–Still Bullish Towards Growth and Bond Prices

By Vicki Schmelzer

NEW YORK (MaceNews) – Global investors reallocated into cash at the start of a new year, waiting for additional economic clarity before entering positions, according to BofA Global Research’s monthly fund manager survey, released Tuesday.

Inflation views were little changed in early 2024 but fund managers were more bullish about growth and bond prices.

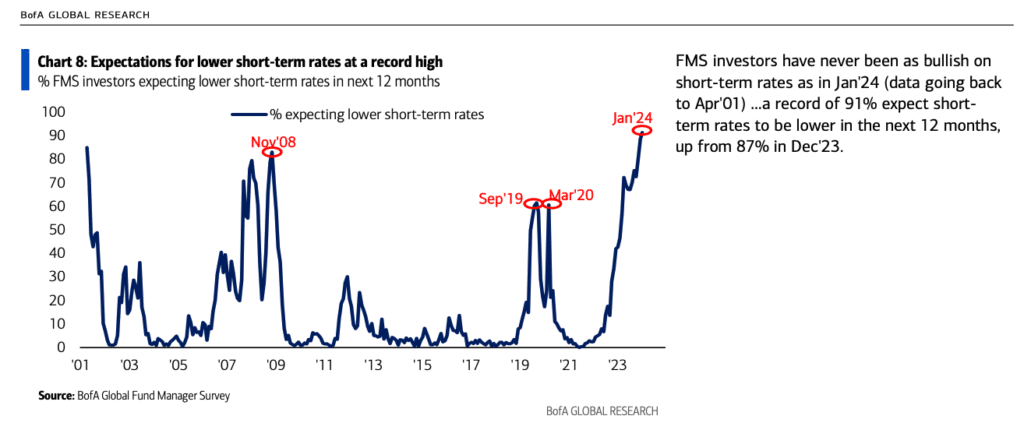

In January, a net 71% of portfolio managers expected lower inflation in 2024, with a record 91% expecting lower short-term rates in the next 12 months.

In December, a net 75% of those polled looked for lower global CPI in the coming year and 87% looked for lower short-term rates in the coming year.

This month, a net 40% of managers looked for weaker economic growth in the coming year, versus a net 50% in December and a net 57% in November.

These levels compare to July 2022, when at the peak of global growth concerns, a net 79%, a record high, were looking for weaker growth.

On bond yields, 55% of those polled looked for lower rates in 12 months’ time versus a record 62% with that view in December.

Portfolio managers were keeping a close eye on the U.S. Federal Reserve.

“An outright majority (52%) of FMS investors sees the Fed as the most important driver of equity prices in 2024,” BofA Global said.

In addition, “Over 2 out of 3 FMS investors think the Fed will be the most important driver of bond yields in 2024, well above those who see global growth (15%), US fiscal policy (9%), or the BoJ (5%) as the #1 driver,” the survey said.

In January, 41% saw no recession at all in 2024 compared to 36% in December, “a higher percentage than any other answer,” the survey said.

On overall holdings, cash levels rose, while allocation to stock and bonds decreased and commodities increased.

Average cash balances increased to 4.8% in January, compared to 4.5% in December and 4.7% in November.

Allocation to cash jumped to a net 16% overweight from a net 3% overweight in December. This compared to a net 18% overweight in November.

In January, a net 9% of portfolio managers were overweight global equities down from a net 15% overweight in December and compared to a net 2% overweight in November.

There was an exodus out of bonds at the start of the new year. A net 3% of managers were overweight bonds in January, compared to a net 20% overweight in December and a net 19% overweight in November.

As a reminder, forty-five percent of those polled in December said “bonds” would be the best performing asset class in 2024.

Commodity allocation improved to a net 2% underweight in January, compared to a 10% underweight in December and a net 3% overweight in November.

In January, the biggest “tail risks” feared by portfolio managers were: “Geopolitics worsen” (25% of those polled), “Economic hard landing” (24%), “Higher inflation” (21%), “Systemic credit event” (11%), “US election” (11%), “China banking crisis” (3%) and “AI bubble” (2%).

In December, the biggest “tail risks” were: “Global recession/hard landing” (32% of those polled), “High inflation keeps central banks hawkish” (27%), “Geopolitics worsen” (17%), “Systemic credit event (government/corporate)” (9%), “US election” (7%), and “China banking crisis” (4%).

In January, the “most crowded” trades deemed by global managers were: “Long Magnificent Seven” (52% of those polled), “Short China equities” (24%), “Long Japan equities” (7%), “Long 30-year Treasury” (5%) and “Short REITS” (5%).

In December, the “most crowded” trades were: “Long Magnificent Seven” (49% of those polled), “Short China equities” (22%), “Long Japan equities” (8%), “Long yield-curve steepeners” (6%), “Short REITS” (5%), and “Short 30-year Treasury” (3%).

Note: the term “Magnificent Seven” was coined by Bank of America’s chief investment strategist Michael Hartnett, referring to a basket of the seven major tech stocks: Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla and Meta.

An overall total of 256 panelists, with $669 billion in assets under management, participated in the BofA Global Research fund manager survey, taken January 5 to January 11, 2024. “221 participants with $589bn AUM responded to the Global FMS questions and 146 participants with $319bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service. For real-time email delivery contact tony@macenews.com.