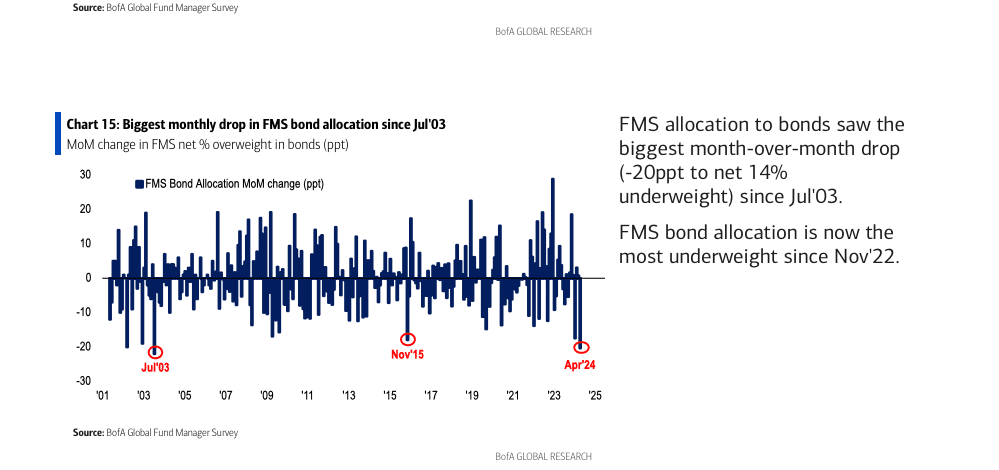

BofA Global Research Fund Manager Survey: Managers Prefer Equities, Commodities, Dump Bonds in April

fund managers switch to equities, commodities

BofA Global Research Fund Manager Survey: Cash Levels Edge Up as Global Investors Rethink Inflation/Interest Rate View

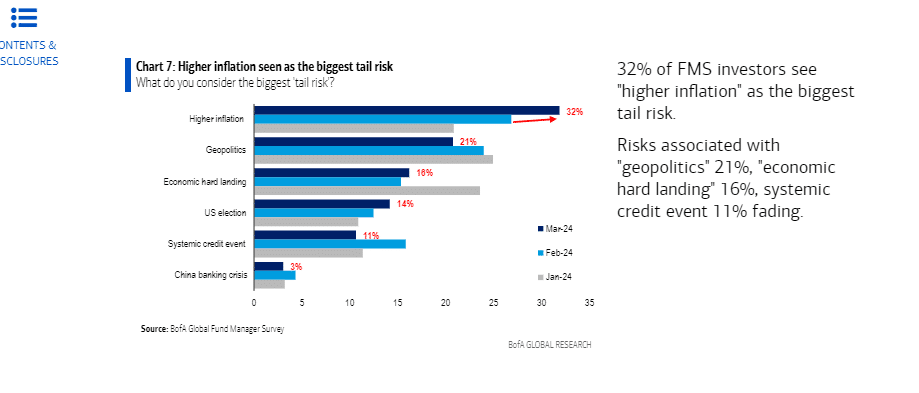

By Vicki Schmelzer NEW YORK (MaceNews) – Cash allocations nudged higher in March, driven by global investors rethinking their views about inflation and the outlook for lower interest rates, according to BofA Global Research’s monthly fund manager survey, released Tuesday. Average cash balances were 4.4% this month compared to 4.2% in February and 4.8% […]

As Foreign Investors Shun Italian Bonds, Domestic Retail Investors Increasingly Buying Public Debt – Sources

By Silvia Marchetti ROME (MaceNews) – Italian business lobbies and Democrat opposition forces voiced concern over foreign investors avoiding Italian bonds, though this is increasingly being counterbalanced by a rise in retail-only securities which is shielding Italy’s soaring public debt. “The Italian debt in the portfolio of foreign investors dropped from EUR 685 billion in […]

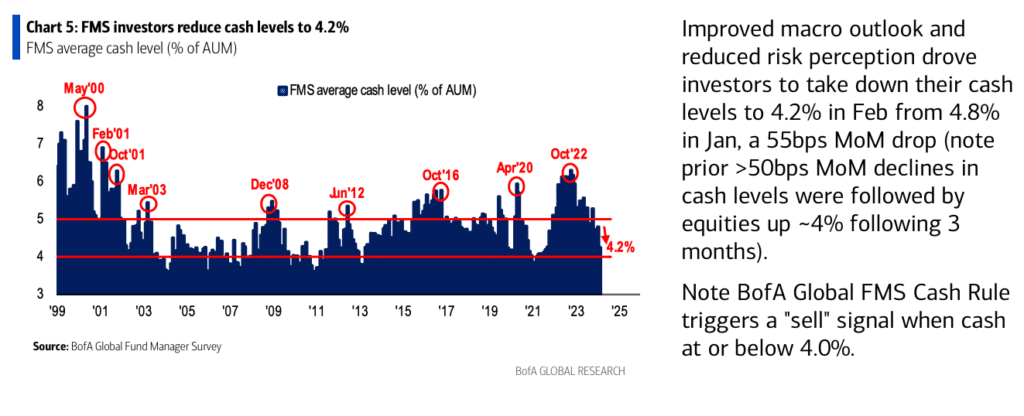

BofA Global Research Fund Manager Survey: Cash Levels Fall as Bullish Fund Managers Shift Into Equities

By Vicki Schmelzer NEW YORK (MaceNews) – Cash levels fell sharply in February as global investors took sidelined monies and made a beeline into equities, according to BofA Global Research’s monthly fund manager survey, released Tuesday. Average cash balances fell to 4.2% in February from 4.8% in January, a 55 basis point drop, and […]

IMF: BOJ Should Consider Unwinding Monetary Easing Under Yield Curve Control Framework Now

–IMF: BOJ Then Should Gradually Raise Interest Rates–IMF Critical of Kishida Government’s ‘Untargeted’ Economic Stimulus Package By Max Sato (MaceNews) – The Bank of Japan should consider unwinding its large-scale monetary easing now by exiting the seven-year-old yield curve control framework, the International Monetary Fund said Friday, noting that easing in the past decade has […]

Italy’s Meloni Takes More Moderate Stance to Lure Bond Investors, Centrist Voters

By Silvia Marchetti ROME (MaceNews)- After more than a year in power, Italian Prime Minister Giorgia Meloni is getting a ‘political makeover’ to take a more moderate stance and lure investors willing to support the country’s funding needs, say opposition forces. “She’s abandoning her neo-fascist rhetoric and revisiting her hard core, nationalist rightist policies in […]

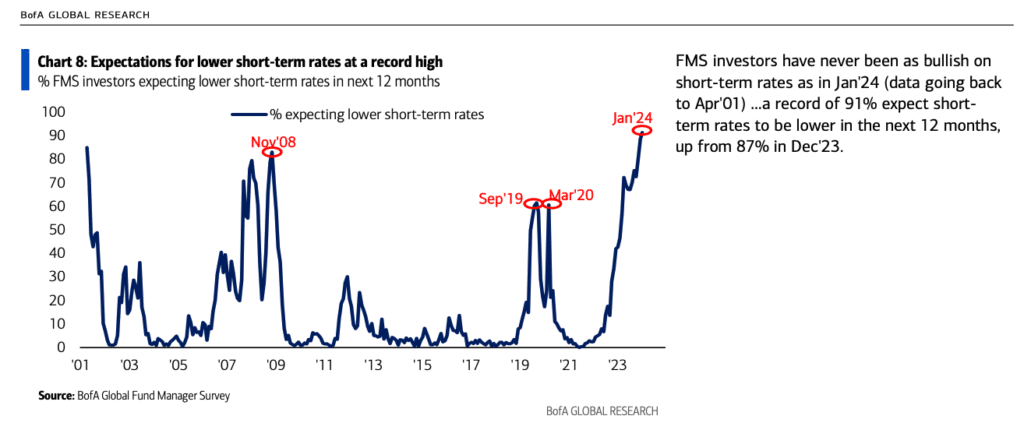

BofA Global Research Fund Manager Survey: Global Investors Choose Cash at Start of 2024

–Still Bullish Towards Growth and Bond Prices By Vicki Schmelzer NEW YORK (MaceNews) – Global investors reallocated into cash at the start of a new year, waiting for additional economic clarity before entering positions, according to BofA Global Research’s monthly fund manager survey, released Tuesday. Inflation views were little changed in early 2024 but […]

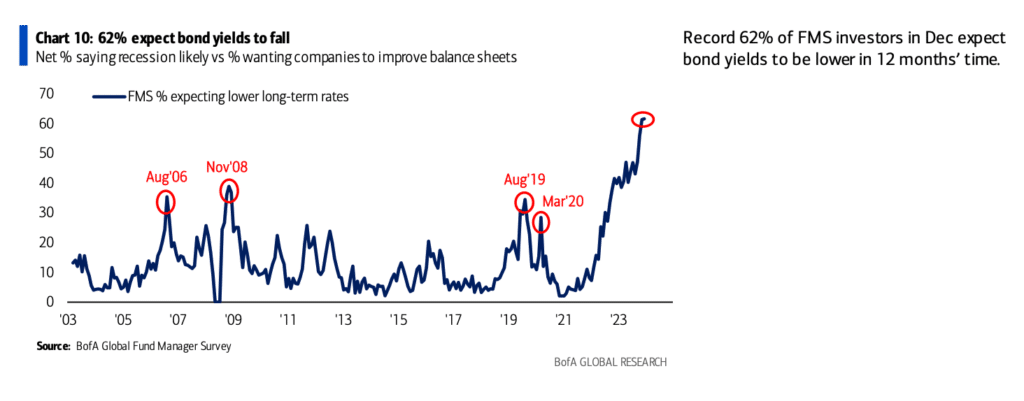

BofA Global Research Fund Manager Survey: Global Investors Eye ‘Goldilocks’ Scenario for 2024

–Record 62% of managers looked for lower bond yields in 2024 By Vicki Schmelzer NEW YORK (MaceNews) – Global investors again put sidelined money to work in December, with allocation to stock and bonds increasing and cash levels falling, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday. Fund manager […]

BofA Global Research Fund Manager Survey: Investors Prepare for Lower Yields in 2024

–Seventy-six percent of managers convinced Fed rate hike cycle over –Geopolitics become number one “tail risk” by Vicki Schmelzer NEW YORK (MaceNews) – Global investors prepared for lower yields in November, with cash levels falling and allocation to stocks and bonds on the rise, according to the findings of BofA Global Research’s monthly fund manager […]

Bank of Canada Seen Keeping Policy Rate at 5% This Week Amid Dim Business Outlook, Easing Inflation

By Max Sato (MaceNews) – The Bank of Canada is widely expected to hold interest rates steady in Wednesday’s policy announcement in light of weak business survey results and slightly easing price pressures, but given some resilience in the labor market and the uncertain inflation outlook, the bank may not be done with tightening that […]