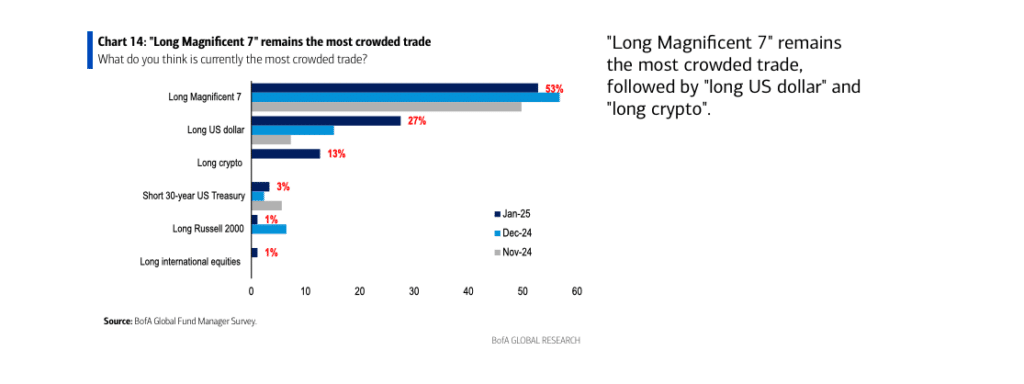

BofA Global Research Fund Manager Survey: Investors Pare Equity and Bond Longs as Growth Optimism Wobbles

–Investors Reallocate into Eurozone Stocks By Vicki Schmelzer NEW YORK (MaceNews) – Global investors pared equity and bond holdings in January, as growth optimism wobbled at the start of 2025, according to BofA Global Research’s monthly fund manager survey, released Tuesday. A net 8% of those polled in January looked for a weaker global economy […]

BofA Global Research Fund Manager Survey: US Growth Optimism, Fed Rate Cut Expectations Drive ‘Super Bullish’ Sentiment at Year-end

–US Stock Allocation Highest on Record –Cash Allocation at All-Time Lows, Triggers Contrarian Sell Signal, BOA Says By Vicki Schmelzer NEW YORK (MaceNews) – U.S. growth optimism and Fed rate cut expectations drove the “super-bullish” risk sentiment seen at year-end, according to BofA Global Research’s monthly fund manager survey, released Tuesday. A net 7% of […]

BofA Global Research Fund Manager Survey: U.S. Election Results Prompt Boost in Global Growth and Inflation Expectations

–Growth Expectations Jump, Inflation Concerns Sharply Rise By Vicki Schmelzer NEW YORK (MaceNews) – U.S. election results prompted seismic shifts in global growth and inflation expectations, according to BofA Global Research’s monthly fund manager survey, released Wednesday. In terms of post-election views, global growth expectations jumped from a net 10% looking for weaker in October […]

BofA Global Research Fund Manager Survey: Global Investors Look For ‘Soft Landing’

–Majority Sees No US Recession in Coming 18 Months –Chinese Economic Expectations See Record Low By Vicki Schmelzer NEW YORK (MaceNews) – Global investors altered more pessimistic world growth expectations in September, with the majority now looking for a “soft landing” in the next 12 months, according to BofA Global Research’s monthly fund manager survey, […]

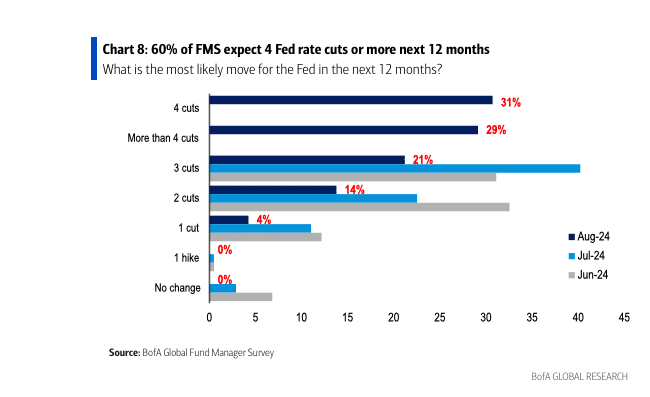

BofA Global Research Fund Manager Survey: Global Investors Buy Bonds on Declining Global Growth Expectations

–US Recession Concern Top Tail Risk –Sixty percent of Managers Expect Four Or More Fed Cuts in Next 12 Months By Vicki Schmelzer NEW YORK (MaceNews) – Global investors made a beeline into bonds in July, driven by declining world growth expectations, according to BofA Global Research’s monthly fund manager survey, released Wednesday. Jitters about […]

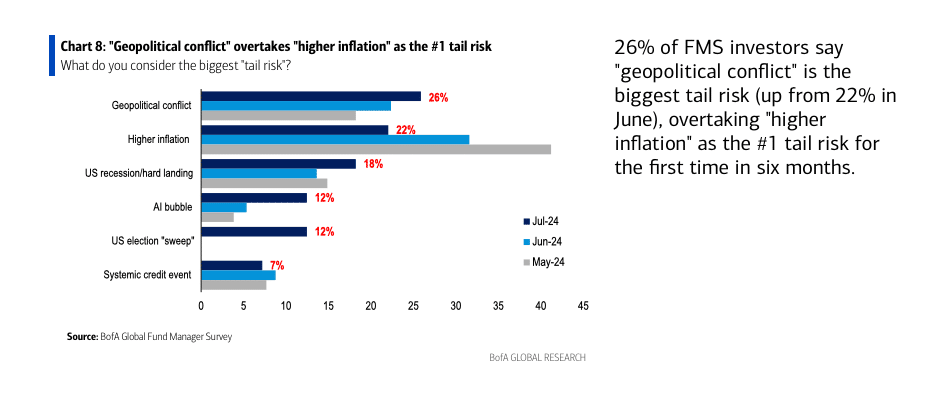

BofA Global Research Fund Manager Survey: Expected Fed Rate Cuts Drive Bulls

–Geopolitics Number One ‘Tail Risk’ –U.S. Yields, Dollar Higher On ‘Clean Sweep’ Expected for Republicans in November By Vicki Schmelzer NEW YORK (MaceNews) – World investors were bullish in July, with sentiment fueled by Federal Reserve rate cuts expected this year and into 2025, according to BofA Global Research’s monthly fund manager survey, released Wednesday. […]

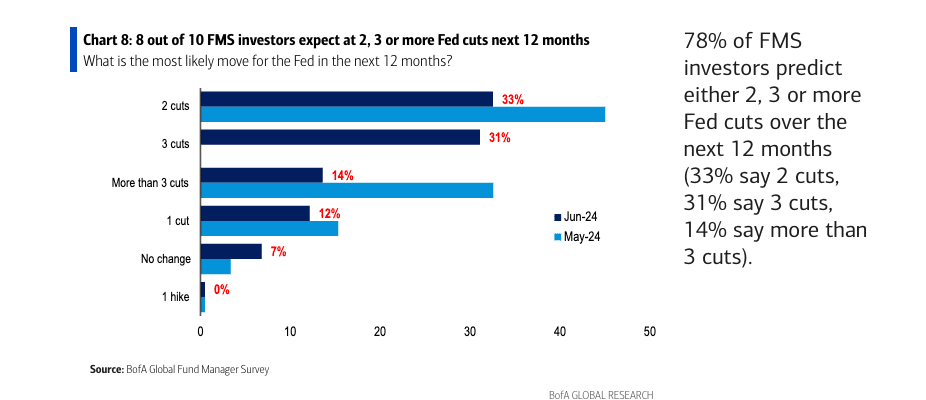

BofA Global Research Fund Manager Survey: Investors Largely on Hold in June, Eye Fed Rate Cuts

investors waiting for rate cuts later in year

BofA Global Research Fund Manager Survey: Rate Cut Optimism Supports Equities in May as Growth Expectations Wobble

investors more bullish on stocks in May

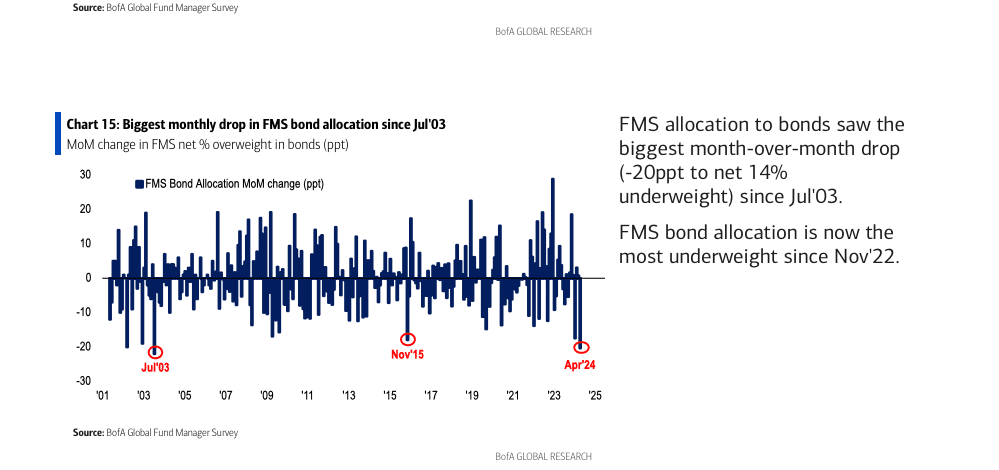

BofA Global Research Fund Manager Survey: Managers Prefer Equities, Commodities, Dump Bonds in April

fund managers switch to equities, commodities

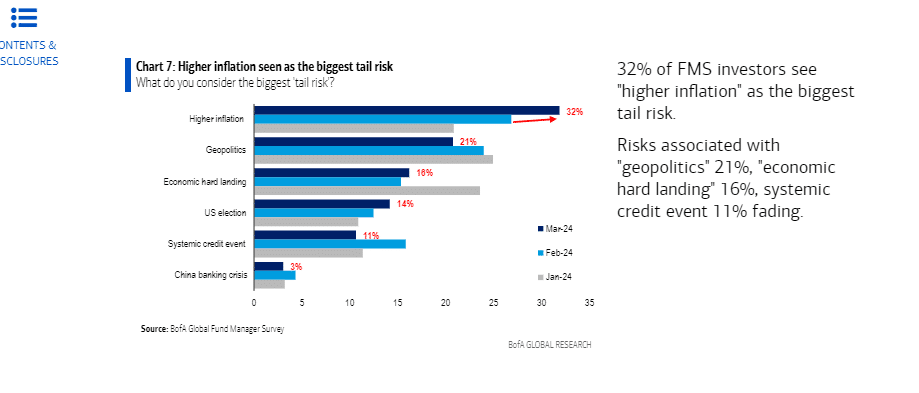

BofA Global Research Fund Manager Survey: Cash Levels Edge Up as Global Investors Rethink Inflation/Interest Rate View

By Vicki Schmelzer NEW YORK (MaceNews) – Cash allocations nudged higher in March, driven by global investors rethinking their views about inflation and the outlook for lower interest rates, according to BofA Global Research’s monthly fund manager survey, released Tuesday. Average cash balances were 4.4% this month compared to 4.2% in February and 4.8% […]