By Vicki Schmelzer

NEW YORK (MaceNews) – Cash allocations nudged higher in March, driven by global investors rethinking their views about inflation and the outlook for lower interest rates, according to BofA Global Research’s monthly fund manager survey, released Tuesday.

Average cash balances were 4.4% this month compared to 4.2% in February and 4.8% in January.

Allocation to cash stood at a net 5% overweight in March versus a net 6% overweight in February and a net 16% overweight in January.

Inflation projections have become less optimistic in recent months, even as views about global economic prospects have become more upbeat.

In March, a net 57% of portfolio managers expected lower inflation, versus a net 69% in February and a net 71% in January.

This month, a net 12% of managers looked for weaker economic growth in the coming year, versus a net 25% in February and a net 40% in January.

These levels are the “most optimistic” since January 2022, the survey said and compared to July 2022, when at the peak of global growth concerns, a net 79% of those polled, a record high, were looking for weaker growth.

On overall holdings, despite the small rise in cash levels, there was renewed interest in world equities.

In March a net 28% of portfolio managers were overweight global equities, versus a net 21% overweight in February and a net 9% overweight in January.

A net 7% of managers were overweight bonds in March, compared to a net 6% overweight in February and a net 3% overweight in January.

“Investors have been overweight bonds for 12 of the past 13 months,” BofA Global Research said.

At the same time, expectations for lower bond yields have waned.

“In March, 40% of FMS investors expected lower bond yields, down from 62% in Dec’23,” the survey said.

Commodity allocation stood at a net 8% underweight in March, versus a net 6% underweight in February and a net 2% underweight in January.

Investors have been underweight commodities for the past four months, making it the “longest underweight streak” since August 2019, the survey noted.

On regional asset allocation, investors moved monies out of the United States into other equity markets, with the eurozone and emerging markets the chief beneficiaries.

Allocation to U.S. equities fell to a net 8% overweight in March, the lowest in five months and compared to a net 21% overweight in February, which had been the highest since November 2021. Holdings were at a net 14% overweight in January.

This month, a net 14% of managers were overweight eurozone stocks, the highest level since May 2023 and compared to a net 10% underweight in February and a net 12% underweight in January.

Allocation to global emerging markets (GEM) rose to a net 16% overweight in March from a net 8% underweight in February and a net 8% overweight in January.

Allocation to Japanese equities stood at a net 21% overweight in March versus a 13% overweight in February, while UK allocation held steady at a net 27% underweight.

“FMS investors have been consistently overweight Japanese equities for the past 8 months,” the survey said.

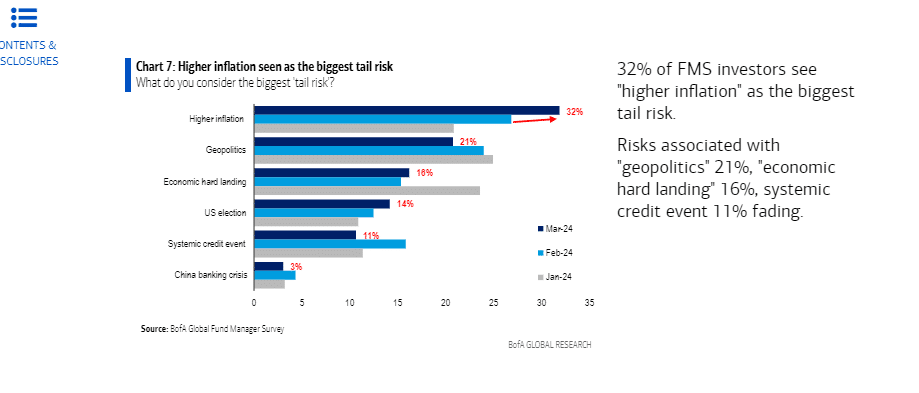

In March, the biggest “tail risks” feared by portfolio managers were: “Higher inflation” (32% of those polled), “Geopolitics” (21%), “Economic hard landing” (16%) and “Systemic credit event” (11%).

In February, the biggest “tail risks” were: “Higher inflation” (27% of those polled), “Geopolitics” (24%), “Systemic credit event” (16%), “Economic hard landing” (15%), “The US election” (12%), and “China banking crisis” (4%).

In March, the “most crowded” trades deemed by global managers were: “Long Magnificent Seven” (58% of those polled), “Short China equities” (14%), “Long Japan equities” (13%), “Long bitcoin” (10%), “Long Cash” (3%) and “Long IG corporate bonds” (2%).

In February, the “most crowded” trades were: “Long Magnificent Seven” (61% of those polled), “Short China equities” (25%). “Long Japan equities” (4%), “Long cash” (2%), and “Long IG corporate bonds” (1%).

Note: the term “Magnificent Seven” was coined by Bank of America’s chief investment strategist Michael Hartnett, referring to a basket of the seven major tech stocks: Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla and Meta.

An overall total of 226 panelists, with $572 billion in assets under management, participated in the BofA Global Research fund manager survey, taken March 8 to March 14, 2024. “198 participants with $527bn AUM responded to the Global FMS questions and 119 participants with $256bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service.

For real-time email delivery contact tony@macenews.com.