BofA Global Research Fund Manager Survey: Recession Concerns Lowest Since June 2022

— Big Jump in Emerging Market Equity Holdings By Vicki Schmelzer NEW YORK (MaceNews) – Global investors polled in February were decidedly less fearful of recession and more upbeat about world growth, but were taking a wait-and-see attitude towards inflation, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday. More […]

Italy Faces Showdown on ESM Reform; Financial Stability Risks Ahead

– Market volatility set to rise, ruling parties at odds – EZ banking union progress could come to a halt By Silvia Marchetti ROME (MaceNews) – The rising prospect that Italy will reject proposed reform of the European Stability Mechanism could raise new doubts about European integration and the stability of the ruling center-right coalition. Sources from […]

<strong>BOJ Keeps Easing Stance Amid Slowing Global Growth, Expects Cost-Push Inflation to Lose Steam in FY23</strong>

–Board Sees 3% Core CPI Rise in FY22 to Slow to 1.6% in FY23, 1.8% in FY24 –Board Revises Down GDP Forecasts to 1.9% in FY22, 1.7% in FY23, 1.1% in FY24 By Max Sato (MaceNews) – The Bank of Japan said Wednesday its policy board decided unanimously to maintain its basic monetary easing stance, […]

BofA Global Research Fund Manager Survey: US Equity Allocation Drops; Global Growth Concerns Fade Further in January

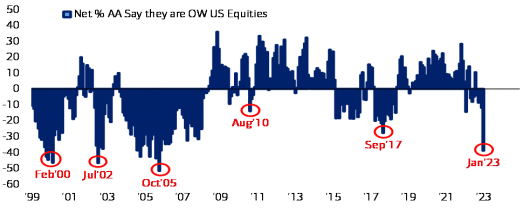

— China Growth Outlook Improves By Vicki Schmelzer NEW YORK (MaceNews) – Global investors cut allocations to US equities and were less downbeat about global growth prospects than in prior months at the start of 2023, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday. Allocation to U.S. stocks stood […]

Analysis: US Political System Struggles to Deal With Era of Limits

By Denny Gulino WASHINGTON (MaceNews) – As the Speaker of the U.S. House of Representatives enters 2023 as a greatly diminished figure, derided by late show comedians as “House Squeaker,” his humiliating path to leadership may be a bell which tolls for his peers in the U.S. political system as well. Although many market participants […]

Italy Keeps New USD-denominated Bond Issuance on Hold for 2023 — For Now

– Current Market Conditions Unfavorable, Coalition Sources Say By Silvia Marchetti ROME (MaceNews) – Italy is holding off for now on new issuance of US dollar-denominated bonds as it sees market conditions, especially the euro’s weakness, as unfavorable, according to ruling coalition government sources. In a shift from past practice, with the government laying out […]

BofA Global Research Fund Manager Survey: Investors Less Pessimistic About 2023 Prospects

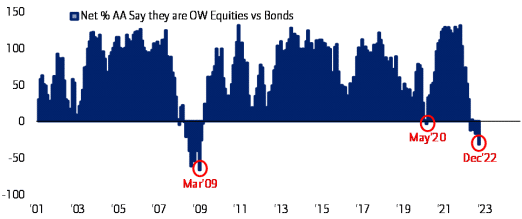

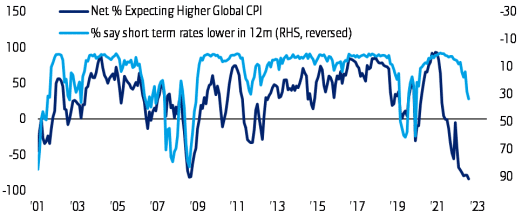

— Inflation Expected to Decline — First Bond Overweight Since April 2009 By Vicki Schmelzer NEW YORK (MaceNews) – Global investors polled at year-end were decidedly less pessimistic about 2023 prospects especially for inflation, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday. In December, a net 68% of managers […]

BofA Global Research Fund Manager Survey: Recession Likely Despite Reduced Inflation Concern

By Vicki Schmelzer NEW YORK (MaceNews) – Despite diminishing inflation concerns, global investors saw recession as a likely outcome in the coming year, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday. In November, a net 85% of fund managers looked for lower global consumer price inflation in the coming […]

FOMC Lifts FFR 75 BP to 3.75-4.0%; Projects More Rate Hikes

Powell Says Slower Pace of Hikes Could Come in Next Two Meetings But Powell Says Rates May Have To Go Higher Than Projected in September And Powell Says It’s ‘Very Premature’ To Talk About Pausing Rate Hikes Also Warns Against ‘Mistake’ Of Loosening Monetary Policy ‘Prematurely’ FOMC Says Funds Rate Needs To Get ‘Sufficiently Restrictive’ […]

Japan Appears to Have Sold Dollars in Stealth Intervention to Slow Yen’s Slide

–Currency Intervention Suspected as Dollar Slumps from Above Y151 to Under Y146 in New York Friday –Vice Finance Minister Kanda Declines Comment to Reporters in Tokyo–Yen Remains Weak Amid Wide US-Japan Rate Gap; BOJ Seen Keeping Easy Stance By Max Sato (MaceNews) – The Japanese government and the Bank of Japan appear to have stepped […]