— Big Jump in Emerging Market Equity Holdings

By Vicki Schmelzer

NEW YORK (MaceNews) – Global investors polled in February were decidedly less fearful of recession and more upbeat about world growth, but were taking a wait-and-see attitude towards inflation, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday.

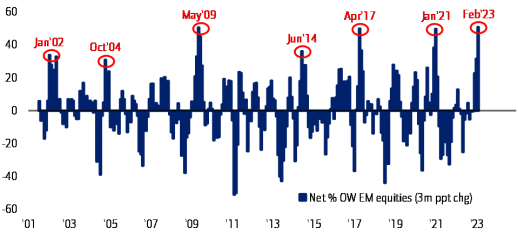

More positive growth sentiment led to another “big jump” in allocation to emerging market stocks,” the survey said, with “the 3-month rise in allocation (Feb vs Nov) a whopping 51ppt, the most on record).

This month, a net 24% of managers said a recession was likely in the coming 12 months. This compared to a net 51% in January and a net 68% in December and well down from a net 77% in November, which was the highest level since the COVID-19 high from April 2020.

A net 35% of those polled looked for weaker economic growth in the next year, down from a net 50% with that view in January and a net 69% in December.

This month’s reading is well down from the record high print of 79%, seen last July at the peak of global growth concerns.

On the inflation front, a net 83% of fund managers looked for lower global CPI in the coming 12 months, unchanged from January and down from the record net 90% seen in December and compared to a net 85% in November.

“The majority (68%) of FMS investors expect that the reopening of the Chinese economy will have an inflationary impact,” the survey said.

In terms of asset allocation, global investors modestly embraced equities at the expense of bonds and cash.

Allocation to cash stood at a net 36% overweight in February, compared to a net 42% overweight in January and a net 38% overweight in December. This compared to the record net 62% overweight seen in September.

Average cash balances fell to 5.2% this month, versus 5.3% in January and 5.9% in December. Average cash balances stood at 6.3% last October, which was the highest seen since April 2001.

In February, a net 31% of portfolio managers were underweight global equities versus a net 33% underweight in January and a net 22% underweight in December. This compared to the record 52% underweight seen in September.

After a move to overweight holdings in December, this month investors returned to underweight.

A net 4% of managers were underweight bonds in February, compared to a net 1% overweight in January and a net 10% overweight in December, which was the first net overweight in bonds since April 2009.

This month, commodity allocation stood at a net 15% overweight, up from a net 7% overweight in January and a net 9% overweight in December.

On regional equity allocation, global investors increased assets in most regions, especially emerging markets.

Allocation to U.S. stocks stood at a net 34% underweight in February, compared to a net 39% underweight in January and a net 12% underweight in December.

This month, a net 9% of managers were overweight eurozone stocks, versus a net 4% overweight in January and a net 10% underweight in December. This compared to a net 42% underweight last September, which was a record underweight.

Allocation to global emerging markets surged again this month, to a net 46% overweight. This compared to a net 26% overweight in January and a net 13% overweight in December.

“EM equity allocation is now the highest since Mar’21 (pre-war levels),” the survey said.

Allocation to Japanese equities stood at a net 13% underweight in February compared to a net 5% underweight in January and UK allocation stood at a net 11% underweight compared to a net 15% underweight in January.

In February, the biggest “tail risks” feared by portfolio managers were: “Inflation says high” (40% of those polled), “Geopolitics worsen (e.g. Russia/Ukraine, China/Taiwan)” 17%, “Deep global recession” (16%), “Central banks stay hawkish” (15%) and “Systemic credit event”(8%).

In January, the biggest “tail risks” were: “Inflation stays high” (34% of those polled), “Deep global recession” (20%), “Central banks stay hawkish” (19%), “Geopolitics worsen (e.g. Russia/Ukraine, China/Taiwan)” (13%), “Systemic credit event” (9%) and “Covid resurgence” (2%).

Doubts continued to grow about the possibility of a negotiated peace agreement in 2023 to end military conflict between Russia and Ukraine. In February, 64% of those polled said a peace agreement was unlikely this year, compared to 50% with that view in January.

In February, the “most crowded” trades deemed by global managers were: “Long China equities” (21% of those polled), “Long IG bonds” (15%), “Long US dollar” (14%), “Long US Treasuries” (12%), “Long ESG assets” (10%), “Long oil” (8%) and “Long EM bonds” (5%).

In January, the “most crowded” trades were: “Long US dollar (32% of those polled), “Long ESG assets” (17%), “Long China equities” (12%), “Long oil” (9%), “Long US Treasuries” (9%) and “Long IG Bonds” (8%)

An overall total of 299 panelists, with $847 billion in assets under management, participated in the BofA Global Research fund manager survey, taken February 2-9, 2023. “262 participants with $763bn AUM responded to the Global FMS questions and 162 participants with $356bn AUM responded to the Regional FMS questions,” BofA Global said.

—

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service.

For real-time email delivery in entirety contact tony@macenews.com.

Twitter headlines @macenewsmacro