By Vicki Schmelzer

NEW YORK (MaceNews) – Global investors in June maintained their view that any inflation pressure being seen currently and going forward would be transitory, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday.

Growth expectations remained solid this month, but down from the lofty views seen earlier in the year.

In June, a net 64% of managers looked for higher global CPI in the coming 12 months, down a net 83% in May and compared to the record net 93% seen in April and March.

A net 75% of those polled in June looked for stronger world economic growth this year, versus a net 84% in May and a net 90% in April and compared to 91% in March and February, which saw “the best economic outlook ever,” the survey said.

There was scant concern about recession. A net 68% of managers did not expect a recession until 2024, at the earliest. A net 26% of investors looked for a recession in 2024 and a net 25% saw this happening in 2023.

In terms of portfolio holdings, average cash balances fell to 3.9% in June, compared to 4.1% in May and April, according to BofA Global.

Allocation to cash held steady at a net 9% overweight this month, versus a net 1% underweight in April.

On overall asset allocation, a net 61% of portfolio managers were overweight global equities in June, compared to a net 54% overweight in May and a net 62% overweight in April. These levels compare to the record highs near 70% seen in 2011.

This month, a net 69% of fund managers were underweight bonds, compared to a net 68% underweight in May and April.

Fund managers continued to eye the 1.5%-2.0% range for 10-year U.S. Treasury yields, with many thinking that a rise above 2.0% would be the trigger for a larger stock sell-off.

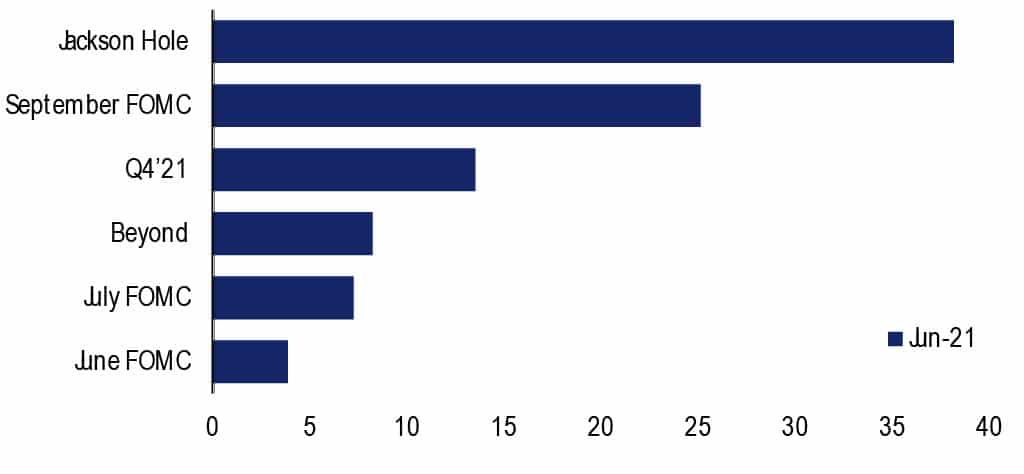

In terms of Federal Reserve policy, a net 38% of global investors polled in June expected the Fed to signal “tapering” at the Jackson Hole policy symposium in late August, while 25% of investors thought the central bank will wait until the September 21-22 meeting to unveil any changes, the survey said.

Global investor allocation to commodities held steady at a net 27% overweight in June, versus a net 23% overweight in April and close to the record net 28% overweight seen in March.

On regional equity asset allocation, global investors continued to favor eurozone and UK stocks.

Allocation to U.S. stocks remained at a net 6% overweight in June, compared to a net 7% overweight in April.

The survey showed expectations for the Federal Reserve’s tapering signal timing:

This month, a net 41% of managers were overweight eurozone stocks, up from a net 35% overweight in May and a net 30% overweight in April.

Fund managers had a net 31% overweight to global emerging markets (GEM) in June, compared to a net 30% overweight in May and a net 33% overweight in April. This is half the record net 62% overweight seen in January.

Portfolio managers had a net 4% underweight in Japanese equity markets this month, versus a net 2% overweight in May and a net 8% overweight in April.

UK equity allocations showed managers with a net 4% overweight in May, compared to a net 2% overweight in May and a 2% underweight in April. Current allocation levels are the highest since March 2014, the survey said.

In June, the biggest “tail risks” feared by portfolio managers were: “Inflation” (30% of those polled), “A ‘taper tantrum’” in the bond market (30%), “Asset bubbles” (18%), “COVID-19” (10%) and “China slowdown” (2%).

Last month, the biggest “tail risks” were: “Inflation” (35% of those polled), “A ‘taper tantrum’” in the bond market (27%), “Asset bubbles” (15%), “COVID-19” (9%) and “Higher taxes” (7%).

In June, the top “most crowded” trades deemed by managers were: “Long Commodities” (26% of those polled), “Long Bitcoin” (21%), “Long Tech Stocks” (21%), “Long ESG” (15%), “Short U.S. Treasuries” (10%) and “Long Euro” (3.0%). Note that ESG stands for Environmental, Social and Governance and refers to a class of investment also known as “sustainable investing.”

Last month, the top “most crowded” trades were: “Long Bitcoin” (43% of those polled), “Long Tech” (21%), Long ESG” (20%), “Short U.S. Treasuries (8%) and “Long Infrastructure” (4%).

An overall total of 224 panelists, with $667 billion in assets under management, participated in the BofA Global Research fund manager survey, taken June 4 to 10, 2021. “207 participants with $645bn AUM responded to the Global FMS questions and 92 participants with $78bn AUM responded to the Regional FMS questions,” BofA Global said.

The survey showed expectations for the Federal Reserve’s tapering signal timing:

—

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service. For real-time delivery contact tony@macenews.com.

Twitter headlines @macenewsmacro