– – Inflation is Chief Concern; Rising Fear of Systemic Credit Event

By Vicki Schmelzer

NEW YORK (MaceNews) – Fund managers’ cash levels rose in October to highs last seen in 2001 as investors feared economic weakness and pondered the timing of an eventual Federal Reserve policy pivot, according to the findings of Bank of America Global Research’s monthly fund manager survey, released Tuesday.

Average cash levels in October rose to 6.3% from 6.1% in September and 5.7% in August to reach levels last seen in April 2001, the survey said.

This month, a net 72% of fund managers looked for weaker economic growth in the coming 12 months, unchanged from September and compared to a net 67% in August and the record high print of a net 79% in July.

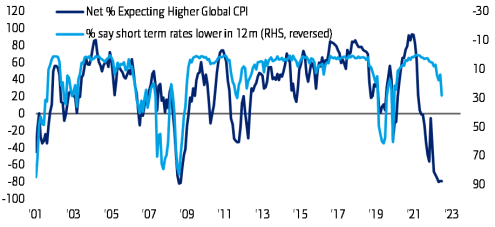

A net 79% of managers looked for lower global CPI in the coming 12 months, also unchanged from September and compared to a net 80% in August, which was the highest since December 2008.

The October reading suggests that “the world economy is currently at peak inflation, while actual global inflation rate was 9.8% in September,” the survey observed.

Investors remained on high alert for recession, with a net 74% of managers looking for a global downturn in the next 12 months, compared to a net 68% with that view in September and a net 58% with that view in August.

In October, investors repriced terminal federal funds rates to 4.5%-5.0%, up 50 basis points from September, but also brought forward the time when the Fed might pivot away from tightening.

“The Fed will end its current rate hiking cycle in Q1’23, according to 38% of FMS investors, who were expecting “peak” fed funds rate in Q2 ’23 a month ago,” the survey said.

For the Fed to contemplate an end to its tightening cycle, investors believed that “inflation, as measured by the PCE deflator, needs to slow to below 4% (currently 6.3%),” the survey said.

In a new development, roughly one fifth of those surveyed in October maintained that a “global credit event” might be enough for the Fed to stop tightening.

“Near a third of FMS investors view European sovereign debt markets as the most likely source for a systemic credit event. Adding to concerns on Euro Area banks (11%), about 45% of FMS investors see the next credit event occurring in Europe.,” BofA Global said.

In terms of asset allocation, allocation to cash stood at a net 59% overweight in October, down from the record 62% overweight seen in September and compared to a net 48% overweight in August.

This month, a net 49% of portfolio managers were underweight global equities, improved modestly from the record underweight of a net 52% underweight seen in September, but still nearly double the net 26% underweight seen in August

A net 32% of managers were underweight bonds this month, versus a net 40% underweight in September and a net 28% underweight in August.

Commodity allocation slipped to a net 15% overweight in October, down from a net 19% overweight in September and compared to a net 10% overweight in August.

On regional equity asset allocation, global investors decreased U.S. and UK holdings, while adding eurozone, emerging market and Japanese assets to their portfolios.

Allocation to U.S. stocks stood at a net 9% underweight in October, compared to a net 4% underweight in September and a net 10% overweight in August.

This month, a net 32% of managers were underweight eurozone stocks compared to a net 42% underweight in September, which was a record underweight, and a net 34% underweight in August.

Allocation to global emerging markets (GEM) stood at a net 6% underweight compared to a net 10% underweight in September and a net 9% underweight in August.

Allocation to Japanese equities saw a 4% underweight in October compared to a net 10% underweight in September and UK allocation saw a 33% underweight compared to a net 24% underweight in September.

In October, the biggest “tail risks” feared by portfolio managers were: “Inflation” (27% of those polled), “Geopolitics” (19%), “Hawkish central banks” (18%), “Deep global recession” (17%), “Systemic credit event” (17%), “Other” (1%), “and Covid-19 resurgence” (1%).

Last month, the biggest “tail risks” were: “Inflation stays high” (36% of those polled), “Hawkish central banks” (20%), “Geopolitics” (17%), “Global recession” (17%), “Systemic credit event” (7%), and “Covid-19 resurgence” (1%).

In October, the “most crowded” trades deemed by global managers were:

“Long US dollar” (64% of those polled), “Short EU equities” (8%), “Long ESG assets” (8%), “Long oil” (6%), “Short EM/China debt & equity” (6%), and “Short UK debt & equity” (4%).

Last month, the “most crowded” trades deemed by global managers were: “Long US dollar,” (56% of those polled), “Long oil/commodities” (10%), “Long ESG assets” (8%), “Short US Treasuries” (8%), “Long growth stocks” (7%), and “Long Cash.”

Indeed, “a record high share of FMS investors (68%)” saw the U.S. dollar as “overvalued” in October 2022, compared to 61% with that view in September, the survey noted.

In a special question this month, panelists were asked about possible outcomes stemming from the G-20 Summit taking place in Bali, Indonesia on November 15-16.

A “near majority” stated that “the most bullish outcome from the next G20 meeting would be some form of resolution of the Russia-Ukraine conflict,” the survey said.

An overall total of 371 panelists, with $1.1 trillion in assets under management, participated in the BofA Global Research fund manager survey, taken October 7-13, 2022. “326 participants with $971bn AUM responded to the Global FMS questions and 189 participants with $419bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service.

For real-time email delivery contact tony@macenews.com.

Twitter headlines @macenewsmacro