–Cash Level Pop Triggers “Buy” Signal for S&P 500

By Vicki Schmelzer

NEW YORK (MaceNews) – Cash levels jumped in October as global investors turned bearish in light of unfolding world events, according to the findings of BofA Global Research’s monthly fund manager survey released Wednesday.

The survey period, from October 6-12, included responses in the wake of the Oct. 7 Hamas attack on Israel.

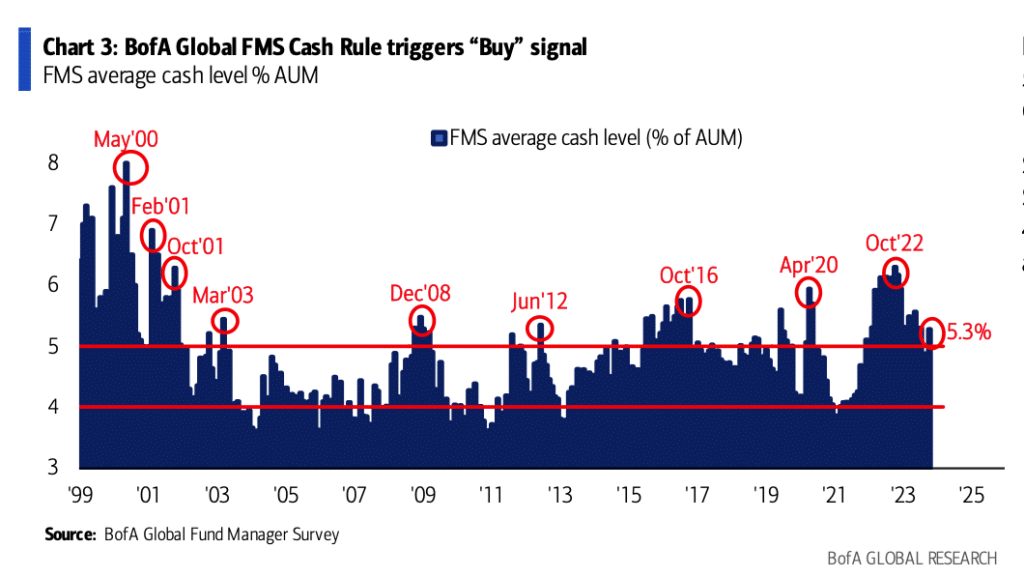

Average cash balances stood at 5.3% in October versus 4.9% in September and compared to 4.8% in August. This month’s rise in cash levels triggered a “‘buy’ signal for BofA Global FMS Cash Rule,” the survey said.

“Since 2011, the ‘buy’ signal would have seen S&P 500 returns of 2% in the 2 months after, 4% in the 3 months after, 7% in the 6 months after,” BofA Global said.

Despite the sudden move into cash, key market views about growth and inflation were more upbeat this month.

In October, a net 70% of fund managers looked for lower global CPI in the next 12 months, compared to a net 69% in September and a net 81% in August. These levels compare to the record high of 90% looking for lower inflation back in December 2022.

This month, a net 50% of those polled looked for weaker economic growth in the coming year, compared to a net 53% in September and a net 45% in August. These levels compare to July 2022, when at the peak of global growth concerns, a net 79%, a record high, were looking for weaker growth.

Nevertheless, recession uncertainty was evident in October, with 25% of investors now saying there would be no recession in the next 18 months, down from 30% in September and August.

While a “soft landing” remained the consensus for fund managers, “hard landing” concerns were on the rise, seen at 30% in October versus 21% in September.

Despite increased jitters, 60% of managers maintained that the U.S. Federal Reserve “has finished its rate hike cycle,” unchanged from last month.

Most managers still looked for the first Fed cut in the second half of 2024.

On the breakdown, 32% of those polled in October eyed Q3 2024 and 20% eyed Q4 2024 for the timing of the first cut in the benchmark fed funds rate.

In September, 38% of managers expected a cut in H2 2024 and 36% saw the first cut in Q2 2024 specifically.

In terms of asset allocation, aside from adding to cash coffers, global investors merely tweaked equity and bond holdings.

In October, a net 4% of portfolio managers were underweight global equities, compared to a net 3% underweight in September and a net 11% underweight in August. In comparison, back in September 2022 fund managers held a record 52% underweight in stocks.

A net 1% of fund managers were overweight bonds in October, compared to a net 1% underweight in September and a net 5% overweight in August.

“Investors have been overweight bonds for 8 out of 10 months thus far in 2023,” the survey said. As background, May 2023, which saw a net 14% bond overweight, was the highest bond allocation since March 2009.

Allocation to cash increased to a net 29% overweight this month, compared to a net 27% overweight in September and a net 20% overweight in August.

Commodity allocation rose to a net 8% overweight in October from a net 2% overweight in September and compared to a net 1% underweight in August.

On equity allocation, most regions, other than Japan, saw trimming of stock holdings in October.

Allocation to U.S. stocks was a net 6% overweight this month, compared to a net 7% overweight in September and a net 22% underweight in August.

This month, a net 19% of managers were underweight eurozone stocks versus a net 10% underweight in September and a net 12% underweight in August.

Allocation to global emerging markets (GEM) fell to a net 3% underweight in October, down from a net 9% overweight in September and compared to a net 34% overweight in August.

“In the last two months, EM equity allocation has declined 37ppt, the largest two-month decline since Mar’11,” BofA Global said.

Allocation to Japanese equities stood at a 16% overweight in October compared to a net 10% overweight in September and UK allocations stood at a net 25% underweight compared to a net 22% underweight last month.

In October, the biggest “tail risks” feared by portfolio managers were: “High inflation keeps central banks hawkish” (31% of those polled), “Geopolitics worsen” (23%), “Global recession/hard landing” (21%), “Systemic credit event” (government/corporate) (15%), “AI/tech bubble” (4%), and “China real estate bust” (3%).

In September, the biggest “tail risks” were: “High inflation keeps central banks hawkish” (40% of those polled), “Geopolitics worsen” (14%), “Systemic credit event (government/corporate) (13%), “Bank credit crunch & global recession” (13%), “AI/tech bubble” (10%) and “China real estate bust” (8%).

In October, the “most crowded: trades deemed by global managers were: “Long Big Tech” (37% of those polled), “Short China equities” (21%), “Long Japan equities” (11%), “Long T-bills” (10%), “Short REITS” (7%) and “Short US dollar” (3%).

In September, the “most crowded” trades were: “Long Big Tech” (55% of those polled), “Short China equities” (21%), “Long Japan equities” (8%), “Short REITs” (4%), “Long T-bills” (3%) and “Short US dollar” (3%).

An overall total of 295 panelists, with $736 billion in assets under management, participated in the BofA Global Research fund manager survey, taken October 6 to October 12, 2023. “259 participants with $664bn AUM responded to the Global FMS questions and 165 participants with $334bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service. For real-time email delivery contact tony@macenews.com