-Investors Stay Watchful For Recession

By Vicki Schmelzer

NEW YORK (MaceNews) – Global investors polled in August were hopeful that inflation and rate shocks will dissipate in the coming quarters, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday.

At the same time, investors remained on high alert for recession, with a net 58% looking for a global downturn in the next 12 months. This was up from a net 47% with that view in July.

In terms of the global outlook, this month a net 67% of fund managers looked for weaker economic growth in the coming 12 months. This is an improvement from the net 79% looking for weaker growth in July, which was an all-time low since record keeping began in 1995.

US rate hike views were adjusted downward, but an increasing number of investors still expected central bank tightening to dampen inflation in the coming year.

Fund managers looked for the Federal Reserve to raise interest rates by another 100-125 basis points in the current tightening cycle, down from 150 basis points in July.

A move in PCE inflation below 4% was still seen as the “most likely reason for the Fed to ‘pause’ or ‘pivot,’” the survey said.

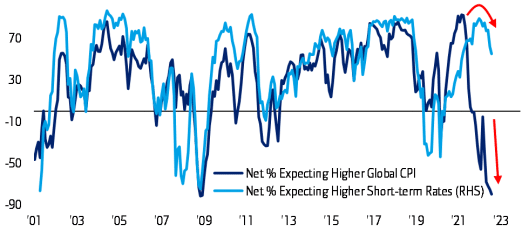

A net 80% of managers now look for lower global CPI in the coming 12 months, the highest since December 2008 and compared to a net 76% in July and a net 40% with that view in April.

A net 90% of those polled in August voiced concern about “stagflation,” a record high, unchanged from July and up from a net 83% in June.

In addition, a net 72% of fund managers looked for global profits to worsen in the next year, a moderate improvement from the record high of net 79% seen in July.

In terms of asset allocation, allocation to cash stood at a net 48% overweight this month, compared to a net 50% overweight in July and a net 47% overweight in June.

Similarly, average cash balances fell to 5.7% in August, down from 6.1% in August but up from 5.6% in June. The survey stressed that cash balances were still “well above the long -term average of 4.8%,” suggesting that sentiment remained “too bearish” for an “immediate reversal” of the “bear rally.”

This month, global equities benefited from outflows from commodity holdings.

In August, a net 26% of portfolio managers were underweight global equities, compared to a net 44% underweight in July, which was the largest underweight since October 2008. This compared to a net 15% underweight in June.

A net 28% of managers were underweight bonds, compared to a net 31% underweight in July and a net 46% underweight in June.

Commodity allocation fell to a net 10% overweight, the smallest overweight since November 2020. This is down from a 17% overweight in July and compared to the record 38% overweight seen in April.

On regional equity asset allocation, global investors decreased emerging market and UK holdings, while adding to other regions, especially the U.S.

Allocation to U.S. stocks rose to a net 10% overweight in August. This compared to a net 5% underweight in July and a net 8% underweight in June, but was not quite back at the net 14% overweight seen in April.

This month, a net 34% of managers were underweight eurozone stocks, versus the net 35% underweight seen in July, which was the lowest holdings since June 2012. Managers had a net 12% underweight in June.

Allocation to global emerging markets (GEM) fell to a net 9% underweight in August, compared to the net 5% underweight seen in July and June.

Allocation to Japanese equities stood at a net 6% underweight in August versus a net 12% underweight in July and UK allocation stood at a net 15% underweight from a net 4% underweight in July.

In August, the biggest “tail risks” feared by portfolio managers were: “Inflation stays high” (39% of those polled), “Global recession” (24%), “Hawkish central banks” (16%), “Systemic credit events” (8%), “COVID-19 resurgence” (4%) and “Russia-Ukraine conflict” (3%).

Last month, the biggest “tail risks” were: “Inflation stays high” (33% of those polled), “Global recession” (24%), “Hawkish central banks” (17%), “Systemic credit events” (10%), “Russia-Ukraine conflict” (7%), “Civil unrest” (4%) and “COVID-19 resurgence” (4%).

In August, the “most crowded” trades deemed by global managers were: “Long US dollar” (42% of those polled), “Long oil/commodities” (14%), “ Long Cash” (9%), “Long FAANG stocks” (8%), “Short US Treasuries” (5%) and “Short EM debt” (2%).

In July, the “most crowded” trades were: “Long US dollar” (41% of those polled), “Long oil/commodities” (23%), “Long ESG assets” (12%), “Long cash” (6%), “Short US Treasuries” (6%), “Short US distressed tech stocks” (5%), and “Long China stocks” (0.4%).

An overall total of 284 panelists, with $836 billion in assets under management, participated in the BofA Global Research fund manager survey, taken August 5 to 11, 2022. “250 participants with $752bn AUM responded to the Global FMS questions and 141 participants with $322bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service.

For real-time email delivery contact tony@macenews.com.

Twitter headlines @macenewsmacro