WASHINGTON (MaceNews) – The week ahead seems designed to be a time of reflection given the consumer inflation reading is the single highlight, Federal Reserve speakers go quiet before the following week’s FOMC meeting, and we’re reminded how fortunate the United States is, increasing household wealth by likely double digits despite the pandemic.

Actually the mantle of serenity seemed to envelop markets, analysts and even we news people already on Friday. The Nasdaq recovered some of its old swagger, ending the day up about 1.5%. Most remarkable was how its chart was a nearly horizontal straight line through the day.

The VIX anxiety index settled down to about match its low for the year at week’s end, easing back 9% after a jobs report turned out to be a jobs porridge not too hot nor too cold. The report’s least reported statistic for the second month was the unadjusted – i.e. actual change – in payrolls, an increase of 973 thousand, after the previous month’s 1.097 million increase.

Even more noteworthy during the week was how one of the world’s credit benchmarks, the U.S. 10-year yield, slipped below 1.6%, an impressive 0.073 point slide again, after the jobs report, back to rate of early March. “Transitory” keeps winning.

President Biden could be seen riding his bike at Rehoboth Beach, his spokeswoman was lowering expectations for any breakthrough at the meeting with Russia President Putin coming up in a little less than two weeks, and the White House staff was gearing up for the extended overseas trip, Biden’s first as president, that starts in a few days. The infrastructure negotiations with the Republican senators stayed alive, despite zero sign of progress, so hope was being kept on life support, certainly while Biden tours Europe. By next Friday Biden will have met with British Prime Minister Boris Johnson and will be well into the three-day G-7 summit.

The Reddit and crypto crowd seemed intent not to expose any of their pain of disappointments experienced over the past week. A Bitcoin convention went on as if nothing had happened. Old hands in the market tried to place it all in the context of just another bout of mania that reappears every decade or so. Yet the meme-stock phenomenon in which more than just AMC defied every tenet of investment wisdom in the heights reached among the wild gyrations seemed to be something new, nevertheless, at least in its breadth and audacity. AMC alone – now a large-cap – was more than a sixth of the entire options market volume on some days. On the crypto front the brutal backsliding of the past month, a ragged tumble off Mt. Everest, seemed a very severe test yet nothing approaching an obituary.

On the virus front, the font of all the optimism, the experts said the gains made so far seem secure for the months ahead. The president’s goal of a 70% vaccination rate by the next holiday seemed within reach. And even the most aggressive variants from Nepal and India still seemed vulnerable to the vaccines while the pace of mutation may be slowing.

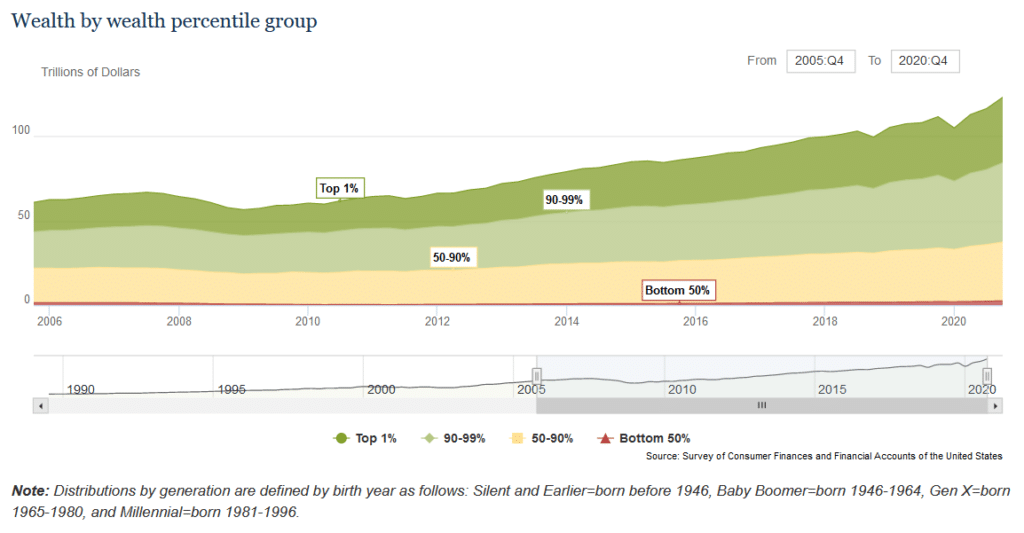

And if it’s a week for reflection, there’s no more profound subject than the one to be illustrated by Z-1 on Thursday. That’s the report once known as the Federal Reserve’s Flow of Funds that is a sizable volume of tables and charts, most of which only the most dedicated numbers wonks care about. But a few of the charts show something that goes to the heart of America’s future.

The report on the first quarter will show the growth of American household wealth and if it’s anything like the 10.1% spurt in the fourth quarter, it will be a remarkable testament to the continuing good fortune of American society as a whole. And the report will reveal something that’s probably not so wonderful, the relentless distributional inequities of that – hold your breath – $130.2 trillion with a “t”- in wealth. Not only the wealth, but how fast it grows for different slices of the population, are unprecedented. Those lucky few at the top are getting luckier by the minute.

The accompanying chart from the Fed describes “wealth by wealth percentile group,” in other words, how the top 1% has 15.5 times as much as the bottom 50%. More telling is how the dark green portion, again the territory of just the 1%, gets wider and wider with the trajectory of that widening showing a steeper climb during the pandemic. Think about that. During the pandemic. That muddy bottom 50% is just so much sedimentation. Financialization – stocks and other market assets – has been very, very good to the top 1% and the top 10% and to a lesser extent, to the top 50%. Further breakdowns, by ethnicity for instance, show tiny fractured splinters of the American dream are all that’s within reach for a lot of Americans.

The week’s upcoming data points are listed below.

UPCOMING ECONOMIC DATA

Monday, June 7 – 3p ET Fed’s monthly consumer credit

Monday, June 7 – US Senate returns; House out to June 14

Tuesday, June 8 – 6a ET US NFIB Small Business Optimism Index (Apr 99.8)

Tuesday, June 8 – 8:30a ET US Apr int’l trade in goods/svcs (Mar -$74.4 bln)

Tuesday, June 8 – 8:55a ET Johnson-Redbook wkly retail Y/Y (prvs wk 13.0%)

Tuesday, June 8 – 10a ET Apr JOLTS job openings (Mar record 8.123 mln)

Wednesday, June 9 – 7a ET US MBA wkly mortgage apps (prvs wk -4.0%)

Wednesday, June 9 – 10a ET US Apr prelim wholesale inventories (Mar +1.3%)

Wednesday, June 9 – 10:30a ET US EIA wkly oil stocks (prvs wk -5.1 mln bls)

Wednesday, June 9 – Pres Biden leaves on his first overseas trip as president

Thursday, June 10 – Pres Biden meets with UK PM Boris Johnson

Thursday, June 10 – 8:30a ET US wkly initial jobless benefit claims (prvs +385K)

Thursday, June 10 – 8:30a ET US May CPI (Apr +0.8%/annl +4.2%/core +3.0%)

Thursday, June 10 – 10a ET US Census final 1Q services survey (prelim +2.4%)

Thursday, June 10 – noon ET – Q1 Fed Flow of Funds rpt

Thursday, June 10 – 2p ET US Tsy May budget statements (Apr -$225.6 bln)

Friday, June 11 – President Biden attends June 11-13 G7 Summit

Friday, June 11 – 10a ET UMich June consumer sentiment (Apr 82.9)

Friday, June 11 – 1p ET Baker-Hughes wkly rig count (prvs wk US -1/456)

—

Contact this reporter: denny@macenews.com.

Content may appear first or exclusively on the Mace News premium service. For real-time delivery contact tony@macenews.com. Twitter headlines @macenewsmacro.