By Vicki Schmelzer

NEW YORK (MaceNews) – Inflation concerns spiked in September and were at odds with lower recession fears and increased anticipation of Federal Reserve rate cuts, according to the findings of BofA Global Research’s monthly fund manager survey released Tuesday.

In September, a net 69% of fund managers looked for lower global consumer prices in the next 12 months, compared to a net 81% with that view in August and a net 78% in July. These levels compare to the record high of 90% looking for lower inflation back in December 2022.

This month, a net 53% of those polled looked for weaker economic growth in the coming year, compared to a net 45% in August and a net 60% in July. These levels compare to July 2022 when, at the peak of global growth concerns, a net 79%, a record high, were looking for weaker growth.

While a majority remains pessimistic about world growth, this did not translate into increased recession concerns.

“… Nearly 30% of FMS investors think there will be no recession at all in the next 18 months,” the survey said. This was little changed from 30% with that view in August and still up from 19% in July.

Despite a one-month spike in inflation concerns, many managers maintain that the Fed is on track to lower interest rates in 2024, the survey said.

A net 60% of managers “believe the Fed is ‘done’ hiking rates,” the survey noted. This compared to a net 47% in August and a net 9% in July.

“Most FMS investors expect the first Fed cut to occur between Apr-Dec 2024,” BoA Global said. On the breakdown, 38% of managers expected cuts in H2 2024 and 36% eyed Q2 2024 specifically.

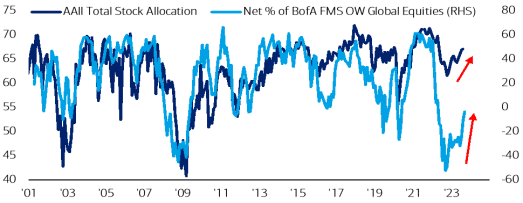

In terms of asset allocation, global investors added to equity and cash holdings, while trimming bond longs.

In September, a net 3% of portfolio managers were underweight global equities, compared to a net 11% underweight in August and a net 24% underweight in July. In September 2022, fund managers held a record 52% underweight in stocks.

A net 1% of managers were underweight bonds in September, compared to a net 5% overweight in August and a net 3% overweight in July. “This is the first time that investors have been UW bonds in 7 months,” the survey said.

May 2023, which saw a net 14% bond overweight, was the highest bond allocation since March 2009.

Allocation to cash increased to a net 27% overweight in September, compared to a net 20% overweight last month and a net 32% overweight in July.

Average cash balances stood at 4.9% this month versus 4.8% in August, which was the lowest since November 2021 and compared to 5.3% in July.

Commodity allocation stood at a net 2% overweight in September, versus a net 1% underweight in August and a net 9% underweight in July.

“Commodity allocation has now risen for two months in a row, after five straight months of decline,” BofA Global said.

On regional equity allocation, “September saw a record jump in FMS investors’ allocation, with a shift in US equities and out of EM equities,” the survey said.

Allocation to U.S. stocks rose to a net 7% overweight this month, compared to a net 22% underweight in August and a net 10% underweight in July.

This month, a net 10% of managers were underweight eurozone stocks, little changed from the net 12% underweight seen in August and compared to a net 1% underweight in July.

Allocation to global emerging markets (GEM) fell to a net 9% overweight in September from a net 34% overweight in August and compared to a net 23% overweight in July.

“This is the largest monthly decline in allocation since Nov’16,” the survey noted.

Allocation to Japanese equities stood at a net 10% overweight in September versus a net 6% overweight in August and UK allocations stood at a net 22% underweight this month compared to a net 18% underweight in August.

In September, the biggest “tail risks” feared by managers were: “High inflation keeps central banks hawkish” (40% of those polled), “Geopolitics worsen” (14%), “Systemic credit event (government/corporate) (13%), “Bank credit crunch & global recession” (13%), “AI/tech bubble” (10%) and “China real estate bust” (8%).

In August, the biggest “tail risks” were: “High inflation keeps central banks hawkish” (45% of those polled), “Geopolitics worsen” (14%), “Bank credit crunch & global recession” (14%), “Systemic credit event” (12%) and “AI/tech bubble” (10%).

In September, the “most crowded” trades deemed by global managers were: “Long Big Tech” (55% of those polled), “Short China equities” (21%), “Long Japan equities” (8%), “Short REITs” (4%), “Long T-bills” (3%) and “Short US dollar” (3%).

In August, the “most crowded” trades were: “Long Big Tech” (60% of those polled), “Short China equities” (14%), “Long Japan equities” (6%), “Short US dollar” (5%), “Long T-Bills” (4%), and “Long IG bonds” (3%).

An overall total of 258 panelists, with $678 billion in assets under management, participated in the BofA Global Research fund manager survey, taken September 1 to September 7, 2023. “222 participants with $616bn AUM responded to the Global FMS questions and 141 participants with $276bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service.

For real-time email delivery contact tony@macenews.com.

Twitter headlines @macenewsmacro