–Consumption Hit by Public Health Rules During Most of January-March

–Capex Slower on Supply Constraints, High Producer Costs Amid Ukraine War

–Q2 GDP Rebound Expected as Economy Reopens but Uncertainty Lingers

–Japan GDP Report at 19:50 ET Tuesday

By Max Sato

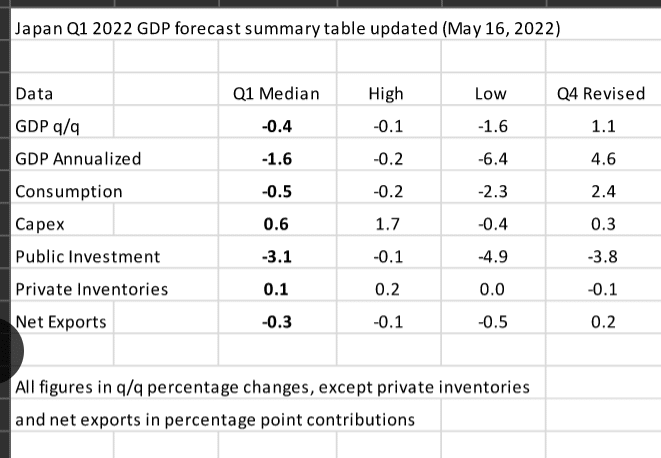

(MaceNews) – Japan’s gross domestic product for the January-March quarter is forecast by economists to post a 0.4% contraction on quarter, or an annualized 1.6% fall, as a spike in new Covid cases promoted strict restrictions on economic activity, hurting consumer spending, while uncertainty caused by the Ukraine war made firms more cautious about capital investment.

The median forecast for Q1 GDP is based on projections by 10 economists compiled by Mace News, which ranged from decreases of 1.6% to 0.1% on quarter, or 6.4% to 0.2% declines annualized.

The Cabinet Office will release preliminary GDP data for the first quarter of 2022 at 0850 JST Wednesday, May 18 (2350 GMT/1950 EDT Tuesday, May 17).

The expected contraction would be the first quarter-on-quarter drop in two quarters after the economy rebounded 1.1%, or an annualized 4.6%, in October-December, when the government lifted Covid restrictions before the Omicron variant wreaked havoc in the New Year and easing parts supply constraints supported auto production and shipments.

Consumption Seen Down, Capex Slower

The median forecast for private consumption, which accounts for about 55% of GDP, is for a 0.5% dip on quarter in Q1 (ranging from -2.3% to -0.2%) following a 2.4% rebound in Q4.

Demand-side data showed real average household spending posted the first month-on-month rise in three months in March, up 4.1%, as the government eased public health restrictions toward the end of the month, but it fell 1.8% on quarter in the January-March period amid the worst spike in new coronavirus cases during the two-year pandemic, after rebounding 5.2% in October-December, when the drag from the Delta variant had subsided.

The Bank of Japan’s supply-side Consumption Activity Index showed a similar picture. It posted the first month-on-month gain in four months in March, up a real 1.9% on a seasonally adjusted basis, but fell 3.4% on quarter in the first three months of 2022 after rising 3.2% in the final quarter of 2021. Figures exclude inbound tourism consumption but include outbound tourism spending.

Business investment in equipment is expected to show a 0.6% increase in Q1 (forecast ranged from -0.4% to +1.7%) after rising a modest 0.3% in Q4 following a 2.4% slump in Q3.

There is solid potential demand for upgrading computer software for digitizing and automating operations as well as a move toward reducing emissions, but some firms appear to be cautious as the global growth outlook has been clouded by the Ukraine war and supply constraints.

Shipments of capital goods excluding transport equipment – a key indicator of CAPEX in GDP data – marked the third straight quarter-on-quarter decline, down 0.1% in January-March, after falling 1.5% in the final quarter of 2021 and slipping 0.7% in July-September.

External Demand Seen Down

The median forecast for net exports of goods and services – exports minus imports – is for a negative 0.3 percentage point contribution to total domestic output (ranging from -0.5 to -0.1 percentage point) in the first quarter of 2022. In Q4, the key measure of external demand pushed up the GDP by 0.2 point.

Japanese exports are expected to show a second straight quarterly gain in January-March but imports are seen rising at a faster pace, reflecting the need to purchase more Covid-19 vaccines from the U.S. and Europe.

The Bank of Japan’s real export index rose a seasonally adjusted 2.2% on quarter in January-March for the first rise in three quarters, recovering from decreases of 0.1% in October-December and 1.9% in July-September. A decline in capital goods shipments amid uncertainty caused by the Ukraine war was more than offset by a pickup in auto and auto parts shipments as well as solid demand for computers, semiconductors and other information technology goods.

In its monthly report for April, the government maintained its assessment of exports as being “largely flat” after downgrading it for the second month in a row in November.

In other details, private sector inventories are expected to have provided a positive 0.1 percentage point contribution to the Q1 GDP (forecasts ranged from zero to +0.2 point), after trimming Q4 GDP by 0.1 point.

On the downside, public works spending is expected to mark a fifth consecutive quarter-on-quarter decline amid construction worker shortages and surging materials costs, while the government is focused more on purchasing Covid-19 vaccines, which falls into the public consumption category. The median forecast for public investment is a 3.1% slump on quarter in Q1 (forecasts ranged from -4.9% to -0.1%) after a 3.8% drop in Q4.

Rebound Seen in Q2 but Uncertainty Remains

Economists expect private consumption to lead a rebound in the April-June quarter GDP now that the government ended on March 21 its strict Covid rules which had been in place since late January. But there is a risk of a resurgence in Covid cases after many people traveled on packed trains and planes and crowded sightseeing spots during the Golden Week holidays from late April to early May.

The monthly Economy Watchers Survey, which was conducted by the Cabinet Office from April 25 to April 30 and released Thursday, indicated that sentiment continued improving last month from the Omicron-hit slump, although at a slower pace than a sharp rebound seen in March.

The Watchers’ sentiment index showing the direction of Japan’s current economic climate rose 2.6 points to 50.4 on a seasonally adjusted basis in April after surging

10.1 points to 47.8 in March, slipping 0.2 point to 37.7 in February and plunging 19.6 points to 37.9 in January. It is now above the key 50 line but still well below the 16-year high of 57.5 hit in December 2021 (the highest since 57.7 in December 2005).

On the upside, a travel agency official in the Tohoku region in northeastern Japan told the survey, “Even though the numbers of new coronavirus infections are not falling below certain levels, our business has recovered to more than 70% (of the pre-pandemic level) during the Golden Week. The domestic accommodations market has most likely bottomed out despite global uncertainties and high prices.”

A food processor in the Kinki region in western Japan noted the flow of people has been increasing now that more people have received three shots of Covid vaccines, adding that “the economic climate is becoming slightly better as more eating and drinking places are operating while taking Covid safety measures.”

On the downside, a car dealer in Tohoku said, “The semiconductor shortages are making delivery delays even longer and more people are giving up buying new vehicles.”

“Higher crude oil and materials prices, the weaker yen and the Ukraine crisis are definitely pushing up overall food prices,” a supermarket operator in Kinki said. “The expectation that price rises will continue is spreading, making people tighten the purse strings.”

The Watchers’ outlook index, which shows sentiment in two to three months, marked the third straight rise, edging up 0.2 point to 50.3 in April after rising 5.7 points to 50.1 in March, rebounding 1.9 points to 44.4 in February and falling 7.8 points to 42.5 in January, which was the lowest since 36.9 in December 2020.

Looking ahead, some companies said consumer spending is likely to pick up further if the Covid situations stabilizes.

“The number of customers is slightly increasing but still far below the pre-pandemic level,” a firm at a sightseeing spot in Hokkaido in the north said. “We expect an overall tourism industry recovery on the assumption that the number of new coronavirus infections will be capped.”

A department store operator in Kinki said, “Customers are becoming more positive about spending. If the Covid infections stabilize, we can expect strong demand for clothing, accessories and traveling goods for the summer holiday season.”

But other firms are more cautious.

“The impact of slower spending after the price hikes in April has been limited, but the supply of goods remains low or unavailable, making it hard to close transactions,” a large retailer of electric appliances in the Kyushu region in southwestern Japan said. “In addition to the existing semiconductor shortages, we know see the effects of the lockdown of Shanghai and the Ukraine situation.”

A real-estate agent in the Hokuriku region in central Japan said, “We cannot see when sales prices will peak because we have no choice but to reflect higher costs as lumber prices are forecast to surge further due to the Ukraine situation and the prices for other materials are also rising. This will dampen spending on big-ticket items.”

—

Contact this reporter: max@macenews.com

Content may appear first or exclusively on the Mace News premium service. For real-time delivery contact tony@macenews.com. Twitter headlines @macenewsmacro.