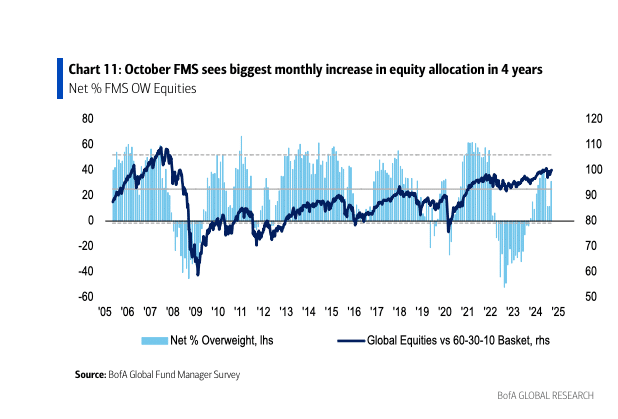

–Largest Jump in Global Equity Allocation Since June 2020

By Vicki Schmelzer

NEW YORK (MaceNews) – Global investors became more bullish toward equities in October, driven by an improved outlook for world growth, according to BofA Global Research’s monthly fund manager survey released Tuesday.

Positive views about the U.S. and Chinese economies fueled this change in growth sentiment, which in turn prompted the largest jump in global equity allocation since June 2020, the survey noted.

In October, a net 10% of investors looked for weaker economic growth in the next 12 months. This compared to a net 42% looking for weaker growth last month and a net 47% looking for weaker growth in August. As a reminder, in April 2024, a net 11% of those polled looked for stronger world growth in the coming year.

This shift in growth sentiment follows a 50-basis point rate cut by the Federal Reserve, a surprising 250,000 rise in U.S. non-farm payrolls and moves by China’s central bank to stimulate its economy, the survey said.

In addition, “asset prices are driving economic growth expectations higher,” BofA Global said.

This month, a net 76% of managers looked for a soft landing in the global economy, little changed from a net 79% expecting a soft landing in September.

More negative inflation views failed to dent risk sentiment.

A net 44% of managers looked for lower CPI in the coming months, well down from a net 67% and a net 76% looking for lower inflation in September and August respectively.

On China’s growth outlook after recent stimulus measures were announced, a net 48% of those polled looked for a stronger economy in the next 12 months. This is a sharp contrast to September, when a net 18% looked for a weaker Chinese economy, the survey said.

Of the impact of China’s stimulus, a net 47% of managers saw Emerging Market Equities and a net 41% of managers saw “Commodities” as the “biggest winners,” while “Government Bonds” (net 41%) and “Japanese equities” (net 33%) were deemed the “biggest losers.”

In terms of asset allocation, global investors made a nosedive into equities, real estate and commodities while exiting cash and bonds.

In October, a net 31% of portfolio managers were overweight global equities, well up from September and August, when a net 11% of managers were overweight equities. This was the biggest one-month jump in equity holdings since June 2020, BoA Global said.

In a flip-flop, a net 15% of those polled this month were underweight bonds, a stark contrast to a net 11% overweight in September and a net 8% overweight in August.

Allocation to real estate improved to a net 3% underweight in October, compared to a net 17% underweight in September and a net 28% underweight in August.

This month, commodity holdings stood at a net 1% overweight versus a net 11% underweight in September and a net 7% underweight in August.

Average cash balances slipped to 3.9% in October, down from 4.2% in September and 4.3% in August.

With cash levels slipping below 4.0%, “the BofA Global FMS Cash Rule triggered its first contrarian ‘sell’ signal since Jun’24,” the survey said.

“Since 2011, there have been 11 prior ‘sell’ signals which saw global equity (ACWI) returns of -2.5% in the 1 month after and -0.8% in the 3 months after the ‘sell’ signal was triggered,” BoA Global noted.

Allocation to cash fell to a net 4% underweight this month, down from a net 11% overweight in September and compared to a net 6% overweight in August.

In equity allocation this month, emerging markets saw larger inflows and eurozone and UK stocks saw larger outflows, while other regions were little changed.

Allocation to U.S. equities rose to a net 10% overweight in October, from to a net 8% overweight in September and were nearly back at August levels (net 11% overweight).

Asked about the prospects of a “sweep” i.e. the same party winning the White House and Congress,” in October a net 47% of those polled viewed the outcome as negative for the S&P 500, while 28% viewed it as a positive. In contrast, last month, a net 43% viewed a “sweep” as negative for stock and 33% viewed it as positive.

On the greenback, this month a net 43% of those polled looked for a higher U.S. dollar in the event of a “sweep,” while a net 35% looked for the dollar to move lower.

In October, a net 3% of portfolio managers were underweight eurozone stocks, compared to a net 8% overweight in September and a net 4% overweight in August.

Allocation to global emerging markets (GEM) rose to a net 21% overweight this month, compared to a net 1% overweight in September and a net 3% overweight in August.

This month, allocation to Japanese equities edged down to a net 2% underweight from a net 1% underweight in September, while UK allocation fell to a net 6% underweight from a net 2% overweight in September.

In October, the biggest “tail risks” feared by portfolio managers were: “Geopolitical conflict” (33% of those polled), “Global inflation accelerates” (26%), “US Recession” (19%), “US election ‘sweep’” (14%) and “Systemic credit event” (5%).

In September, the biggest “tail risks” were” “U.S. recession (40% of those polled), “Geopolitical conflict” (19%), “Inflation accelerates” (18%), “Systemic credit event” (8%), “US election ‘sweep’” (6%) and “AI bubble” (5%).

In October, the top three “most crowded” trades were deemed “Long Magnificent 7 stocks” (43% of those polled), “Long Gold” (17%) and “Long Chinese equities” (14%). The shift in views on Chinese equities was marked.

In September, the top three “most crowded” trades were “Long Magnificent 7 stocks” (46% of those polled), “Short China equities” (19%) and “Long Gold” (16%).

Note: the term “Magnificent Seven” was coined by Bank of America’s chief investment strategist Michael Hartnett, referring to a basket of the seven major tech stocks: Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla and Meta.

An overall total of 231 panelists, with $574 billion in assets under management, participated in the BofA Global Research fund manager survey, taken October 4 to October 10, 2024. “195 participants with $503bn AUM responded to the Global FMS questions and 128 participants with $273bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com