–Hawkish Central Bank Hikes Still Biggest ‘Tail Risk’

By Vicki Schmelzer

NEW YORK (MaceNews) – Global investors polled at the start of 2022 looked for above-trend growth and an inflation peak in the coming year, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday.

In January, a net 1% of fund managers looked for weaker economic growth in the coming 12 months versus a net 4% and a net 3% who looked for stronger economic growth in December and November respectively.

Despite this monthly downturn in growth expectations, “January FMS asset allocation points to faith in global reopening story,” the survey said, adding that “only 7 out of 100 investors believe there will be a recession in the next 12 months.”

Inflation concerns continued to be becalmed, with a net 48% now looking for lower global CPI in the coming 12 months, the most since February 2009 and compared to a net 33% with that view in December and a net 14% with that view in November.

This month, a net 56% of fund managers viewed inflation as transitory versus a net 55% in December and a net 61% in November. A net 36% said inflation was permanent, unchanged from last month and compared to a net 35% in November.

In terms of Fed hikes, global investors on average now expect three Fed hikes in 2022, with the first hike likely to take place in April. In the December survey, managers had the first hike as likely to occur in July.

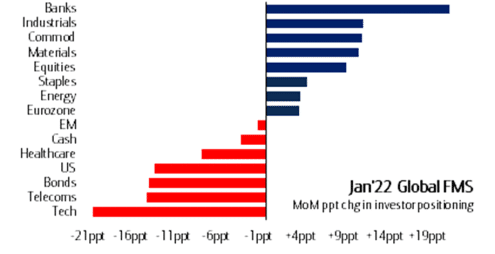

Despite jitters about world central bank tightening, investors dipped their toes back into equities at the start of the year.

A net 55% of portfolio managers were overweight global equities in January, compared to a net 46% overweight in December and a net 58% overweight in November.

This month, a net 77 percent of managers were underweight bonds, compared to a net 63% underweight in December and a net 69% underweight in November and not far from the net 80% underweight seen in October, which was the largest bond underweight ever.

The “equity optimism and bond pessimism” seen in January 2022’s survey showed that the spread between net equity overweights and bond underweights was back at the all-time highs seen at the start of 2011, the survey said.

In terms of portfolio holdings, average cash balances fell to 5.0% this month, “as investors get more positive on global reopening,” the survey said. This compared to 5.1% in December and 4.4% in November.

Allocation to cash fell to a net 33% overweight in January, compared to a net 36% overweight in December, the largest since May 2020, and a net 22% overweight in November.

Global investor allocation to commodities rose to a net 31% overweight in January, a record high, up from a net 19% overweight in December and compared to the 26% overweight in November.

On regional equity asset allocation, global investors continued to favor eurozone equities over other regions.

Allocation to U.S. stocks fell to a net 5% overweight in January, compared to a net 18% overweight in December and a net 29% overweight in November, which was the highest level since August 2013.

This month, a net 35% of managers were overweight eurozone stocks, compared to a net 31% overweight in December and a net 33% overweight in November.

Fund managers reduced their global emerging market (GEM) stock holdings in January, with investors having a net 2% underweight compared to a net 1% underweight in December and back at November levels. Current holdings are well down from the record net 62% overweight seen in January 2021.

Japanese equity holdings were little changed on the month, with a modest overweight.

UK equity allocations showed managers with a net 13% underweight in January, compared to a net 11% underweight in December and a net 15% underweight in November.

In a special question about the outcome of U.S. elections taking place in November, “a plurality of investors (35%) believe Congress will be Republican after the 2022 midterms while only 4% of investors think it will remain Democratic,” BofA Global said.

“This compares to OddsChecker odds of 70% expecting a Republican Congress while only 7% expect a Democratic Congress,” the survey said.

In January, the biggest “tail risks” feared by portfolio managers were: “Hawkish central bank rate hikes” (44% of those polled), “Inflation” (21%), “Asset bubbles” (9%), “Global growth scare” (7%), “COVID-19 resurgence” (6%), “China credit contagion” (4%) and “US-China geopolitics” (3%).

In December, the biggest “tail risks” were: “Hawkish central bank rate hikes” (42% of those polled), “Inflation” (22%), “COVID-19 resurgence” (15%), “Asset bubbles” (8%), “Geopolitics” (6%), “China credit contagion” (4%) and “EM currency crisis” (1%).

In January, the “most crowded” trades deemed by managers were: “Long Tech Stocks (39% of those polled), “Short US Treasuries (15%), “Short China stocks” (15%), “Long ESG” (14%), and “Long Bitcoin” (11%).

In December, the “most crowded” trades were: “Long Tech Stocks (39% of those polled), “Long Bitcoin” (18%), “long ESG” (17%), “Short US Treasuries” (10%), “Short China stocks” (9%) and “Short EM FX” (2%).

An overall total of 374 panelists, with $1.2 trillion in assets under management, participated in the BofA Global Research fund manager survey, taken January 7-13, 2022. “329 participants with $1.1tn AUM responded to the Global FMS questions and 181 participants with $429bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com

Content may appear first or exclusively on the Mace News premium service. For real-time delivery, contact tony@macenews.com. Twitter headlines @macenewsmacro.