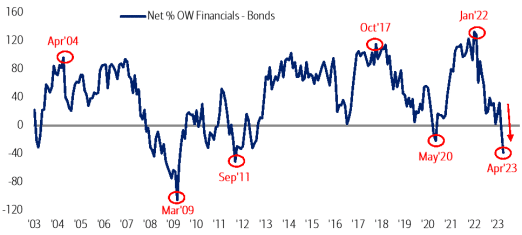

–Bond Allocation Highest Since March 2009

By Vicki Schmelzer

NEW YORK (MaceNews) – Global investors made a beeline into bonds in April, driven by fear of a credit crunch and ongoing uncertainty about inflation, according to the findings of BofA Global Research’s monthly fund manager survey, released Wednesday.

There were also renewed concerns about the world economy, the survey said.

A net 10% of managers were overweight bonds in April, the highest bond allocation since March 2009. This compared to a net 1% overweight in March and a net 4% underweight in February.

This month, a net 63% of those polled looked for weaker economic growth in the coming year, versus a net 51% in March and 50% in March. April’s reading is still well down from the record high print of a net 79%, seen last July at the peak of global growth concerns.

On the inflation front, this month a net 84% of fund managers looked for lower global CPI in the coming 12 months, unchanged from March and little changed from a net 83% in February. This is down from the record net 90% seen in December.

In terms of other asset allocation, cash held more allure than equities on the month.

Allocation to cash rose to a net 43% in April up from a net 38% in March. This was well down from the record net 62% overweight seen in September.

Average cash balances were unchanged at 5.5% in April versus 5.2% in February. Last October, average cash balances stood at 6.3%, which was the highest seen since April 2001.

This month, a net 29% of portfolio managers were underweight global equities, compared to a net 27% underweight in March and a net 31% underweight in February. Last September, managers held a record 52% underweight.

In April, commodity allocation stood at a net 13% overweight, little changed from the 14% overweight in March and the a net 15% overweight in February.

On regional equity allocation, global investors pared holdings in most regions, with some renewed interest in the U.S.

Allocation to U.S. stocks stood at a net 34% underweight in April, compared to a net 44% underweight in March and back at February levels.

This month, a net 1% of managers were overweight eurozone stocks, compared to a net 19% overweight in March and a net 9% overweight in February. This compared to a net 42% underweight last September, which was a record underweight.

Global investors pared back global emerging market holdings for a second month. Allocation to GEM stood at a net 30% overweight in April compared to a net 37% overweight in March and a net 42% overweight in February.

Allocation to Japanese equities stood at a net 10% underweight in April compared to a net 5% underweight in March, and UK allocation stood at a net 21% underweight this month, compared to a net 6% underweight in March.

In April, the biggest “tail risks” feared by managers were: “Bank credit crunch and global recession” (35% of those polled), “High inflation keeps central banks hawkish” (34%), “Systemic credit event” (16%), and “Geopolitics worsen (i.e. Russia/Ukraine, China/Taiwan)” (11%).

In March, the biggest “tail risks” were: “Systemic credit event” (31% of those polled), “Inflation stays high” (25%), “Central banks stay hawkish” (15%), “Geopolitics worsen” (e.g. Russia/Ukraine, China/Taiwan) (14%), “Deep global recession” (11%) and “Stock market crash” (1%).

In April, the “most crowded” trades deemed by global managers were: “Long big tech stocks” (30% of those polled), “Short U.S. banks” (18%), “Long China Equities” (13%), “Short REITs” (12%), “Long European equities” (11%) and “Long U.S. dollar” (5%).

In March, the “most crowded” trades were: “Long European Equities” (19% of those polled), “Long U.S. dollar (18%), “Long China equities” (15%), “Long ESG assets” (15%), “Long U.S. Treasuries” (12%) and “Long IG bonds” (10%).

In terms of Federal Reserve expectations, 35% of global investors looked for the central bank to start an easing cycle in Q1 2024, while 28% say Q4 2023, 14% say Q3 2023 and 10% say Q2 2024.

“These expectations are in line with bond markets, which currently price in 12bps of cuts in Q3’23, 37bps in Q4’23, 36bps in Q1’24, and 47bps in Q2’24,” BofA Global said.

An overall total of 286 panelists, with $728 billion in assets under management, participated in the BofA Global Research fund manager survey, taken April 6-13, 2023. “249 participants with $641bn AUM responded to the Global FMS questions and 150 participants with $283bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service.

For real-time email delivery contact tony@macenews.com.

Twitter headlines @macenewsmacro