–Stagflation fears rise

By Vicki Schmelzer

NEW YORK (MaceNews) – Global investor sentiment turned dire in June as U.S. stocks entered bear market territory, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday.

“History is no guide to future performance but if it were, today’s bear market would end on Oct 19th 2022, with the S&P 500 at 3,000,” the survey said.

The S&P 500 closed at 3,749.63 Monday, which would imply another 20% decline into October. US stocks entered bear market territory on Monday for the 20th time in the past 140 years.

Investors polled this month saw the so-called “Fed put” for the S&P 500 at 3,453. In May, the “Fed-put” level was 3,529 and in April, it was 3,637. Under this “Fed-put” notion, the Federal Reserve would purportedly take policy easing action to prevent further stock losses if this downside support was broken.

In June, fund managers continued to fret over the ramifications of diminished growth and rising inflation.

In terms of the global outlook, a net 73% of fund managers looked for weaker economic growth in the coming 12 months, the lowest since 1994, and compared to a net 72% with that view in May and a net 71% with that view in April.

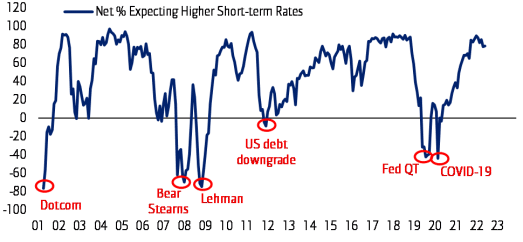

More notably, a net 83% of those polled voiced concern about “stagflation” in June, the highest since June 2008 and compared to a net 77% in May.

A net 72% of managers now look for lower global CPI in the coming 12 months, the highest level since December 2008 and up from a net 68% in May and a net 40% in April.

This month, asset allocation showed modest outflows from equities and commodities and renewed interest in bonds.

In June, a net 15% of portfolio managers were underweight global equities, compared to a 13% underweight in May and a net 6% overweight in April.

A net 46% of managers were underweight bonds, versus a net 65% in May and a net 68% in April.

Average cash balances slipped to 5.6% in June versus 6.1% in May, which was the

the highest cash balances since after the 9/11 attacks.

BoA Global noted however that the survey, taken June 3-10, closed a “day before May CPI shattered hopes” of a pause in the Fed rate hiking cycle.

Allocation to cash fell to a net 47% overweight in June from a net 53% overweight in May, and back at April levels.

Global investors took profit on commodity holdings, with allocation falling to a net 27% overweight in June. This is down from the record 38% overweight seen in April and compared to a net 29% overweight in May.

On regional equity asset allocation, global investors shunned U.S. stocks this month while dipping their toes into other regions.

Allocation to U.S. stocks fell to a net 8% underweight in June versus a net 6% underweight in May and compared to a net 14% overweight in April.

This month, a net 12% of managers were underweight eurozone stocks, compared to a net 26% in May and a net 17% underweight in April.

Allocation to global emerging markets (GEM) rose to a net 5% underweight in June from a net 14% underweight in May. Allocation to Japanese equities stood at a net 3% underweight in June compared to a net 12% underweight in May, while UK equity allocation stood at a net 5% underweight compared to a net 9% underweight in May.

In June, the biggest “tail risks” feared by portfolio managers were: “Hawkish central banks” (32% of those polled), “Global recession” (25%), “Inflation” (22%), “A systemic credit event” (9%), “Russia-Ukraine conflict” (6%), “COVID-19” (3%) and “Cryptocurrencies” (1%)

Last month, the biggest “tail risks” were: “Hawkish central banks” (31% of those polled), “Global recession” (27%), “Inflation” (18%), “Russia-Ukraine conflict” (10%), “A systemic credit event” (7%), “COVID-19” (1%) and “Asia FX war” (1%)

In June, the “most crowded” trades deemed by global managers were: “Long oil/commodities” (38% of those polled), “Long US dollar” (19%), “Long US Treasuries (13%), “Short China stocks” (9%), “Long ESG” (8%), “Long Cash” (4%) and “Long bitcoin” (4%).

Last month, the “most crowded” trades were: Long Oil/Commodities” (28% of those polled), “Short U.S. Treasuries” (25%), “Long Tech Stocks” (14%), “Long bitcoin” (8%), “Long ESG” (7%), “Short China stocks” (7%), and “Long Cash” (4%).

An overall total of 300 panelists, with $834 billion in assets under management, participated in the BofA Global Research fund manager survey, taken June 3-10, 2022. “266 participants with $747bn AUM responded to the Global FMS questions and 155 participants with $352bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service.

For real-time email delivery, contact tony@macenews.com.

Twitter headlines @macenewsmacro