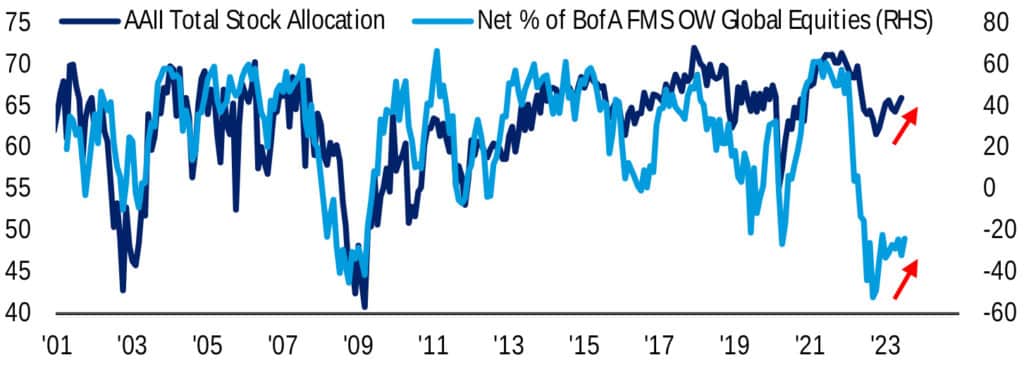

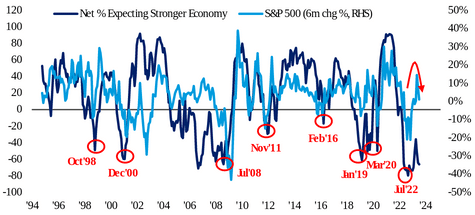

BofA Global Research Fund Manager Survey: Global Investors Trim Cash, Add to Equity Holdings in August as Recession Fears Fade

By Vicki Schmelzer NEW YORK (MaceNews) – Improved growth prospects and fading recession fears prompted global investors to trim their cash allocation and add to equity holdings in August, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday. A net 45% of those polled this month looked for weaker economic […]

BofA Global Research Fund Manager Survey: Global Investors Add to Cash, Equity Holdings in July

By Vicki Schmelzer NEW YORK (MaceNews) – Global investors added to cash and equity positions and pared bonds in July, in a recalibrating of current holdings more than a shift in mindset, according to the findings of Bank of America Global Research’s monthly fund manager survey, released Tuesday. Investor fear is still exceeds greed, the […]

Fed’s Daly, Mester Argue for Further Fed Rate Hikes To Reduce Inflation

– Daly: 2 Rate Hikes ‘A Very Reasonable Projection’; Could Do More or Less – Mester Urges ‘Somewhat Tighter Monetary Policy’ For ‘More Timely’ Inflation Fall – Daly: Banks Not Curbing Credit More Than Expected in Slowing Economy By Steven K. Beckner (MaceNews) – Senior Federal Reserve officials largely concurred Monday on the need for […]

BofA Global Research Fund Manager Survey: Global Investors Add To Equity Shorts, Pare Bonds and Cash Longs in June

— Investors Eye Improved World Growth Outlook, Fret ‘Big Tech’ Longs, AI/Tech Bubble By Vicki Schmelzer NEW YORK (MaceNews) –Global investors added to equity short positions and pared bond and cash long positions in June, with the latter driven by an improved world growth outlook, according to the findings of BofA Global Research’s monthly fund […]

FOMC Faces Tough Choice of Policy Options: Hike, Skip or Pause

– At Issue: The Funds Rate May Be ‘Restrictive,’ But Is it ‘Sufficiently Restrictive‘? By Steven K. Beckner (MaceNews) – In the run up to the Federal Reserve’s mid-June monetary policy meeting we’ve been witnessing a kind of clinic on central bank communication or, some would say, miscommunication. With key data yet to arrive and […]

Bank of Canada Surprises Market with 25 BP Rate Hike; Warns Policy-makers More Worried Inflation Could Get Stuck Well Above 2%

–BOC Decision Reflects Its View: Policy Not Sufficiently Restrictive to Bring Supply/Demand Back into Balance, Return Inflation Sustainably To 2% Target –BOC: Canada’s Labor Market Remains Tight; Overall, Excess Demand Looks to Be More Persistent Than Anticipated By Max Sato (MaceNews) – The Bank of Canada on Wednesday raised its policy interest rate – the […]

BofA Global Research Fund Manager Survey: Global Investors Test Waters in Equities in May, Remain Risk Averse

By Vicki Schmelzer NEW YORK (MaceNews) – Global investors dipped their toes back into equities in May but largely clung to bond and cash holdings, according to the findings of BofA Global Research’s monthly fund manager survey, released Wednesday. Uncertainty about the health of the world economy and central banks’ ability to rein in inflation […]

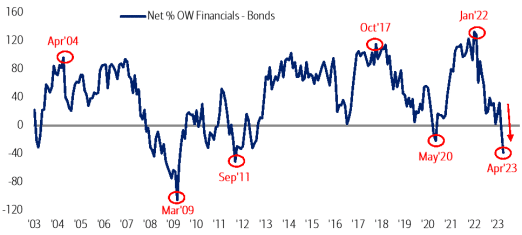

BofA Global Research Fund Manager Survey: Global Investors’ Attitude Towards Risk Worsens in April on Surging Credit/Counterparty Risk

–Bond Allocation Highest Since March 2009 By Vicki Schmelzer NEW YORK (MaceNews) – Global investors made a beeline into bonds in April, driven by fear of a credit crunch and ongoing uncertainty about inflation, according to the findings of BofA Global Research’s monthly fund manager survey, released Wednesday. There were also renewed concerns about the […]

BofA Global Research Fund Manager Survey: Global Investors’ Attitude Towards Risk Worsens in March on Surging Credit/Counterparty Risk

By Vicki Schmelzer NEW YORK (MaceNews) – Global investors’ attitude towards risk worsened in March with negative sentiment driven by surging credit and counterparty risk, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday. Shifting risk views led to a marked uptick in recession and growth concerns, but little change […]

Italy Aims to Boost Share of Debt Held by Domestic Retail Investors, Keeps Dollar Debt Issuance on Hold, Government Sources Say

By Silvia Marchetti ROME (MaceNews) – Italy’s nationalist government plans to increase the share of public debt held by domestic retail investors as it looks to offset fading European Central Bank purchases and as dollar-denominated debt issuance remains on hold, according to ruling coalition sources. “The goal is to nationalize as much as possible our […]