ZURICH (MaceNews) – Economic sentiment in the countries sharing the euro increased for the sixth consecutive month, reaching a new high, according to data released Thursday by the European Commission.

The Economic Sentiment Index (ESI) rose to 119.0 in July from 117.9 in June, beating the median expectation for 118.5 in an Econoday survey of economic forecasts.

A more positive outlook in the industrial sector helped push overall sentiment higher, with sentiment rising to 14.6 in July from 12.8 the previous month and beating the Econoday median forecast of 13.0.

Consumer confidence by contrast fell to -4.4 after a -3.3 reading in June, matching Econoday’s median forecast.

Results of main sectors for the Eurozone:

- Services: 19.3 in July vs 17.9 in June

- Retail trade: 4.6 in July vs 4.7 in June

- Construction: 4.0 in July vs 5.2 in June

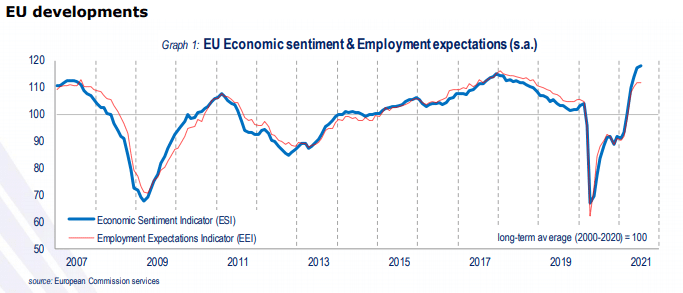

Developments in the broader European Union reflected those for the Eurozone, with the ESI rising to 118.0 from 117.1, also led by an increase for industrial confidence which rose for an eighth consecutive month and reaching an all-time high.

Among sectors for the EU:

- Industry confidence: “Managers’ production expectations remained practically unchanged, the improvement resulted from developments in managers’ assessments of the current level of overall order books and the stocks of finished products. The order books assessments matched their highest reading on record, while stocks were considered scarcer than ever.”

- Services: “While managers were more positive about past demand and, to a lesser extent, the past business situation, their demand expectations dropped for the first time since November 2020.”

- Consumer confidence: “Households’ assessments of the future general economic situation and, to a lesser extent, their future financial conditions, as well as their intentions to make major purchases clouded over, while the appraisals of their past financial situation remained virtually unchanged.”

Retail trade: “Stayed virtually flat, as the lowest reading on record in respect of the volume of stocks got counterbalanced by managers’ more cautious assessments of the past and expected business situation.

—

Content may appear first or exclusively on the Mace News premium service. For real-time delivery contact tony@macenews.com. Twitter headlines @macenewsmacro.