By Vicki Schmelzer

NEW YORK (MaceNews) – Rate hike jitters and slow growth concerns turned bulls into bears in February, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday.

At the same time, the survey stressed that “sentiment is bearish but not extreme bearish.”

“Only 30% of investors expect an equity bear market in 2022 while 66% don’t,” the survey said.

Central bank tightening around the world is expected to rein in global growth.

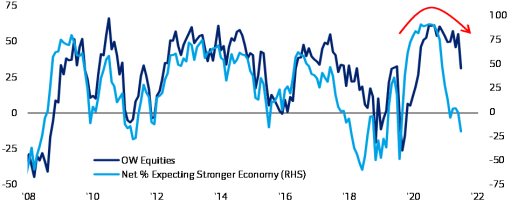

In February, a net 20% of fund managers looked for weaker economic growth in the coming 12 months versus a net 1% looking for weaker growth in January and a net 4% looking for stronger growth in February.

Nevertheless, “only 12 out of 100 investors believe there will be a recession in the next 12 months,” the survey cautioned.

Inflation concerns remained becalmed this month, with a net 56% now looking at lower global CPI in the coming 12 months, the most since January 2009. In January, a net 48% looked for lower global inflation and in December, a net 33% looked for lower global inflation in the year ahead.

In February, a net 52% saw inflation as transitory versus a net 56% in January and a net 55% in December. A net 39% said inflation was permanent, up from a net 36% in January and December.

In terms of Fed hikes, global investors on average now expect five Fed rate hikes in 2022, up from three Fed rate hikes in the January survey. “Note most survey participants completed the survey before the massive CPI print on Feb 10th,” BoA Global added.

Investor concerns were evident in the sharp monthly changes in asset allocation.

A net 31% of portfolio managers were overweight global equities in February, down from a net 55% overweight in January and compared to a net 46% overweight in December.

This month, a net 72% of managers were underweight bonds, compared to a net 77% underweight in January and a net 63% underweight in December. Last October, managers had a net 80% underweight, which was the largest bond underweight ever.

Average cash balances rose to 5.3% in February from 5.0% in January and compared to 5.1% in December.

Allocation to cash rose to a net 38% in this month, compared to a net 33% overweight in January and a 36% overweight in December.

Global investor allocation to commodities held steady at a net 31% overweight in February, still a record high, and up from a net 19% overweight in December.

On regional equity asset allocation, global investors continued to shun the U.S. over other regions.

Allocation to U.S. stocks fell to a net 15% underweight in February compared to a net 5% overweight in January and a net 18% overweight in December. This is the first U.S. underweight since February 2019.

Investors saw the so-called “Fed-put” for the S&P 500 at 3,698 or 16.0% lower than Monday’s S&P 500 close of 4,401.67. Under this “Fed-put” notion, the Federal Reserve would purportedly take policy easing action to prevent further stock losses.

A sharp decline in U.S. CPI to 3% or lower and or fewer Fed hikes in 2022 were the top two catalysts that would likely push the S&P 500 higher, the survey said.

This month, a net 30% of managers were overweight eurozone stocks, compared to a net 35% overweight in January and a net 31% overweight in December.

In February, fund managers looked more favorably at global emerging markets (GEM), increasing stock holdings to a net 11% overweight. This is up from a net 2% underweight in January and a net 1% underweight in December.

Allocation to Japanese equities fell to a net 1% underweight from a 2% overweight this month, while UK equity allocation rose to a 4% underweight from a 13% underweight.

This month, fund managers were asked to rate the top potential risks to financial market stability. A net 83% of those polled said “Monetary Risk,” a net 78% said “Geopolitical Risk” and a net 36% said “Business Cycle Risk.”

In February, the biggest “tail risks” feared by portfolio managers were: “Hawkish central bank rate hikes (41% of those polled), “Inflation” (23%), “Asset bubbles” (11%), “Global recession (8%), “Russia-Ukraine conflict” (7%), “COVID-19” (4%), and “LTCM-like credit event” (3%).

In January, the biggest “tail risks” were: “Hawkish central bank rate hikes” (44% of those polled), “Inflation” (21%), “Asset bubbles” (9%), “Global growth scare” (7%), “COVID-19 resurgence” (6%), “China credit contagion” (4%) and “US-China geopolitics” (3%).

In February, the “most crowded” trades deemed by managers were: “Long Tech Stocks” (28% of those polled), “Short US Treasuries” (18%), “Long ESG” (17%), “Long Commodities” (15%) and “Long Bitcoin” (10%).

In January, the “most crowded” trades were: “Long Tech Stocks (39% of those polled), “Short US Treasuries (15%), “Short China stocks” (15%), “Long ESG” (14%), and “Long Bitcoin” (11%).

An overall total of 363 panelists, with $1.1 trillion in assets under management, participated in the BofA Global Research fund manager survey, taken February 4-10, 2022. “314 participants with $1.0tn AUM responded to the Global FMS questions and 171 participants with $391bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service. For real-time email delivery contact tony@macenews.com.

Twitter headlines @macenewsmacro