 2-8, 2022. “281 participants with $728bn AUM responded to the Global FMS questions and 178 participants with $344bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service.

For real-time email delivery contact tony@macenews.com.

Twitter headlines @macenewsmacro