By Vicki Schmelzer

NEW YORK (MaceNews) – Despite diminishing inflation concerns, global investors saw recession as a likely outcome in the coming year, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday.

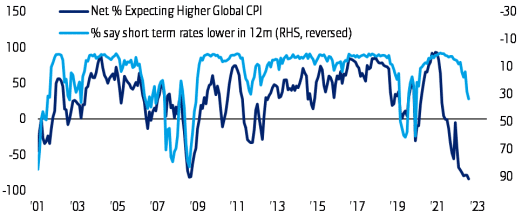

In November, a net 85% of fund managers looked for lower global consumer price inflation in the coming 12months, up from a net 79% in October and September.

This is a new record reading for this view, breaking above the prior record of a net 82% looking for lower inflation, seen in December 2008 at the peak of the U.S. financial crisis.

Investors saw U.S. headline CPI inflation at 4.5% year-on-year in the next 12 months. If the CPI pattern follows the October monthly print of 0.4%, inflation should be heading toward 4.0% by the summer of 2023, the survey said.

A decline in inflation below 4% is still deemed the top reason for the Federal Reserve to “pivot” from its current tightening monetary policy stance. U.S. initial unemployment claims rising above 300,000 is the second top reason for the Fed to “pause,” the survey said.

Despite reduced fears about inflation, recession has become the consensus view.

Investors remained on high alert for recession, with a net 77% of managers saying a recession is likely over the next 12 months, “the most since the COVID high in April 2020,” BofA Global said. This compared to a net 74% with that view in October and a net 68% with that view in September.

In November, a net 73% of fund managers looked for weaker overall economic growth in the next year, up from a net 72% in October and September and compared to the record high print of a net 79% seen in July.

In terms of asset allocation, allocation to cash stood at a net 51% in November, down from a net 59% overweight in October as well as the record net 62% overweight seen in September.

Average cash balances fell to 6.2% this month, down from the 6.3% seen in October, which was the highest seen since April 2001, but above the 6.1%

seen in September.

This month, a net 34% of portfolio managers were underweight global equities, a solid improvement from the net 49% underweight seen in October and the record 52% underweight seen in September.

A net 19% of managers were underweight bonds in November, compared to a net 32% underweight in October and a net 40% underweight in September.

This month, commodity allocation declined to a net 13% overweight from a net 15% overweight in October and a net 19% overweight in September.

On regional equity asset allocation, global investors increased U.S., eurozone and UK holdings, while trimming emerging market and Japanese assets.

Allocation to U.S. stocks stood at a net 7% underweight in November, compared to a net 9% underweight in October and a net 4% underweight in September.

This month, a net 23% of managers were underweight eurozone stocks, compared to a net 32% underweight in October and a net 42% underweight in September, which was a record underweight.

Allocation to global emerging markets (GEM) stood at a 9% underweight, compared to a net 6% underweight in October and a net 10% underweight in September.

Allocation to Japanese equities saw a net 11% underweight in November compared to a net 4% underweight in October and UK allocation saw a net 25% underweight compared to a net 33% underweight in October.

In November, the biggest “tail risks” feared by portfolio managers were: “Inflation stays high” (32% of those polled), “Geopolitics worsen (e.g. Russia/Ukraine, China/Taiwan)” (18%), “Central banks stay hawkish” (18%), “Deep global recession” (18%), “Systemic credit event” (13%) and “Debt deflation” (1%).

Last month, the biggest “tail risks” were: “Inflation” (27% of those polled), “Geopolitics” (19%), “Hawkish central banks” (18%), “Deep global recession” (17%), “Systemic credit event” (17%), “Other” (1%), “and Covid-19 resurgence” (1%).

In November, the “most crowded” trades deemed by global managers were:

“Long US dollar” (58% of those polled), “Short China Equities” (13%), “Long oil” (10%), “Short EU equities” (7%), “Long ESG assets” (6%), and “Long T-bills” (2%).

In contrast last month, the “most crowded” trades were: “Long US dollar” (64% of those polled), “Short EU equities” (8%), “Long ESG assets” (8%), “Long oil” (6%), “Short EM/China debt & equity” (6%), and “Short UK debt & equity” (4%).

“Long U.S. dollar” has been number one on the “most crowded” list for five consecutive months, the survey noted.

Indeed, a record high share of global investors (72% of those polled) saw the U.S. dollar as “overvalued” in November, compared to 68% with that view in October, the survey noted.

An overall total of 309 panelists, with $854 billion in assets under management, participated in the BofA Global Research fund manager survey, taken November 4-10, 2022. “272 participants with $790bn AUM responded to the Global FMS questions and 161 participants with $333bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com

Stories may appear first on the Mace News premium service.

For real-time email delivery contact tony@macenews.com.

Twitter headlines @macenewsmacro