US NABE Panel of 45 Forecasters Show Wider-Than-Usual Disparity of Views on Key Metrics, Improve Outlook vs February

WASHINGTON (MaceNews) – The National Association for Business Economics Monday presented the results of its latest quarterly survey of forecasters, with the panel of 45 showing a wider degree of uncertainty over key etrics than usual, although somewhat improved over the previous survey. Some excerpts follow: GDP • Expectations for inflation-adjusted gross domestic product (real […]

Japan March Machine Orders Down for 2nd Straight Month, Q1 Up; Q2 Seen Rising Faster Amid Solid Capex Demand

–Machine Orders Seen +4.6% in Q2 Vs. +2.6% in Q1, Led by Strong Demand from Non-Manufacturers –Cabinet Office Keeps View: Machine Orders Pausing By Max Sato (MaceNews) – Japanese machinery orders, the key leading indicator of business investment in equipment, came in much weaker than expected in March, posting drops on the month and year, […]

Powell: Fed Committed To 2% Goal but May Need To Do Less Given Bank Stress

– Williams Blames Demand, Shocks for Inflation – Not Past Monetary Ease – Fed Policymakers Divided on Where Funds Rate Needs To Go By Steven K. Beckner (MaceNews) – Federal Reserve Chairman Jerome Powell renewed the Fed’s commitment to reducing inflation Friday, but gave no clear indication whether he thinks the central bank will need […]

Japan April Core CPI Up 3.4% Y/Y After Slowing to 3.1% Rise on Continued Markups in Process Food, Rebound in Hotel Fees

–Energy Subsidies, Softer Commodities Somewhat Easing Consumer Inflation –Total CPI +3.5% Y/Y V. +3.2% Y/Y in March, 41-Year High of +4.3% in January –Core-Core CPI (Ex-Fresh Food, Energy) Hits Fresh 41-Year High of +4.1% Y/Y, Largest Gain Since +4.2% in September 1981 By Max Sato (MaceNews) – Consumer inflation in Japan picked up to around […]

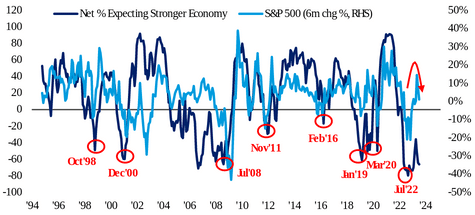

BofA Global Research Fund Manager Survey: Global Investors Test Waters in Equities in May, Remain Risk Averse

By Vicki Schmelzer NEW YORK (MaceNews) – Global investors dipped their toes back into equities in May but largely clung to bond and cash holdings, according to the findings of BofA Global Research’s monthly fund manager survey, released Wednesday. Uncertainty about the health of the world economy and central banks’ ability to rein in inflation […]

Japan April Producer Inflation Eases Further to 5.8% from March’s 7.4% on Energy Subsidies, Weaker Lumber, Non-Ferrous Metals

–April’s 5.8% Lowest Y/Y Rise Since 5.7% in August 2021 –December’s 10.6% Surge Remains Highest in 42 Years By Max Sato (MaceNews) – Producer inflation in Japan eased for the fourth straight month in April as the government’s expanded utilities subsidies continued to cap energy costs and slowing global demand has cooled off many commodities […]

White House and Other Schedules for Friday, May 12

WASHINGTON (MaceNews) – The following are Friday’s schedules for the White House, Treasury, USTR, the State Department and Capitol Hill as well as U.S. economic data and Federal Reserve events: DAILY GUIDANCE AND PRESS SCHEDULE FOR FRIDAY, MAY 12, 2023 In the morning, the President will receive the President’s Daily Brief. This meeting will be […]

White House and Other Schedules for Thursday, May 11

WASHINGTON (MaceNews) – The following are Thursday’s schedules for the White House, Treasury, USTR, the State Department and Capitol Hill as well as U.S. economic data and Federal Reserve events: DAILY GUIDANCE AND PRESS SCHEDULE FOR THURSDAY, MAY 11, 2023 In the morning, the President will receive the President’s Daily Briefing. The Vice President will attend. This […]

White House and Other Schedules for Wednesday, May 10

WASHINGTON (MaceNews) – The following are Wednesday’s schedules for the White House, Treasury, USTR, the State Department and Capitol Hill as well as U.S. economic data and Federal Reserve events: DAILY GUIDANCE AND PRESS SCHEDULE FOR WEDNESDAY, MAY 10, 2023 In the morning, the President will receive the President’s Daily Brief. This meeting will be closed press. […]

Bank of Canada’s Macklem: Prepared to Hike Rates If Inflation Shows Signs of Being Stuck Well Above 2% Target

–Governor Repeats: Too Early to Think About Rate Cuts; To Make Decisions When Economy Needs Them (MaceNews) – The Bank of Canada’s policymakers are prepared to raise interest rates again if inflation shows signs that it is stuck well above their 2% target, Governor Tiff Macklem said in a speech at the Toronto Regional Board […]