BofA Global Fund Manager Survey: Higher Inflation Worries at Odds with Reduced Recession Fears and US Rate Cut Anticipation

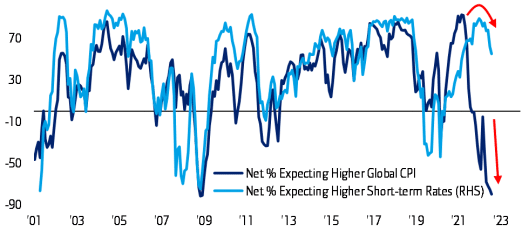

By Vicki Schmelzer NEW YORK (MaceNews) – Inflation concerns spiked in September and were at odds with lower recession fears and increased anticipation of Federal Reserve rate cuts, according to the findings of BofA Global Research’s monthly fund manager survey released Tuesday. In September, a net 69% of fund managers looked for lower global consumer […]

BofA Global Research Fund Manager Survey: Global Investors Trim Cash, Add to Equity Holdings in August as Recession Fears Fade

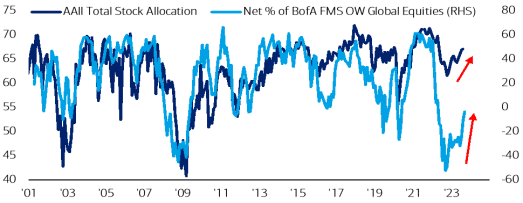

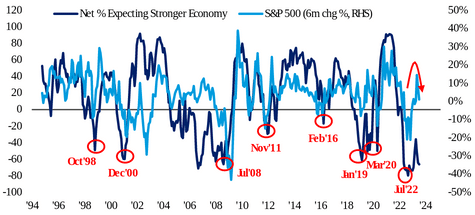

By Vicki Schmelzer NEW YORK (MaceNews) – Improved growth prospects and fading recession fears prompted global investors to trim their cash allocation and add to equity holdings in August, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday. A net 45% of those polled this month looked for weaker economic […]

BofA Global Research Fund Manager Survey: Global Investors Test Waters in Equities in May, Remain Risk Averse

By Vicki Schmelzer NEW YORK (MaceNews) – Global investors dipped their toes back into equities in May but largely clung to bond and cash holdings, according to the findings of BofA Global Research’s monthly fund manager survey, released Wednesday. Uncertainty about the health of the world economy and central banks’ ability to rein in inflation […]

BofA Global Research Fund Manager Survey: Global Investors’ Attitude Towards Risk Worsens in March on Surging Credit/Counterparty Risk

By Vicki Schmelzer NEW YORK (MaceNews) – Global investors’ attitude towards risk worsened in March with negative sentiment driven by surging credit and counterparty risk, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday. Shifting risk views led to a marked uptick in recession and growth concerns, but little change […]

BofA Global Research Fund Manager Survey: US Equity Allocation Drops; Global Growth Concerns Fade Further in January

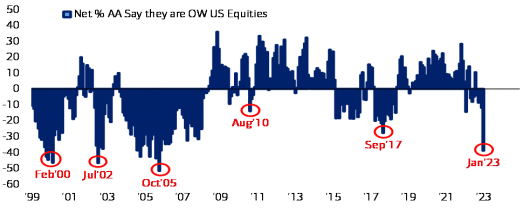

— China Growth Outlook Improves By Vicki Schmelzer NEW YORK (MaceNews) – Global investors cut allocations to US equities and were less downbeat about global growth prospects than in prior months at the start of 2023, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday. Allocation to U.S. stocks stood […]

BofA Global Research Fund Manager Survey: Cash Levels at 2001 Highs As Investors See Economic Weakness, Consider Eventual Fed Pivot

– – Inflation is Chief Concern; Rising Fear of Systemic Credit Event By Vicki Schmelzer NEW YORK (MaceNews) – Fund managers’ cash levels rose in October to highs last seen in 2001 as investors feared economic weakness and pondered the timing of an eventual Federal Reserve policy pivot, according to the findings of Bank of […]

White House and Other Schedules for Monday, Oct 17

WASHINGTON (MaceNews) – The following are Monday’s schedules for the White House, Treasury, USTR, the State Department and Capitol Hill as well as U.S. data and Federal Reserve events: DAILY GUIDANCE AND PRESS SCHEDULE FOR MONDAY, OCTOBER 17, 2022In the afternoon, the President will return to the White House from Wilmington, Delaware. The departure from Delaware Air National […]

BofA Global Research Fund Manager Survey: Investor Sentiment ‘Super Bearish’ in September

By Vicki Schmelzer NEW YORK (MaceNews) – Global investor sentiment was “super bearish” in September, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday. Accordingly, cash allocation rose to the “biggest overweight on record” and equity allocation fell to a “record underweight,” the survey said. Investors remained on high alert […]

BofA Global Research Fund Manager Survey: Investors Hopeful Inflation/Rate Shocks to Dissipate Soon

-Investors Stay Watchful For Recession By Vicki Schmelzer NEW YORK (MaceNews) – Global investors polled in August were hopeful that inflation and rate shocks will dissipate in the coming quarters, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday. At the same time, investors remained on high alert for recession, […]

BofA Global Research Fund Manager Survey: Global Growth Optimism at All-Time Low

— Cash Levels ‘Highest Since 9/11’ — Equity Allocation ‘Lowest Since Lehman’ By Vicki Schmelzer NEW YORK (MaceNews) – Optimism about global growth prospects fell to an all-time low in July, according to the findings of BofA Global Research’s monthly fund manager survey, released Tuesday. Investor cash levels are the “highest since 9/11” and equity […]