— Global Recession Largest ‘Tail Risk’ in 15-year Survey History

By Vicki Schmelzer

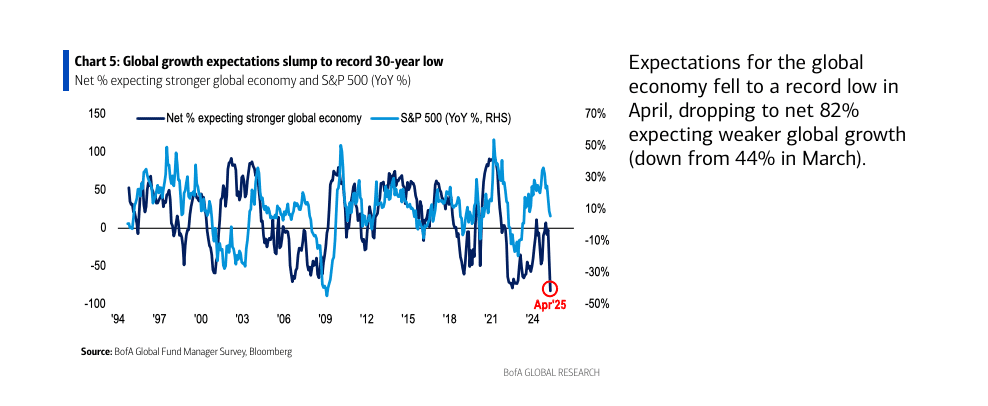

NEW YORK (MaceNews) –Trade war jitters sent global growth expectations to a record low in April, according to BofA Global Research’s monthly fund manager survey, released Wednesday.

At the same time, “trade war triggering a global recession” was viewed as the biggest tail risk in 15 years, the survey said.

A net 82% of those polled this month looked for a weaker global economy in the coming 12 months, the “most on record,” (30-year history) BofA Global said, adding that, “Global growth expectations have collapsed 80ppt in the past 2 months.”

This month, a net 57% of managers looked for higher global inflation in the next 12 months. This compared to a net 7% looking for higher global inflation in March and a net 4% looking for lower global inflation in February.

Cash levels jumped again this month, rising to 4.8% in April from 4.1% in March and compared to 3.5% in February, which was the lowest level since 2010.

Cash allocation rose to a net 25% overweight in April, up from a net 10% overweight in March and compared to a net 6% underweight in February.

In terms of asset allocation, global investors made a beeline into bonds, while shunning other asset classes.

In April, a net 17% of portfolio managers were underweight global equities, compared to a net 6% overweight in March and a net 35% overweight in February.

In contrast, a net 17% of those polled were overweight bonds, compared to a net 13% underweight in March and a net 11% underweight in February.

Allocation to real estate fell to a net 11% underweight this month. This compared to a net 7% underweight in March and a net 6% underweight in February.

.

Commodity allocation stood at a net 8% underweight in April, compared to a net 1% underweight in March and a net 2% underweight in February.

In terms of regional equity allocation this month, all regions saw outflows.

Allocation to U.S. equities stood at a net 36% underweight in April, compared to a net 23% underweight in March and a net 17% overweight in February.

“In just 2 months, U.S. equity allocation has been slashed by a record 53 ppt,” the survey said.

This month, a net 22% of those polled were overweight eurozone stocks, compared to a net 39% overweight in March and a net 12% overweight in February.

Allocation to global emerging markets (GEM) fell to a net 16% overweight in April from a net 20% overweight in March and compared to neutral in February.

This month, allocation to Japanese equities stood at a net 7% underweight compared to a net 1% underweight in March, while UK allocation slipped to a net 3% underweight from a net 4% overweight in March.

Sentiment was little changed in terms of overall U.S. Federal Reserve rate cut expectations, although the magnitude of the cuts again shifted.

In April, 34% of investors looked for two cuts in 2025, 25% said 3 cuts, 16% said 4 cuts or more, 13% said 1 cut and 9% expected “no change” this year. In March, 49% of those polled looked for two Fed cuts in 2025.

This month, the three biggest “tail risks” were “Trade war triggers global recession (80% of those polled, “the largest concentration for a ‘tail risk’ in 15-year history”) “Inflation causes Fed to hike” (10%) and “US dollar crash on international buyers’ strike (7%).

In March, the top tail risks were “Trade war triggers global recession” (55% of those polled) and “Inflation causes Fed to hike” (19%). In third place, managers were “concerned about the impact of the Department of Government Efficiency (DOGE) on the U.S. economy”, with 13% of those polled fearful that “DOGE sparks U.S. recession.”

In April, the three “most crowded” trades were deemed “Long Gold” (49% of those polled), “Long Magnificent 7” (24%), and “Long EU stocks” (10%).

In March, the three “most crowded” traders were “Long Magnificent 7” (40% of those polled), “Long EU stocks” (23%), and “Long crypto” (9%).

Note: the term “Magnificent Seven” was coined by Bank of America’s chief investment strategist Michael Hartnett, referring to a basket of the seven major tech stocks: Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla and Meta.

An overall total of 205 panelists, with $477 billion in assets under management, participated in the BofA Global Research fund manager survey, taken April 4 to April 10, 2025. “195 participants with $444bn AUM responded to the Global FMS questions and 106 participants with $204bn AUM responded to the Regional FMS questions,” BofA Global said.

Contact this reporter: vicki@macenews.com