- Upbeat About 2024 Growth Prospects

- Cash Underweight Largest Since Jan 2002

By Vicki Schmelzer

NEW YORK (MaceNews) – Fund managers raised their equity and commodity allocation in April while dumping their bond holdings according to BofA Global Research’s monthly fund manager survey, released Wednesday.

The move was driven by an increasingly upbeat attitude toward 2024 economic growth prospects, the survey said.

This month a net 11% of managers looked for stronger economic growth in the coming year. This compared to March, when a net 12% were looking for weaker growth. As a reminder, in January 2024, a net 40% of those polled looked for weaker growth this year.

“While global growth expectations are picking up rapidly (to the highest since September 2021), they are still playing ‘catch up’ with equity prices,” BofA Global said.

Meanwhile, inflation projections have become less optimistic.

In April, a net 45% of portfolio managers expected lower inflation in the next 12 months versus a net 57% in March and a net 69% in February.

Managers increased their equity and commodity allocation while dumping bond holdings in the latest month.

In April, a net 34% of portfolio managers were overweight global equities, up from a net 28% overweight in March and a net 21% overweight in February.

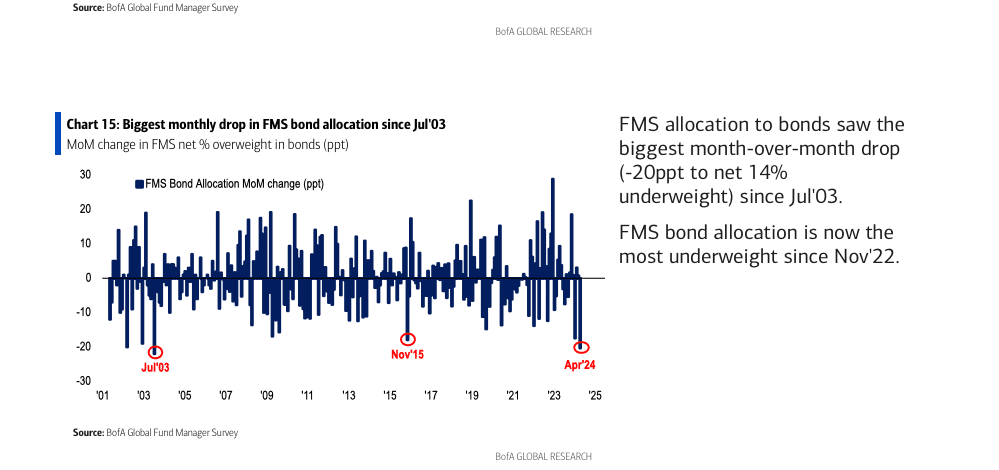

In contrast, a net 14% of managers were now underweight bonds versus a net 7% overweight last month and a net 6% overweight in February. This was the “biggest month-over-month drop” since July 2003, the survey said.

“FMS bond allocation is now the most underweight since November 2022,” BofA Global Research said.

Expectations for lower bond yields also waned, with a net 38% of managers looking for bond yields to be lower in the next 12 months. This is down from a net 40% in March and compared to a net 62% with that view last December.

Commodity allocation saw the biggest monthly increase on record in April, with allocation now the biggest overweight in a year.

This month, commodity holdings stood at a net 11% overweight, compared to a net 8% underweight in March and a net 6% underweight in February.

Average cash balances were 4.2% in April, down from 4.4% in March and back at February levels.

Allocation to cash stood at a net 9% underweight this month, “the biggest underweight since Jan’02,” the survey said. This compared to a net 5% overweight in March and a net 6% overweight in February.

On regional asset allocation, investors moved monies out of emerging markets and into other regions.

Allocation to U.S. equities stood at a 9% overweight in April, versus a net 8% overweight in March and a net 21% overweight in February.

This month, a net 26% of managers were overweight eurozone stocks, the biggest overweight since February 2022. This compared to a net 14% overweight in March and a net 10% underweight in February.

Allocation to global emerging markets (GEM) fell to a net 4% overweight in April, from a net 16% overweight in March. This compared to a net 8% underweight in February.

Allocation to Japanese equities stood at a net 23% overweight in April, the largest overweight since March 2018 and compared to a net 21% overweight in March, while UK allocation increased to a net 17% underweight in April from a net 27% underweight in March.

In April, the biggest “tail risks” feared by portfolio managers were: “Higher inflation” (41% of those polled), “Geopolitics” (24%), “US election” (12%), “Economic hard landing” (12%), “Systemic credit event” (7%) and “China banking crisis” (1%).

In March, the biggest “tail risks” were: “Higher inflation” (32% of those polled), “Geopolitics” (21%), “Economic hard landing” (16%), “US election” (14%) and “Systemic credit event” (11%) and China banking crisis (3%).

In April, the “most crowded” trades deemed by global managers were: “Long Magnificent Seven” (52%) of those polled, “Short China equities” (16%), “Long Japan equities” (14%), Long bitcoin” (11%) and “Short 30-year US Treasury” (2%).

In March, the “most crowded” trades were: “Long Magnificent Seven” (58% of those polled), “Short China equities” (14%), “Long Japan equities” (13%), “Long bitcoin” (10%), “Long Cash” (3%) and “Long IG corporate bonds” (2%).

Note: the term “Magnificent Seven” was coined by Bank of America’s chief investment strategist Michael Hartnett, referring to a basket of the seven major tech stocks: Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla and Meta.

An overall total of 260 panelists, with $719 billion in assets under management, participated in the BofA Global Research fund manager survey, taken April 5 to April 11, 2024. “224 participants with $638bn AUM responded to the Global FMS questions and 144 participants with $319bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com