— Investors Eye Improved World Growth Outlook, Fret ‘Big Tech’ Longs, AI/Tech Bubble

By Vicki Schmelzer

NEW YORK (MaceNews) –Global investors added to equity short positions and pared bond and cash long positions in June, with the latter driven by an improved world growth outlook, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday.

Despite renewed optimism about growth, investors voiced concern about potential extreme positioning in technology holdings and “AI/tech bubble” appeared on the list of “Tail Risks” for the first time.

This month, a net 62% of those polled looked for weaker economic growth in the coming year, versus a net 65% looking for weaker growth in May and a net 63% looking for weaker growth in April. As a reminder, last July at the peak of global growth concerns, a net 79%, a record high, were looking for weaker growth.

In terms of the “most likely outcome for the global economy in the next 12 months, a net 64% look for a “soft landing,” a net 26% envision a “hard landing” and a net 3% see “no landing.”

“Investors remain bearish economic growth,” the survey said, with few believing that the global economy will be able to avoid recession in the coming year.

Nevertheless, the “start of recession has been pushed out to Q4’23 or Q1’24” and a “rising 14% of investors see no recession in the next 12 month,” BofA Global Research said.

On the inflation front, this month a net 87% of fund managers looked for lower global CPI in the coming 12 months, up from a net 84% in May and April, but still below the record high of 90%, seen in December 2022.

In terms of asset allocation, global investors added to equity shorts even as they pared bond and cash long positions.

This month, a net 32% of portfolio managers were underweight global equities, compared to a net 24% underweight in May and a net 29% underweight in April.

Last September, fund managers held a record 52% underweight in stocks.

A net 11% of managers were overweight bonds in June, down from a net 14% overweight in May which was the highest bond allocation since March 2009 and nearly back to the net 10% overweight seen in April.

“Six of the last seven months have seen overweight bond allocation, after a 14-year streak of underweight allocation,” BofA Global said.

Allocation to cash fell sharply, to a net 31% overweight in June from a net 44% overweight in May and compared to a net 43% overweight in April.

Average cash balances stood at 5.1% in June compared to 5.6% in May and 5.5% in April and March.

This month, commodity allocation fell to a net 3% underweight, the lowest level since May 2020 and compared to a net 2% overweight in May and a net 13% overweight in April.

On regional equity allocation, global investors showed renewed interest in U.S. UK and Japanese assets at the expense of eurozone and emerging market holdings.

Allocation to U.S. stocks stood at a net 25% underweight in June, the highest allocation of 2023 and compared to a net 39% underweight in May and a net 34% underweight in April.

This month, a net 3% of managers were overweight eurozone stocks compared to a net 4% overweight in May and a net 1% overweight in April.

Global investors again pared back global emerging market holdings in June.

Allocation to GEM stood at a net 13% overweight in June, compared to a net 24% overweight in May and a net 30% overweight in April.

Allocation to Japanese equities stood at a net 4% overweight in June, a big jump from a net 11% underweight in May and UK allocation stood at a net 17% underweight this month compared to a net 20% underweight in May.

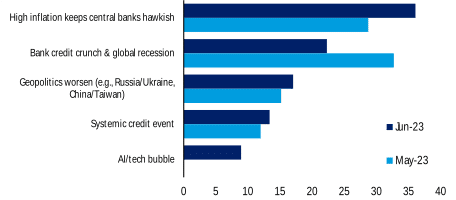

In June, the biggest “tail risks” feared by managers were: “High inflation keeps central banks hawkish” (36% of those polled), “Bank credit crunch and global recession” (22%), “Geopolitics worsen (e.g. Russia/Ukraine, China/Taiwan)” (17%), “Systemic credit event” (13%) and “AI/tech bubble” (9%).

In May, the biggest “tail risks” were: “Bank credit crunch and global recession” (33% of those polled), “High inflation keeps central banks hawkish” (29%), “Geopolitics worsen (e.g. Russia/Ukraine, China/Taiwan) (15%), “Systemic credit event” (12%) and “U.S. debt ceiling” (8%)

In June, the “most crowded” trades deemed by global managers were: “Long Big Tech” (55% of those polled), “Short China equities” (13%), “Long Japan equities” (8%), “Short U.S. dollar” (6%), “Long T-bills: (6%) and “Short U.S. banks” (4%).

In May, the “most crowded” trades were: “Long Big Tech” (30% of those polled), “Short U.S. banks” (22%), “Short U.S. dollar” (16%), “Long European equities” (12%), “Long T-bills” 7% and “Long China equities” (6%).

An overall total of 285 panelists, with $764 billion in assets under management, participated in the BofA Global Research fund manager survey, taken June 2-8, 2023. “247 participants with $708bn AUM responded to the Global FMS questions and 166 participants with $347bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service. For real-time email delivery in entirety contact tony@macenews.com. Twitter headlines @macenewsmacro